SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

The story of how Zalora Philippines eventually came to be part of the Ayala Group serves as a signpost to the conglomerates’ race to keep pace with world rapidly going digital.

Ayala Corp, along with subsidiaries Globe Telecom, Ayala Land, and BPI, took a combined 49% stake in Zalora Philippines in a deal announced last month.

The deal had its roots, not in any of the 3 mainstays of the Ayala Group, but in one of its newer arms: education.

“One of the investors in Zalora had investments in education and they wanted to look for ways we could work together and so they approached Fred Ayala, head of AC education,” said Jose Teodoro Limcaoco, Ayala Corp’s CFO at the firm’s annual stockholder’s meeting on April 21.

“He in turn got a good glimpse into the firm’s operations and after over a year of discussions and trying to understand the ecommerce model and their plans, the deal went through. It was teamwork,” he explained.

Ecommerce but also logistics

For the Ayala Group, the investment represents an entry into not just one but two industries they view as game-changers in the country: electronic commerce (ecommerce) and, potentially, logistics.

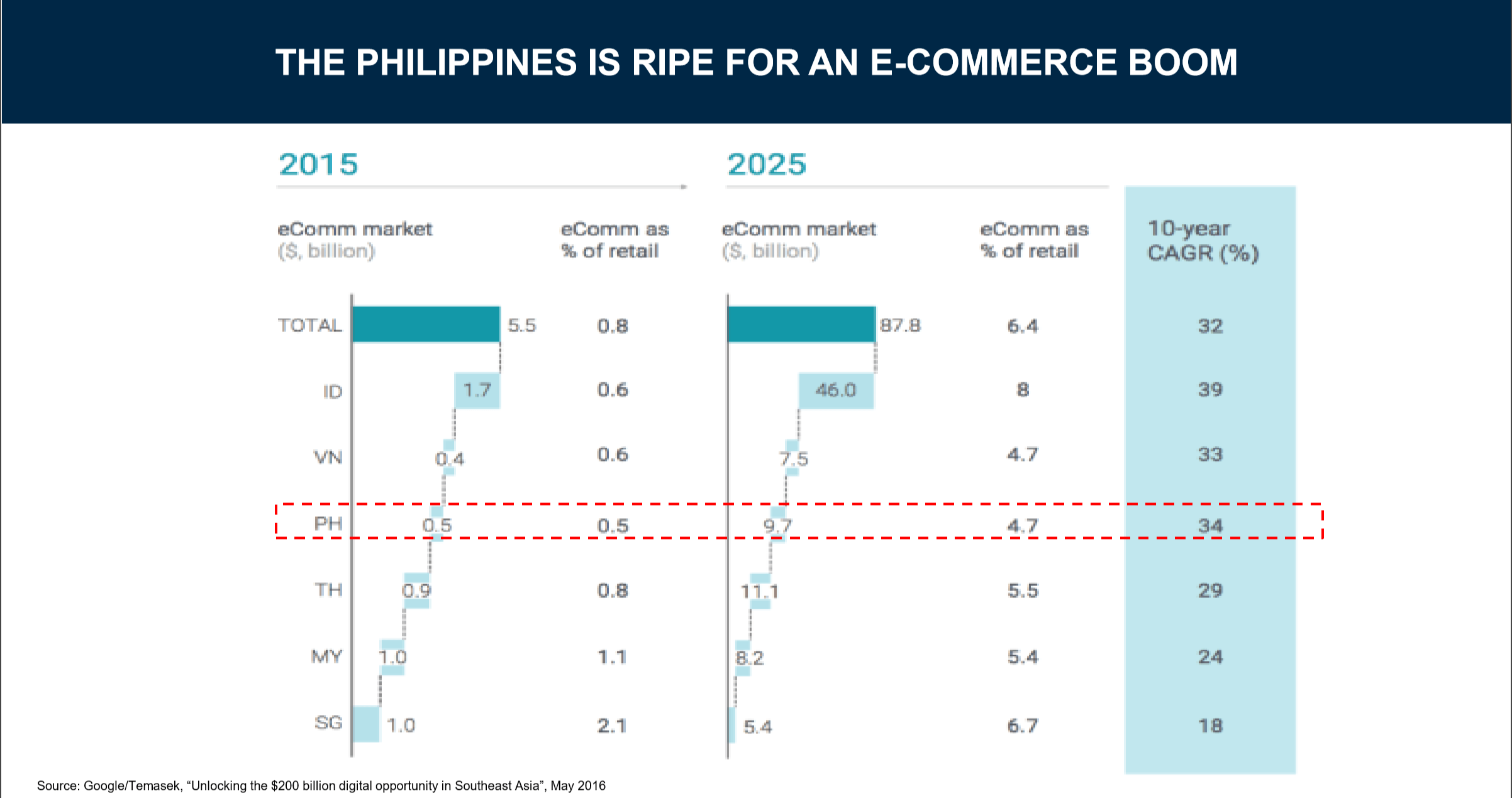

“The way we view [the deal] is that there is a trend beginning to take place in the country. We have many young people and the usage of mobile phones and internet in the country is probably among the highest in the world. Yet our use of the ecommerce space is very, very low. We believe there will be a trend of people using ecommerce more and more over time,” said Ayala Corp Chairman Jaime Zobel De Ayala.

Underpinning that trend, however, is a way to take products from one point to another and that involves a logistics system.

“Logistics is an important component in what makes the country work and we are actually very interested in that field. What was exciting about the Zalora investment is that lying beneath the ecommerce surface is a distribution business built up from scratch,” Zobel de Ayala explained.

“We believe it can become more robust, and we can help grow it as we proceed and have it deliver many more products, not just the ones that Zalora carries at this time,” he added.

Limcaoco elaborated on that noting that Zalora delivers 80% of their own goods through to the last mile averaging about 6,000 two way deliveries a day since most of the products are bought using cash on delivery (COD).

The deal also dovetails nicely with Ayala Corp’s recent deal, creating a joint venture with Ant Financial, the leading digital payments platform in China along with Globe and its subsidiary Mynt.

“The fact that we’ve also invested in the payments system side is also a big advantage. The vast majority of ecommerce in the country is done through COD, which is unusual in a global setting as most people around the world pay electronically. So rather than seeing that as a problem, we see that as an opportunity. ” Zobel de Ayala explained

“People will need a payment system that they can trust and is accessible, and the investment with Mynt, Globe and Ant financial is going to make for a very interesting platform to make that happen,” he added.

The group was also drawn to Zalora beyond other ecommerce firms because its revenues were growing at 40% a year with a business model that aims to be profitable by 2019.

Hedging retail empires

Part of the interest in this is because its conglomerate rival, SM Investments Corportion, has made an even more concrete play into logistics by taking a 34.5% stake and effective control over the 2GO Group; the country’s largest integrated logistics firm.

The two conglomerates are the country’s leading retail mall developers, although the rise of ecommerce is threatening foot traffic in physical malls around the world.

In what most analysts point to as a sign of the changing times, the online-born Alibaba is now also the world’s largest retailer, having overtaken traditional retailing giant Walmart in sales last year with revenues of $15.7 billion.

Digital dive

This rise of ecommerce is part of a wider trend of disruption caused by a world turning more towards the digital, a trend that Zobel de Ayala noted the group is keen to keep pace with.

“If you really look at all our businesses, the digitization of that space is taking place in many ways not just in fintech and an ecommerce platform,” he noted.

“In Globe, its massive, while we’re spending a very substantial amount of money in BPI to upgrade everything to enter the digital space. Ayala Land also uses digitization in many different ways. It is also changing how products and services are delivered in health and education,” he added. (READ: Ayala Corp enters health tech via ePharmacy startup)

One of the group’s businesses that has benefitted immensely from the world going digital is its manufacturing arm IMI.

The firm, which features factories all around the world, has grown on the back of manufacturing semi-conductors and sensors, both of which key components for smart cars and other smart products.

“A lot of the new businesses that are growing in manufacturing is a result of the transformation of the Internet of Things (IoT) and how its transforming how cars and other forms of transport are run,” the Ayala Corp chairman noted.

To reinforce his point, IMI also just recently announced that it acquired a majority stake in UK based STI Incorporated, further diversifying its manufacturing capabilities into aviation and defense components.

Zobel de Ayala also highlighted the group’s size, and the fact it has its hands in plenty of industries, puts it in a unique position in seeking out new opportunities in the fast-changing economy.

“The Zalora deal really reveals a unique opportunity that the Ayala group has with these different window of opportunity that come across. Our size allows us to intelligently harness the flow of relationships and opportunities that come,” he said.

The chairman pointed out that the reason Ayala Corp, aside from its own stake in Globe, got involved in the joint venture with Ant Financial was because the Chinese giant “wanted Ayala Corp’s as part and parcel of that investment given the breadth of interest we have in the group,”

“Sometimes it’s a little bit serendipitous but sometimes there’s a little bit of order in the chaos. Sometimes you can spot trends and people approach you and it starts to fit a pattern in our mind of where trends are going and before you know it, you start putting capital and managers towards the project,” he added.— Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.