SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

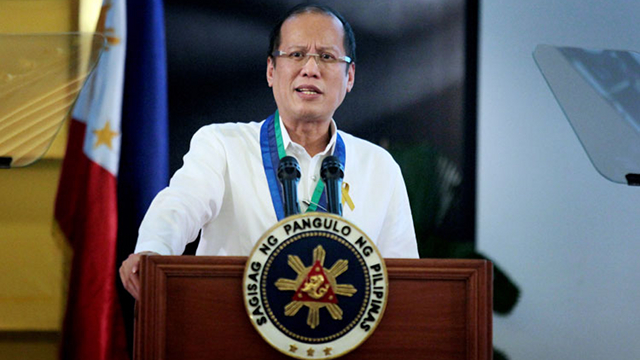

MANILA, Philippines – President Benigno Aquino III on Thursday, October 11, asked for “solidarity” from Congress in passing the Finance department-backed sin tax bill, stressing its importance to the government’s health care program.

Aquino’s administration is pushing for the original bill that seeks to generate for government P60 billion additional revenues in the first year of implementation.

“We are counting on the solidarity of our legislators in the sin tax bill, which can only improve our fiscal situation,” Aquino said in a speech during the 38th Philippine Business Conference.

“The bulk of tax revenues generated from this proposed measure [will go] to universal health care. We will be able to widen access to and improve health services for all,” he added.

Aquino’s remarks echoed statements made by members of his Cabinet, who vowed to push for the ideal bill after the Senate ways and means committee, led by its chair Senator Ralph Recto, endorsed a “watered-down” version to the plenary Wednesday, October 10.

The Recto bill, Senate Bill 3299, seeks to raise only P15 billion to P20 billion incremental revenues from excise taxes on tobacco and alcohol products. This is way below the P31 billion under the version passed by the House of Representatives in June. (The P60 billion is the original proposal of the Department of Finance).

“Certainly, the administration is pushing for our measure that would have looked at the revenues that we have projected, that we’ve anticipated in order to fund our universal health care coverage,” Bureau of Internal Revenue (BIR) Commissioner Kim Henares said.

“We’re going to advocate [or the P60 billion]. It (the measure) will still go to plenary,” Henares told reporters.

Henares admitted that many in the executive branch were disappointed with Recto’s bill because the administration had high hopes that his committee would endorse a version better than what the House approved.

“The objective is to generate P60 billion, so we came out with the House bill with P31 billion. We were hoping that at the Senate, after the whole process, there would be an improvement of the P31 billion,” she said.

“I don’t think that Senator Recto can deny that the BIR and the DOF have extended all the cooperation, all the assistance, all the data he wanted, that’s why there’s a lot of people who were, to put it mildly, were disappointed. They put in hours of work until the wee hours of the morning and a lot of them felt that they were betrayed,” Henares added.

Health Secretary Enrique Ona said he was also disappointed with the Recto bill. “This will not be enough for the health care program.”

Under the DOF proposal, 85% of additional revenues from sin taxes will go to the universal health care program and 15% to affected tobacco farmers.

The health care program aims to cover enrollment of the country’s poorest families with the Philippine Health Insurance Corp. It also aims to improve and modernize the facilities and equipment of public hospitals. – Rappler.com

For related stories, read:

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.