SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

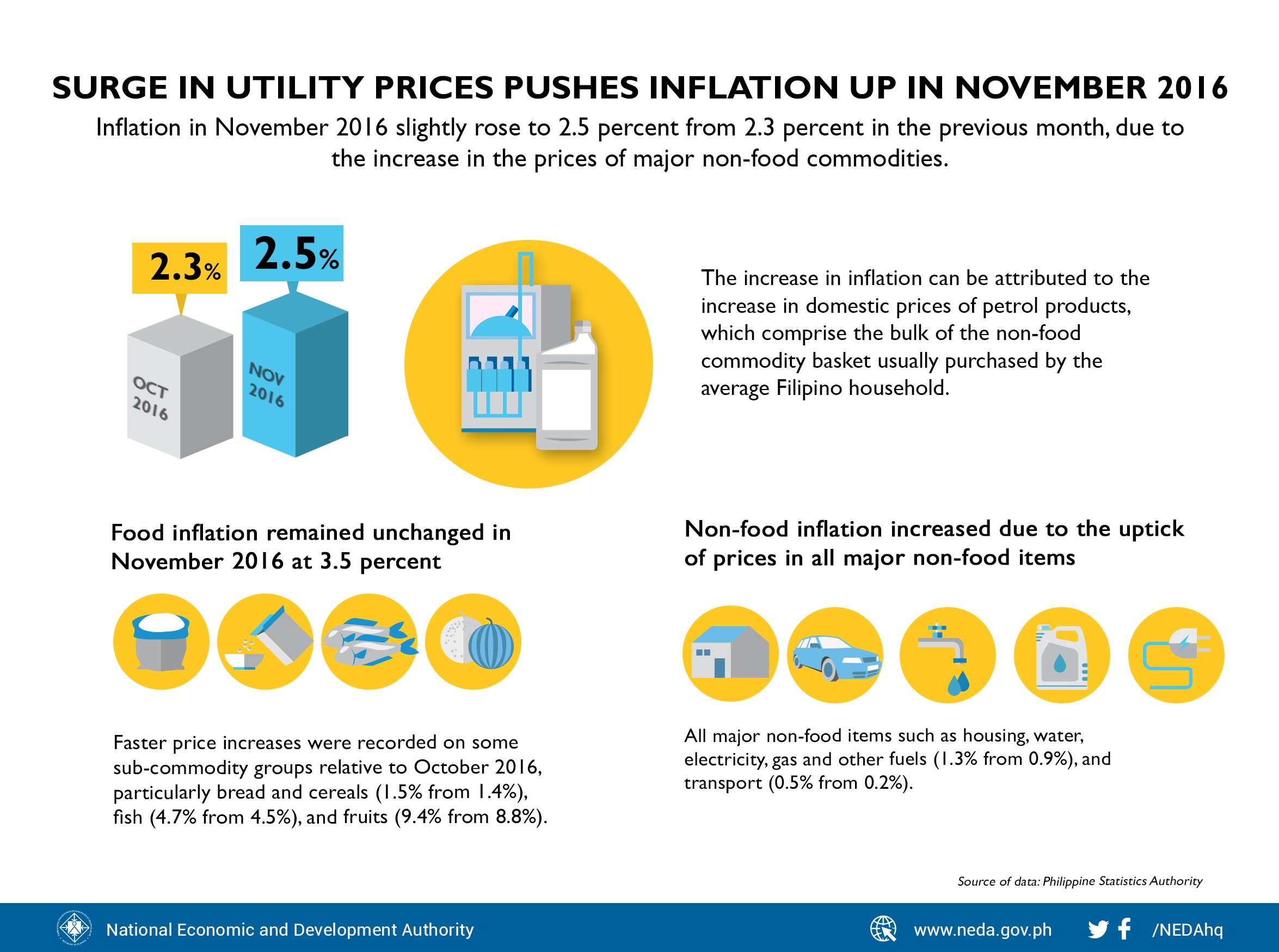

MANILA, Philippines – Inflation increased to 2.5% last November from 2.3% in October due to higher oil prices, said the National Economic and Development Authority (NEDA) on Tuesday, December 6.

The increase means the country’s inflation rate is at its highest level since February 2015, when inflation also averaged 2.5%.

The November figure is also slightly higher than the Bangko Sentral ng Pilipinas’ monthly forecast range of 1.7% to 2.4%.

“The increase in inflation can be attributed to the increase in domestic prices of petrol products, which comprise the bulk of the non-food commodity basket usually purchased by the average Filipino household,” said Socioeconomic Planning Secretary Ernesto Pernia in a statement.

Prices of gas and other fuels for the month increased to 1.3% from 0.9% in October, while transportation prices also rose to 0.5% from 0.2%.

Fuel prices are expected to increase even further after the recent announcement of an agreement by members of the Organization of the Petroleum Exporting Countries (OPEC) for a joint output cut, which sent global oil prices soaring.

Prices for all other major non-food items such as housing, water, and electricity rose as well.

Food inflation, meanwhile, remained unchanged in November at 3.5%, with rice prices breaking their 5-month-long increasing trend and corn prices continuing to go down since August.

NEDA also pointed out that the lifting of the Philippines’ quantitative restrictions for rice imports by July 2017 is expected to cut market prices of well-milled rice by P7.00 and farm gate prices by P5.00.

“Overall we expect the full-year inflation for 2016 to be well within the government’s inflation target band of 2-4%. The overall balance of risks is tilted on the upside, with supply-side factors as the main contributor to price adjustments,” said Pernia.

He added that international and domestic risks are tilted upward from a possible rally in oil prices, the depreciation of the peso against the US dollar, and pending petitions for electricity rate increases. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.