SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

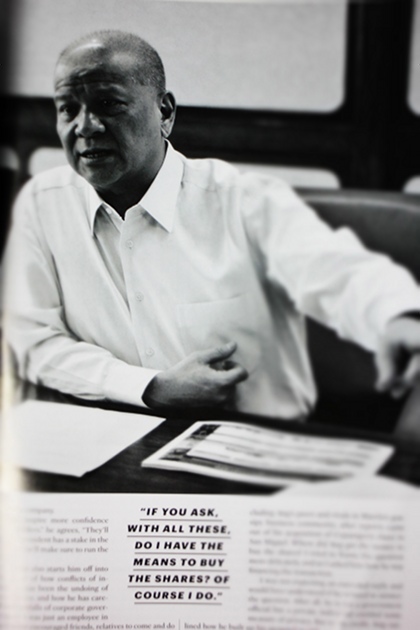

MANILA, Philippines – How did Ramon Ang afford to buy a block of shares in the country’s biggest business group?

That was a nagging question when the top executive bought the majority of Eduardo “Danding” Cojangco’s 14.7% stake in San Miguel Corp.

The two are allies for decades, with Ang rising from the ranks at San Miguel, eventually becoming company president, a position Ang has held for nearly a decade.

The San Miguel shares were sold to Ang at a discount, bring the total stake to P37 billion ($879 million), still a substantial sum. Ang ended up with 11% of the company’s shares and majority shareholder Top Frontier Investment Holdings Inc. took the remaining 3.7%.

In an exclusive interview published by Esquire magazine, Ang disclosed that, of the over $600 million he paid for the shares, $500 million was borrowed from foreign banks. “I expect to repay the banks from the appreciation of the value of my San Miguel shareholdings later,” Ang told the author, business journalist Roel Landingin.

The remaining $100 million came from Ang’s own funds, mainly from his cement business, he explained.

Funds from cement business

In the early 90’s Ang invested in the Zobel family’s Fortune Cement, an investment which paid off.

He recounted to Esquire how Fortune underwent an initial public offer in 1996. Flush with funds, the company went into expansion mode, buying into other cement plants in Iligan and Cebu.

In 1998, Ang sold his shares and reaped his reward. He told Esquire he made more than $200 million in the share sale. With that money he said he put up a cement plant in Malaysia’s Sarawak and the Philippines’ Bulacan.

The article notes how Ang impressively grew his cement businesses while other local companies sold out to large global cement firms in the wake of the Asian financial crisis.

“If you ask, with all these, do I have the means to buy the (San Miguel) shares? Of course I do,” Ang told Esquire with his typical vibrato.

Ang added that he will pay back the sizable debt one of two ways. His first option is earnings from the San Miguel Corp stock, which so far this year has dropped 5% in value from P116.80 per share on January 2 to P110.90 on September 10.

The other option is to leverage his cement companies. “Or, I can do an IPO, of say, 40% of Eagle Cement’s shares, and the debt can be paid in full,” Ang said in the same interview. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.