SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The war between the country’s two largest telecommunication firms Globe Telecom and Philippine Long Distance Co (PLDT) is reaching fever pitch.

In June, both claimed to be No. 1 in the postpaid segment – PLDT by number of subscribers and Globe by revenue per subscriber in the first 3 months of 2012.

In August, a “word war,” which used to be confined among industry players, intensified and became more public. Globe CEO Ernest Cu lashed out at PLDT for the ads of its mobile arm Smart Communications on dropped calls of “other networks.”

“They choose to focus on a negative aspect of advertising against us. If you look at Globe, our advertising has always been on the positive side… It’s a little bit surprising to see this type of advertising going on,” he told Rappler at an August 23 press briefing.

In early September, Globe customers took to social media to vent their complaints about connectivity problems. Smart, on the other hand, cited the social media posts to stress that more subscribers want to shift carriers.

In the months ahead, both are racing to snap up customers for Long Term Evolution (LTE) service, considered a faster and more reliable form of 4G technology. PLDT offered the first LTE service for broadband on August 25. While Globe is following with a broadband LTE option, called Tattoo Black, in September.

Rappler decided to take a closer look to see how the two competitors really match up. Rappler interviewed top executives from both companies and reviewed nearly a decade of reports submitted to the Philippine Stock Exchange.

We found that in terms of revenue and market share, PLDT still dominates the prepaid market, which it has catered to historically. PLDT’s lower-end brand Talk ‘N Text is not only retaining customers but pulling in the majority of the firm’s prepaid growth.

Meanwhile, Globe, which has been strong in the lucrative postpaid market in the past, is retaining customers and still brings in a bigger profit than its competitor. Yet PLDT has made notable inroads in the postpaid segment, and is quickly closing the revenue gap and has even surpassed Globe’s postpaid subscriber count, thanks to the acquisition of rival Digital Telecommunications Philippines Inc last year.

Globe’s stronghold on postpaid

A key battle ground is the lucrative postpaid market, in which customers are bound by a service contract and billed monthly. Postpaid subscribers have 3 key attributes prized by mobile phone operators in a competitive environment – they are loyal, usually willing to pay more, and hungry for broadband service.

For both firms, the postpaid segment is crucial as a source of future growth. Globe’s senior advisor for consumer business Peter Bithos explained: “As the Philippines gets more developed, [and] as households get richer, more and more customers will choose postpaid.”

It’s a trend telecommunications companies have to invest in, he added.

Globe started out catering to premium postpaid users and has largely managed to hold onto those users.

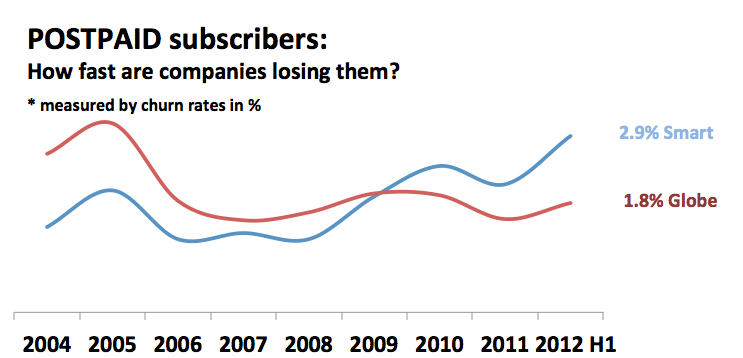

Churn rate, a market measure for how fast a company is losing customers, stood at a low 1.8% in the first 6 months of the year. That number could reflect longtime subscribers’ unwillingness to change brands when their co-workers, friends or family members are on the same network. This means they can take advantage of promotions that make connecting to those within the same network cheaper.

By comparison, Smart lost a slightly higher 2.8% of postpaid customers for the same 6 month period.

“Maybe in the past, Smart was not really the primary number, and, therefore, if it was not the primary number, it was easier to shift out. I see that changing, given the fact that we’re pushing harder to deliver better services,” explained the head of Smart’s Wireless Consumer Division Noel C. Lorenzana.

Globe also managed to add more postpaid customers than its rival brand Smart in the latest 3 month fiscal period.

From April to June, Globe added 59,322 postpaid subscribers or about 27 every hour, while Smart added 24,862 or roughly 11 every hour. But Smart was coming from a lower base. The two brands were neck-in-neck where it counts – growth rate, which stood at 4% quarter-on-quarter.

The additions came at quite a cost to Globe, which shelled out P8,119 to attract each additional customer. PLDT’s first half financial report did not list subscriber acquisition cost for the period.

It remains to be seen if the seemingly high cost was worthwhile for Globe since, according to Bithos, the company mainly added lower-paying customers. Still, those are customers who will be locked into postpaid contracts with Globe temporarily.

As of end-June, postpaid market share by brand was led by Globe with 43%, followed by Digitel’s Sun Cellular brand with 39.7%, Smart with 17.2%, then Red Mobile with less than 1%. Mobile brands Sun, Smart and, previously also Red Mobile, are all under the PLDT umbrella.

However, Smart-operator Philippine Long Distance Telephone Company (PLDT) has begun to dominate pockets of the postpaid market that should worry its competitor.

PLDT’s strategy in postpaid

As a group, PLDT holds the lion’s share of postpaid customers since the group acquired Sun Cellular operator Digital Telecommunications Philippines (Digitel) in late 2011. By end-June, 2.12 million postpaid customers were under the umbrella of PLDT companies, while Globe Telecom held 1.6 million.

Aside from subscriber count, however, the creditors’ and investors’ points of view are also important to consider given that this capital intensive industry constantly needs access to financing. These creditors and investors also watch how much the companies are making from each subscriber.

Although Globe was once primarily associated with the premium market and Smart with the mass market, Smart has cornered a high-paying niche of the postpaid market. Smart now makes more on average from each postpaid subscriber.

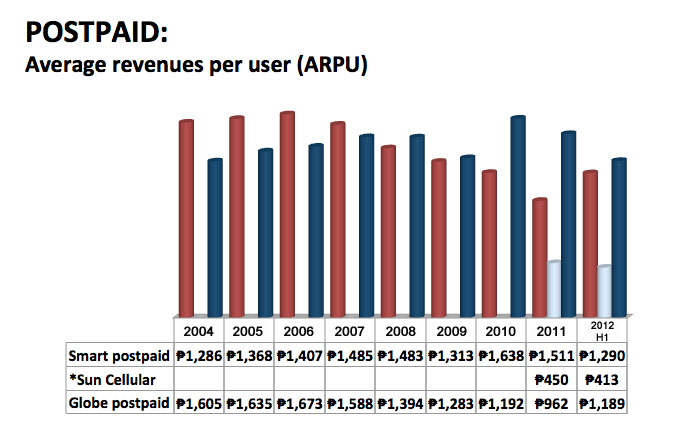

In the graph below, Smart has steadily been making more on average from customers, as measured by the industry indicator known as ARPU, or average revenue per user. Looking at gross ARPU for the first half of the year, Smart made P1,290 from each postpaid customer, while Globe made P1,189.

“The new customers that are coming in are very different than our historical postpaid base,” said Globe’s Bithos.

“We’re bringing many more customers than the competition into the business at the mid and low-end, and that’s bringing down the weighted average,” he explained.

In a seeming flip-flop of strategies, Smart is now seeking to define itself as the top premium brand.

“Well, apparently, that’s their (Globe’s) strategy now. They’re actually choosing price to get subs (subscribers). For us, our strategy is to provide quality. We are now the higher ARPU,” said Smart’s Lorenzana.

“If that means pushing Smart above all the others, we will do that. It’s now looking like Smart is more and more the leading edge brand. Talk ‘N Text becomes the everyday brand for every Filipino. Filipinos love sachet pricing. Talk ‘N Text will give them that. We need to cover all relevant segments,” said Lorenzana.

Acquiring Digitel has given PLDT flexibility to tailor its brands and target the high-end postpaid market with Smart and the low-end prepaid market with Talk ‘N Text. With more brands, PLDT is able to focus in on different segments of the market. With Smart, Sun Cellular, and Talk N’ Text all under the same parent firm, each can take advantage of synergies, including a vast infrastructure network system of the PLDT group.

In the Philippines, it is not uncommon for those who can afford a phone to have two, one for each network, or a single phone with two SIM card slots. Thus, PLDT is hoping to harness more partnerships between the brands it holds.

“Remember, the reason Sun [Cellular] grew was because it was the favorite second number. What we’d like to do is, if there was a chance to make the Smart-Sun combo for the subscriber, [then] why not? Because you have to go deep into what do the subscribers want. Maybe for the primary number they want the cutting edge service like LTE, and for the secondary number they want it for emergencies or the extended circle. It’s all about circles, who is your primary circle and who is your secondary circle,” said Lorenzana.

Despite the advantage of partnering brands, PLDT’s brands don’t bring in as much total revenue as Globe’s. PLDT still has some catch-up to do since, in the first 6 months of the year, postpaid revenue came in at P8.16, compared to Globe’s P10.9 billion.

Prepaid still lion’s share of profits

In the future, postpaid is an important market to keep an eye on, especially looking at developed countries like the US, where service contracts are standard. Yet as a developing country, much of the Philippines’ present is dominated by pay-as-you-go, or prepaid, customers.

“Postpaid remains a very critical line of business for us. But prepaid is still the lion’s share of revenue and profitability,” admitted Bithos.

From January to June, the prepaid market made up 67% of Globe’s mobile revenues and 82% of PLDT’s – the most sizable chunk of the profit pie.

Of the over 95 million prepaid subscribers on the two networks, the majority (68.4%) reside with PLDT and just under a third (31.6%) belong to Globe.

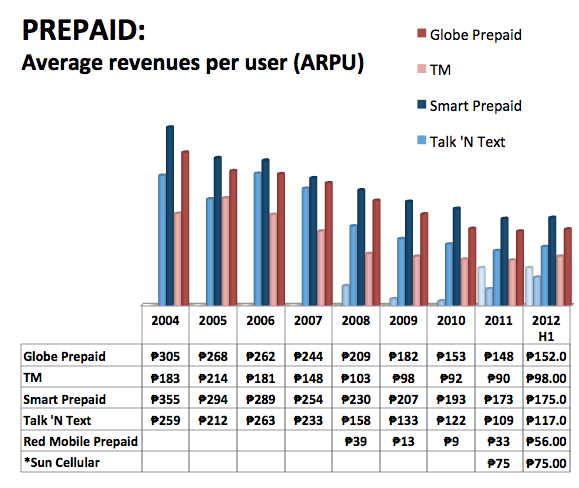

In terms of number of customers, average revenue from each, and total revenue, PLDT has clearly retained its historic hold on the prepaid market.

The average prepaid user may not bring in much revenue, but Smart has consistently made the most money from each one over the years. Globe comes in with the second highest ARPU, followed by Talk ‘N Text and trailed by Red Mobile.

Most brands are losing customers at about the same rate. PLDT’s Red Mobile was the exception, loosing 19.2% of its customers from January to June, when PLDT said it would surrender CURE, Red Mobile’s operator, to the National Telecommunications Commission.

Globe and Smart were neck and neck, respectively shedding 5.6% and 5.9% of customers during the same 6 month period. Globe’s Bithos was quick to point out that while the rates are similar, Smart has many more prepaid customers so their equivalent number of lost customers represents a greater overall loss.

However, one of PLDT’s largest prepaid brands, Talk ‘N Text, only lost 4.9% of its customers during the period. Globe’s equivalent brand, Touch Mobile, was relatively higher with a 6.3% turnover.

What’s different about the prepaid market today is that the majority of growth is coming from Talk ‘N Text.

PLDT’s Talk ‘N Text not only retained the most customers, but also grew 21% in the first half of the year, compared to the same period in 2011. The high growth figure is affirmation of PLDT’s more targeted approach and shift away from Smart as its mass market brand. Prepaid customers of main mobile brand Smart only grew a mere 1%.

Globe’s growth wasn’t nearly as robust at Talk ‘N Text’s. In the same period, Globe prepaid grew 9% and Touch Mobile increased 12%.

However, Globe’s figures still show steady growth in the prepaid market.

Healthy competition

In the telco wars, it actually benefits the Filipino customer to have no clear winner. Battling it out for subscribers forces both companies to improve their service as they see the opponent making gains in key territory.

Arguably, even more competitors would benefit consumers. Lorraine Carlos Salazar’s insightful book “Getting a Dial Tone: Telecommunications Liberalization in Malaysia and the Philippines” chronicles the high rate of dropped calls and the long time it took customers to get a phone when PLDT was the only national network for decades before the turn of the century.

Customer favorites, like bucket unlimited pricing, are the result of a healthy 3 way competition among telecommunications firms.

Filipinos should be worried if one competitor takes it all in the telco wars. – Rappler

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.