SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Department of Finance (DOF) plans to expand the threshold of value-added tax (VAT) exemption to P3 million in order to soften the blow of higher excise tax on fuel and the possible removal of certain exemptions for senior citizens and persons with disabilities (PWDs).

“In terms of the VAT, we are proposing to increase the threshold from the current P1.9 million to P3 million. That means that if you buy goods and services from firms and businesses with sales [of] less than P3 million [a year], it will be VAT-exempt,” said DOF Undersecretary Karl Kendrick Chua at a Senate hearing on tax reform on Monday, October 25.

Chua, also the DOF’s chief economist, said raising the threshold would greatly help small businesses.

The DOF had submitted the first of 5 planned tax reform packages to Congress in late September.

The first package includes lower personal income and corporate tax rates, but also has revenue-generating measures to offset the projected loss of P173.8 billion.

These measures include raising excise tax on fuel and removing certain VAT exemptions for senior citizens and PWDs – proposals which some lawmakers have criticized as “anti-poor.”

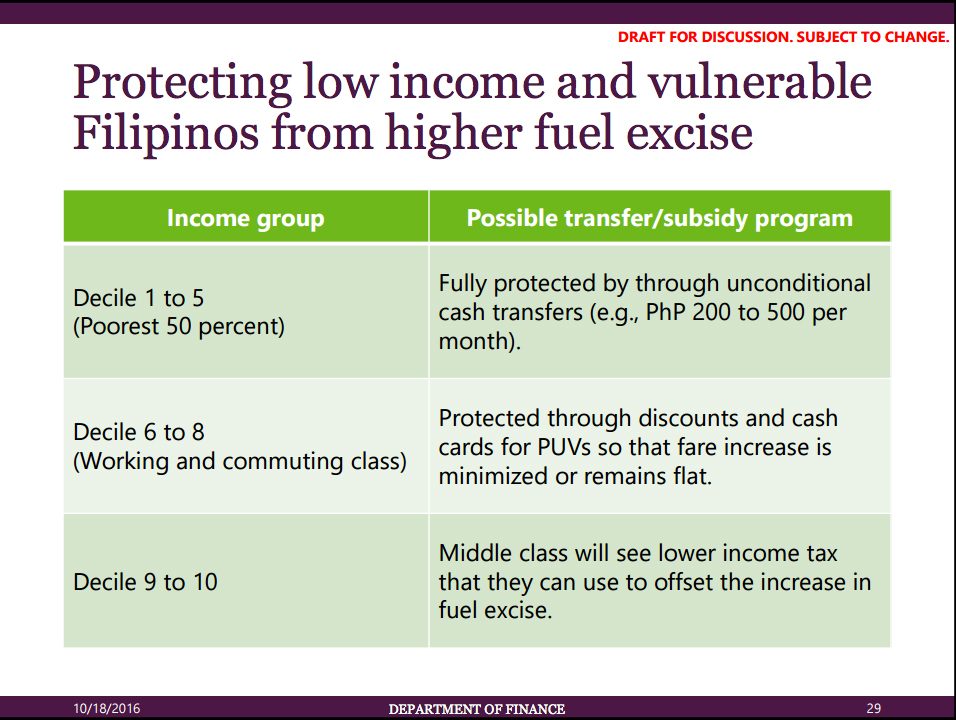

Additional safety net

Chua emphasized, however, that expanding the VAT threshold would benefit the poor.

“This is an additional safety net for the poor,” he said. “We are transforming our blind subsidies that benefit both rich and poor to a tax and transfer system that is more equitable.”

Chua also defended the proposed removal of certain VAT exemptions, which has been described as “counter-productive.”

“For senior citizens, we are proposing to retain the exemptions on medicine [as well as raw food]. However, we find that the expenses [from current VAT exemptions] in restaurants, air travel, and movie tickets are mostly consumed by rich seniors who can afford it so we are proposing to remove these exemptions,” he explained.

The revenue generated from removing these exemptions would then be given to the poor and vulnerable senior citizens through expanded pensions.

“For PWDs, we are proposing to transform the current VAT exemptions through more direct services and health packages,” Chua added.

He also noted that the country currently has 60 lines of VAT exemptions while Indonesia has 30 and Thailand, 35.

The DOF’s rough estimate is that the leakage from senior citizen exemptions is around P6 billion to P10 billion while removing some exemptions for PWDs would raise an additional P1 billion.

“I think we have a very strong case. The rationale for progressivity, simplicity, and efficiency are there. There will be certain people and industries that will be affected but this needs to be looked at from a more comprehensive perspective,” Chua said.

“We did reforms to the VAT in 2004 and we ended up with a far better economy than if we did not do it,” he added.

Emotionally-charged issue

But Senator Juan Edgardo Angara, chairman of the ways and means committee, cautioned that removing certain exemptions for senior citizens and PWDs is a sensitive matter.

“As you know, it’s a very emotionally-charged issue, not a pure mathematical one. It’s something that seniors feel they have already earned, having served for so long. You might not want to spend your political capital there,” Angara told the DOF at the hearing. “There is also the principle of compassion.”

Senate Minority Leader Ralph Recto also noted that the government’s tax collection should be improved first. A World Bank estimate indicates around P323 billion in taxes go uncollected due to evasion and smuggling.

For his part, Chua said the first reform package is targeted to be passed next year with implementation to start in 2018, which gives the DOF plenty of time to consult stakeholders, refine the package, and strengthen tax collection efforts.

“Our goal right now and next year is to work together with the Bureau of Internal Revenue and [the Bureau of] Customs to find a way to improve tax administration,” he said.

“We are not asking for the policy to be implemented today. We are asking [Congress] to consider our proposals and help us come up with a new bill that we can all be proud of. We’ll try to strike a balance,” he added. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.