SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Philippine peso took another beating, as it dipped to a fresh 8-year low against the US dollar on Monday, November 21, pulled down by investors’ concerns over a possible interest rate hike in the US by the end of the year.

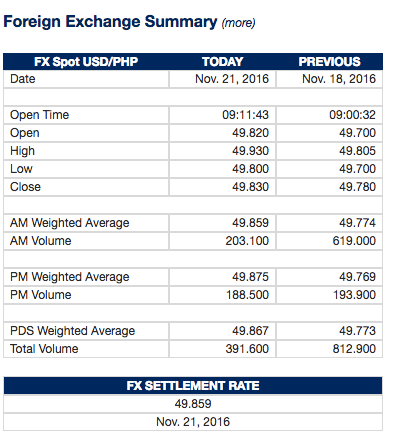

The local currency ended at P49.83:$1 on Monday, weaker than the P48.78:$1 last Friday, November 18. (READ: Peso depreciation: Should we be worried?)

It was the peso’s weakest level against the US dollar since November 24, 2008 – the height of the global financial system meltdown – when it also closed at P49.83:$1.

“The peso depreciated slightly today still because of risk aversion amid US political uncertainties and concerns over the possibility of a US interest rate hike next month,” a trader said in an email.

Another trader said the continuing depreciation of the Philippine peso is because of the “continued strength of the US dollar.”

US Federal Vice Chair Stanley Fischer has also appeared supportive of hiking the rate this December. The minutes of the US Federal Reserve meeting last September 20-September 21 revealed that several central bankers pointed out the need for a rate hike “relatively soon.”

The next Federal Open Market Committee (FOMC) meeting is set for December 13 and December 14.

“For tomorrow (Tuesday, November 22), the exchange rate may move within the P48.70 to P50 range. Trading might still be influenced by worries about December’s likely increase in the federal funds rate. Profit taking, however, might cap the dollar’s appreciation,” the trader said.

Emilio Neri Jr, vice president and lead economist of the Bank of the Philippine Islands, was quoted in a Manila Times article last October as saying that he expects the peso to be closing at P50-P51:$1 at the end of 2017.

“Our view for the foreign exchange has been to some degree of a depreciation. I think it will be P50 to P51 a dollar at the end of next year. I hope it doesn’t happen this year, with the communication style of our leader. But I think that level is very reasonable,” Neri told the newspaper.

On Philippine stocks, the bellweather Philippine Stock Exchange index shed 88.67 points or 1.26% at 6,979.06 on Monday, November 21.

Broader All Shares, meanwhile, lost 31.66 points or 0.74% at 4,222.62 at the same day on the heels of US President-elect Donald Trump’s recent victory. (READ: Philippine stocks plunge to 7-month low on Trump’s win). – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.