SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Despite the perceived misgivings on the capability of the Duterte administration to handle the national economy, an overall economic policy is evolving and getting clearer, as the ongoing consultation process among various sectors intensifies.

The team of economic managers, composed of Finance Secretary Carlos Dominguez III, Economic Planning Secretary Ernesto Pernia, Budget Secretary Benjamin Diokno, Trade and Industry Secretary Ramon Lopez, and Bangko Sentral ng Pilipinas Governor Amando Tetangco Jr., has made the proposed Comprehensive Tax Policy Reform Program of 2016 the linchpin of the overall economic policy, which seeks to post an annual growth rate of 7% for the next 6 years.

The proposed tax reform program seeks to improve the tax system and provide revenue streams, raising an estimated P600 billion in new revenues every year to fund the slightly over P1 trillion investment requirements for the next six years.

The tax reform program envisions P400 billion of the P600 billion new revenues, or an additional 2% in Gross Domestic Product (GDP) through tax reform policies and the remaining P200 billion, or one percent of GDP, through improvements in tax administration. This includes spreading the tax net so that even those in the informal sector would be subject to taxation.

But the tax reform program does not only raise new taxes or provide steady revenue streams. It also recasts the overall economic policy environment by adopting a more inward-looking approach to favor import substitution, the same policy that characterized the postwar reconstruction period.

Replacing existing strategy

Dominguez, in a recent gab with journalists, conceded that the new set of tax reform policies contains provisions that would lead to replacing the existing strategy to spur exports, which the World Bank had imposed on the Philippines in the 1970s. At that time, the Marcos dictatorship needed concessional credits, also called official development assistance (ODA), to prop up the martial law government. The export-driven economic policies still exist.

Dominguez admitted that the current team of economic managers has taken seriously the studies of several Filipino economists, which said that the World Bank-imposed export-driven economic strategy has been a dismal failure for the Philippines. They cited the fact that the local economy could hardly replicate the earlier success of export-driven economies like Japan, Taiwan, Singapore and Hongkong.

Economists Rene Ofreneo and Edgardo Villegas, and Joseph Lim are among the local economists who have come out with findings that the World Bank had failed to convert the Philippines into a viable laboratory for its economic doctrines and prescriptions, as local exports had remained dismally low in the world market and failed to uplift the national economy to higher levels.

The Department of Finance (DoF), the lead agency in the pursuit of the tax reform program, meanwhile, has been holding frequent consultations with the business community, as represented by private various organizations, in a major initiative to refine the tax reform program and make it viable and acceptable for the country.

The consultation process has yielded several amendments, including the adoption of healthy living policies, which include taxes on sugar used in various food preparations and social protection for heavy users of “sin products” – cigarettes and other tobacco products, beer, liquor, and other alcoholic drinks.

Tax reform program

The Comprehensive Tax Policy Reform Program of 2016, serving as the virtual economic blueprint of the Duterte administration, contains policy initiatives, of which its enactment by Congress could lead to profound changes in the economic policy environment.

The tax reform program seeks to shift the source of economic growth to investments from consumption, as the proposed tax reform program envisions massive investments in infrastructures and human resources.

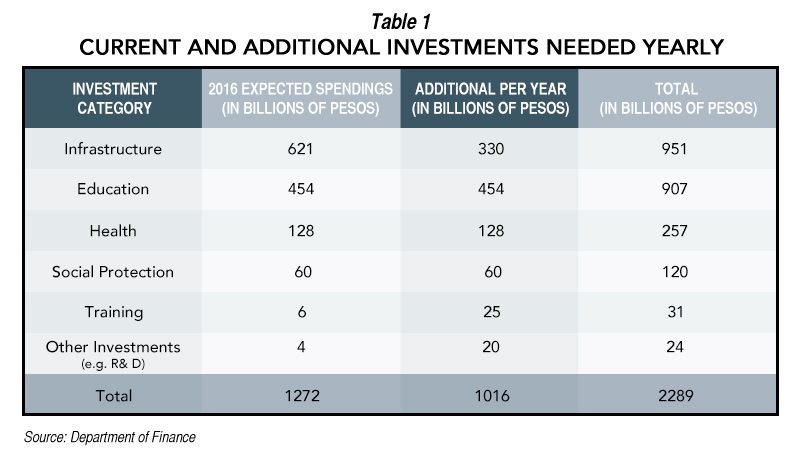

Overall, the proposed tax reform program sets the investment requirements at P1 trillion to reach P3.5 trillion by end-2017, or about 17% of the GDP. It proposes to raise at least P330 billion annually for infrastructure expenditures, up by nearly 50% to the 2016 national budget has P621 billion.

It also seeks to double every year the 2016 budget of P454 billion for education and P128 billion for health services to reach at least P907 billion and P257 billion respectively for the succeeding years. (See Table 1)

The national economy earlier collected of P2.2 trillion, or about 14 percent of GDP, in 2015. It has a revenue target of P2.5 trillion by end-2016. If it could collect at least P600 billion by next year, the revenue collections could reach P3.1 trillion, or about 15 or 16 percent of GDP.

It seeks to reduce by 2022 the incidence of poverty rate, or the number of people who could hardly meet their basic needs of food, shelter, and clothing, from the current 26 percent to 17 percent and achieve high middle income status.

The economic managers believe the tax reform program could eradicate extreme poverty, provide equal opportunities for all Filipinos, and achieve high income status by 2040, or an entire generation from now.

Certain conditions

But the proposed tax reform program has a catch.

It could only raise the funds for its huge investment requirements for infrastructures, education, and other requirements by adopting an efficient tax system with low rates, expanding the tax net, and reforming the existing tax administration systems of the Bureau of Internal Revenue (BIR) and Bureau of Customs (BoC), Dominguez explained.

Twenty years ago, Congress had enacted Republic Act 8424, or the Tax Reform Act of 1997, which has 2 main provisions: restructuring of the tax system on downstream oil industry and shifting to specific tax system the erstwhile ad valorem tax system the excise taxes on “sin products” of cigarettes and other tobacco products, and beer, liquors, and other alcoholic products.

RA 8424 has made the BIR a powerful body, with the BIR commissioner enjoying enormous powers on taxation. It limited the areas of discretion for tax avoidance, and simplified the tax system to encourage taxpayers’ compliance even in the informal sector, or the so-called “underground economy.”

Despite what has been described as its “progressive nature,” the adoption and implementation of RA 8424 has not triggered substantial revenue increases to support a program for massive infrastructure and human resource expenditures.

Tax reform packages

Dominguez said the DoF would submit to Congress, particularly the House of Representatives, where tax laws usually emanate, at least 4 packages, containing the proposed tax reform policy packages.

- The 1st contains amendments to the modified gross personal income tax and the various social protection legislations to soften the impact of its restructuring;

- The 2nd has amendments to the corporate income taxes and the subsequent rationalization of fiscal incentives;

- The 3rd includes amendments to the real estate property taxes;

- The 4th carries amendments to capital income taxes.

According to DoF sources, only the first package on modified personal income tax reform has been submitted to Congress for enactment, as the 3 other packages undergo rigorous consultation processes with affected sectors. They indicated that the 3 packages require thorough vetting processes because of the enormity of their implications.

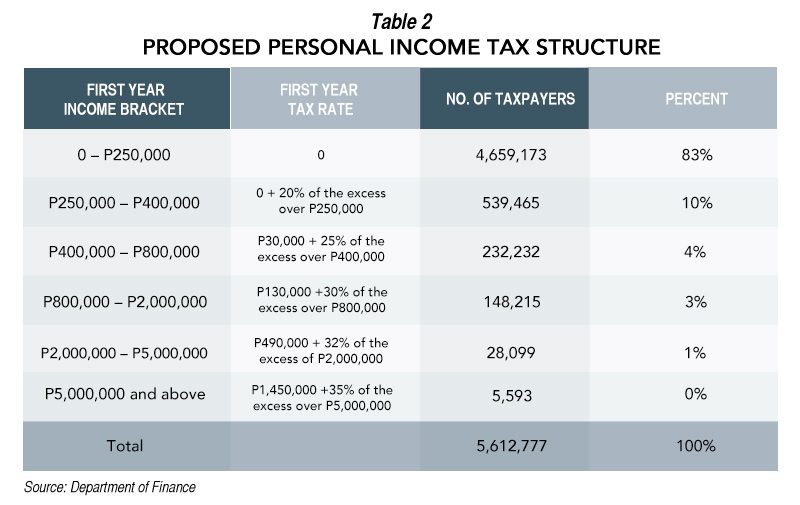

The proposed structure changes on the modified personal income tax seeks to cut the income tax rate to 25 percent from the current 32 percent of all personal earnings. Under this proposed package, all persons earning below P250,000 a year will be exempted from paying income tax, while those earning P250,000 to P400,000 a year will pay 20 percent in excess of P250,000.

The package provides graduated tax rates on various brackets for people earning P400,000 and above a year. It will affect 5.6 million taxpayers. (See Table 2)

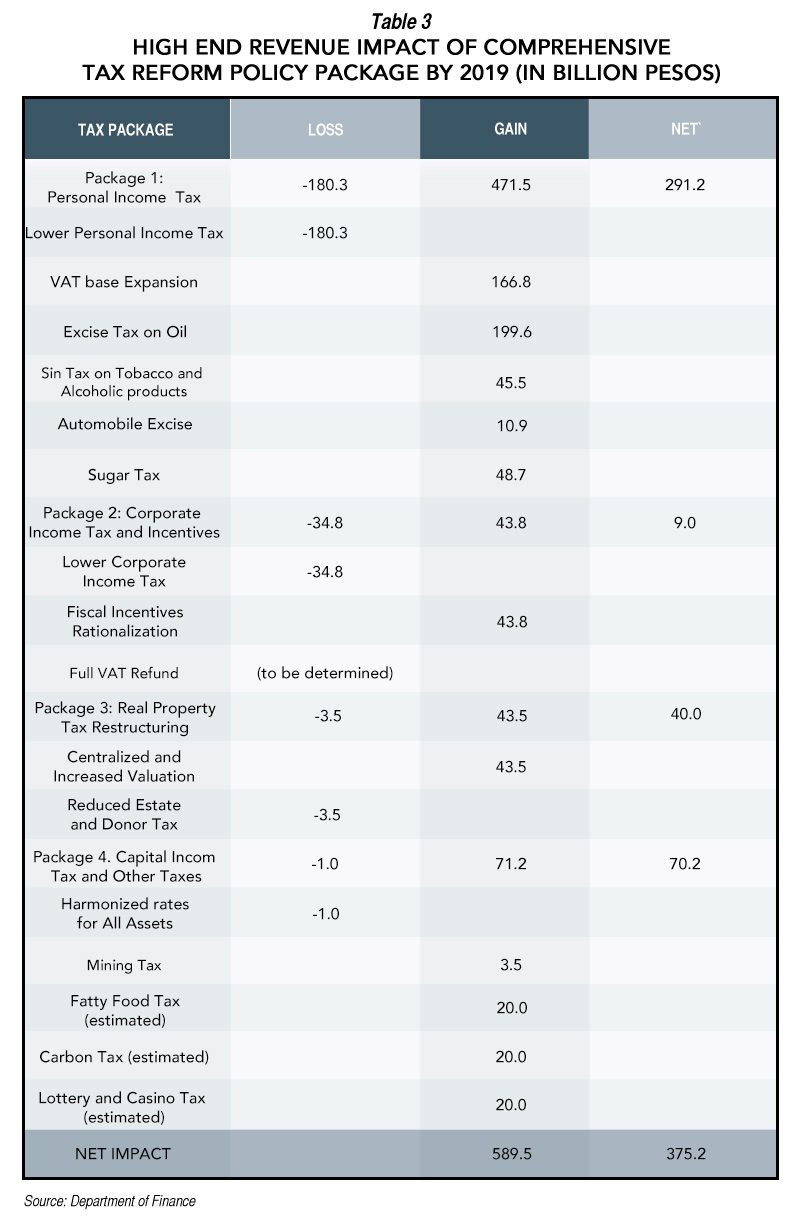

The proposed package on modified gross personal income tax structure could lead to losses of P180 billion in personal income revenues, but they could be offset by a bevy of measures, which could trigger new revenue inflows reaching at least P475.1 billion, or a net gain of P291 billion annually.

These new tax measures include the expansion of the expanded value added tax base, imposition of new excise taxes on petroleum products, automobiles, and “sin products” (cigarette and tobacco products, beer and alcoholic products), and enactment of sugar tax. The government imposes excise tax mainly to recover the social cost of these products.

The expansion of the expanded VAT base includes an amendment to the senior citizens’ law, scrapping the exemption from E-VAT coverage of senior citizens’ purchase of goods and services. While this measure could add P10 billion annually to the national coffers, Dominguez said the DoF was preparing a social protection measure that would lead to P500 monthly subsidy for every senior citizen in the country.

But senior citizens’ organizations have been opposing this proposed measure because it was tantamount to fixing something that was perceived not broken. Senior citizens are already hard up by the rising prices of consumer goods, they claimed, even as they argued that the loss of P10 billion from E-VAT exemption could be recovered and sourced elsewhere.

Dominguez argued that in most cases only the affluent and middle class senior citizens avail of the E-VAT exemption, as the bigger universe of senior citizens hardly go to restaurants and supermarkets. “The intention to help the senior citizens is hardly met by the E-VAT exemption,” he said.

The imposition of new excise taxes is considered crucial to recover lost revenues from the restructuring of the personal income tax and ensure success of the proposed tax reform. But they are also regarded as inflationary, as they could set the prices of commodity goods spiralling without control. (See Table 3)

The program seeks to raise the excise tax to P10 per liter from the current P4.35 per liter on gasoline and related products, and P6 per liter from zero on diesel, kerosene, and essential petroleum products. The new excise taxes could yield as much as P200 billion annually.

Taxes on petroleum products

Some quarters said the new excise taxes on petroleum products could trigger corresponding increases in the prices of petroleum products. They said it could mean at least a 25-percent rise, which could subsequently escalate prices of commodity goods.

But Finance Undersecretary Antonette Tionko said the increases could be “minimal.” She did not elaborate. A top official of a local petroleum firm raised the specter of at least 20 percent inflation upon adoption of the proposed new excise tax rates.

DoF sources confirmed that the proposed new excise taxes on petroleum products is still undergoing consultations and discussions among various business groups and organizations because of their adverse effects. The new excise tax rates have to be firmed up, they said.

Even in Congress, the proposed excise tax rates on petroleum rates have been met with opposition, as lawmakers have expressed fear of inflationary pressures. Dominguez and Tionko admitted that the new excise tax rates have to be discussed thoroughly.

Traffic jams

The new tax reform package includes new excise tax for cars to raise new revenues and recover the social cost associated with heavy traffic jams and pollution in Metro Manila and other major cities nationwide.

The DoF has projected a revenue stream of at least P10 billion annually from the next excise tax structure for automobiles, but lawmakers said the new revenues could go up to P50 billion yearly. Discussions on this legislative measure have started at the House of Representatives, although the conflicting figures on potential revenues have been hardly settled.

The tax reform program proposes excise tax on automobiles priced at P600,000 and above at five percent of the selling price from the current rate of two percent.

But it seeks to impose tax rates of 20 percent for cars selling above P600,000 to P1.1 million; 40 percent for those selling over P1.1 million to P2.1 million, and 60 percent for cars with prices over P2.1 million.

Buses, trucks, cargo vans, jeepneys, jeepney substitutes, single cab chassis, and special purpose vehicles are exempted from the proposed tax hike.

Already, tax manufacturers and dealers have expressed opposition to the proposed tax hikes because it could lead to higher car prices, which in turn could slow down automobile sales and adversely affect the domestic economy.

Healthy living policies

To augment the losses caused by the modified personal income tax structure, the DoF has set to increase excise taxes on tobacco products, beer and alcoholic products, or the so-called “sin products,” to raise at least P45.5 billion annually. The DoF has likewise come out with the planned imposition of sugar tax to raise P48.7 billion yearly.

During the subsequent consultations with private organizations, the emerging consensus is to propose a spate of policies that does not only raise revenues but offset the social costs of those “sin products” and promote healthy living as well.

They have been amply dubbed as “healthy living policies” because they have sought to institutionalize social protection to consumers of “sin products” and sugar laced foods that could trigger diabetes and other healthy issues.

For instance, certain advocacy groups have proposed alternatives to smoking cigarettes, products that have been widely criticized for causing a number of life threatening health issues like cancer and emphysema. For them, it would not be enough for the DoF to raise the excise taxes to moderate the use of cigarette and tobacco products.

Advocacy groups want alternatives, which include the use of electronic smoke to replace. But they expressed beliefs that Congress should come out with pieces of legislation to regulate their use, sets standards, and protect buyers from fraudulent products. E-smoking, or vaping, has come of age in the Philippines, as indicated by the rising number of electronic vapers, but no regulation exists for the emerging market.

“Most vapers agree that regulation is necessary. We need it to ensure quality in the products being sold, for shops to be held accountable if they sell to minors, and to encourage other smokers to switch,” Alan Christopher Marciano, secretary general of Provape Philippines, an advocacy group.

“Whether we like it or not, most people who don’t have access to valid research and studies done on vaping are hesitant to give it a try. With approval from the government in the form of regulations, a lot of smokers will most probably be more confident to switch,” Marciano said even as he pointed that he expected future state regulations as not restrictive to discourage would-be switchers.

Marciano noted that previous surveys and research works showed that a significant number of cigarette smothers want to quit, but existing state policies do not allow smokers to have sufficient information to make informed decision to switch to vaping. Smokers just want to be given the information about the alternatives to smoking traditional cigarettes, Marciano said, adding that the government should not delay growth of such alternative.

In a position paper submitted to the DoF to support legislation to create alternatives to smoking, factsia.org, a regional consumer advocacy group that did the first-of-its-kind survey of adult smokers in Philippines, said it has found that most smokers (70 percent) see e-cigarettes as a “positive alternative” to tobacco products. The same number – 70 percent – would consider switching to e-cigarettes “if they were legal, met quality and safety standards, and were conveniently available”.

The survey was conducted to gauge consumers’ views on safer alternatives to conventional cigarettes, such as e-cigarettes that contain nicotine – products that do not burn tobacco and therefore do not produce the potentially dangerous particulates, tar and smoke found with cigarettes. E-cigarettes are viewed as a far less harmful alternative for smokers, who either find it difficult to quit or who enjoy their nicotine.

Few smokers in the Philippines have tried them – just 15 percent of the survey of three major population centers. But they are almost unanimous in believing they should have a right to access information about less harmful products (86 percent agree), while more than three-quarters agree that: “Through tax and regulatory policies, the government should encourage adult smokers to switch to less harmful alternatives to cigarettes and ensure they are not used by youth.”

Advocacy groups are also proposing the creation of a smokers’ fund, where a portion of collected excise taxes would automatically set aside to finance the hospitalization of chronic smokers. Certain European countries have institutionalized these “smokers’ fund.” But this is regarded long shot at the moment.

The imposition of sugar tax is a way to lessen the consumption of sugar, which is being viewed as a culprit in the rising incidence of diabetes and other illnesses. DoF sources said the sugar tax is still being determined in the consultation process. – Rappler.com

Next: Tax reform package abandons World Bank prescriptions

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.