SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

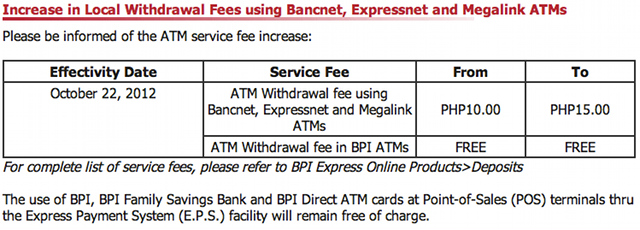

MANILA, Philippines – The Ayala-led Bank of the Philippine Islands announced that it would increase its service fee on card withdrawals outside its own network of automated teller machines (ATM).

In the statement below posted on its website, the country’s 3rd largest bank in terms of assets said the increase to P15 from the current P10 service charge on withdrawals transacted via the ATMs that are part of the Bancnet, Expressnet and Megalink networks. The higher fees take effect on October 22.

BPI’s announcement is seen to start a series of fee hikes by other banks.

In August, Sy-led Banco De Oro already announced it would increase the fee it charges its cash card holders.

The officials of Bangko Sentral ng Pilipinas acknowledge that there are costs involved in maintaining an ATM network service, but noted that the banks must also be prepared for the negative customer reaction the fee hike will likely generate, a Business Mirror report said.

BSP Governor Amando M. Tetangco Jr. was quoted as saying regulators will only intervene when industry-wide collusion is suspected.

“If they [ATM cardholders] find the price increase unreasonable, perhaps choices with respect to other banks can be considered. But when the industry as a whole raises their rates, this is typically where the BSP checks if it looks like collusion,” Tetangco said.

The report also noted that ATM fee hikes come after the BSP recently excluded cash held inside the ATMs from the funds subject to the deposit-reserve system, which means the banks can no longer generate interest income for those funds from the BSP.

This also means the banks incur interest costs for keeping the funds in the ATMs until someone withdraws them.

BPI President and CEO Aurelio Montinola III was quoted as saying that the bank deploys P2 billion everyday to its network of about 1,900 ATMs nationwide. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.