SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Philippines’ biggest business group, San Miguel Corp., saw profits surge 61% in the first 9 months of 2012 to P19.2 billion from P11.9 billion in the same period last year.

The gains came largely from the company’s power unit and brewery.

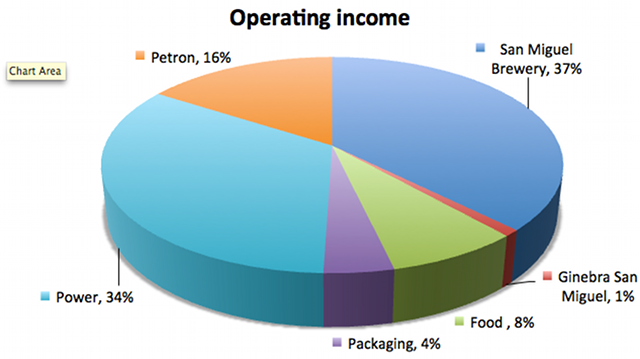

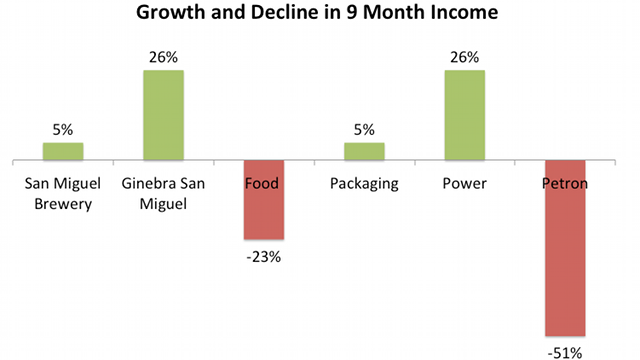

San Miguel Brewery was the largest contributor to operations income, which rose 5% to a whopping P15.4 billion. SMC Global power was the second largest, bringing in an operations income of P13.9 billion.

San Miguel’s power group generated 9% more power year on year and increased net sales 7%. In a statement to the Philippine Stock Exchange on Wednesday, November 14, San Miguel attributed the gain to “a combination of higher revenues and a decline in operating expenses.”

San Miguel has diversified in recent years and relies less on the brewery unit that was originally its primary business. San Miguel Brewery brought in the greatest share of the vast conglomerate’s operating revenue although it actually sold fewer cases of beer year-on-year.

The number of cases sold dropped 1% to 164 million cases in the first 9 months of the year from 165.8 million last year. Still the brewery brought in 3% higher net sales to reach P53.85 million which the company said was due to “management of fixed costs for beer domestic and improved operating performance.”

The food group was not able to fully recover from higher corn prices as well as a cassava shortage in the first quarter.

“Operating income for year-to-date September amounted to P3.3 billion, lower than last year due to the effect of high corn prices and low supply of cassava experienced during the first quarter,” said San Miguel in a statement.

At the same time Petron Corporation sold 55% more fuel amounting to 53.2 million barrels, but operating income for the unit dropped a whopping 51% amid fluctuating fuel prices.

“Consolidated operating income amounted to P6.5 billion, still lower than last year, as global oil markets remained volatile particularly from April to July. Slight increases in crude oil prices and finished products, which started in the second week of July, are likely to continue for the rest of the year,” said SMC. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.