SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The increase in consumer prices in June 2017 was the slowest in 5 months as the cost of domestic gasoline fell significantly – a trend seen to continue for the rest of the year.

With stable and low oil prices, slower price adjustments in both food and non-food commodities were recorded last month by the Philippine Statistics Authority (PSA).

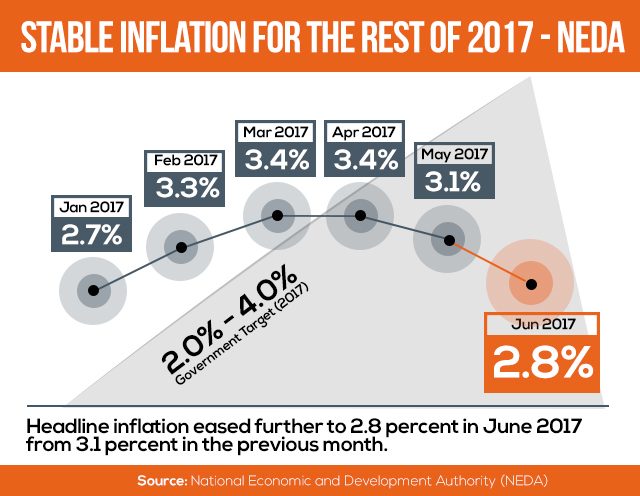

This caused the Philippine inflation rate to slow down to 2.8% in June, from the 3.1% recorded in May.

The National Economic and Development Authority (NEDA) projects the moderate inflation rate registered in the first 6 months of 2017 to continue for the rest of the year.

First Metro Investments Corporation, the investment banking arm of Metrobank Group, expects the inflation rate to be between 2.8% and 3.2% by year-end.

“Food prices will continue to be stable and oil prices will remain low due to increased crude oil production and higher US shale oil output,” First Metro senior vice president Christopher Salazar said in a media briefing on Wednesday, July 5.

The June inflation rate is lower than market expectations of 3%, and within the government’s target of 2% to 4%.

Without the volatile prices for food and energy, the core index for consumer prices also eased to 2.6% in June from 2.9% in May. This reflects the general price stability across goods and services.

For food and non-alcoholic beverages, inflation slowed to 3.5% in June from 3.8% in May.

Likewise, non-food inflation slowed to 2% in June from 2.5% in May.

“This follows the significantly slower year-on-year increase in domestic petrol prices during the period, particularly unleaded gasoline (5.1% from 9.9%), diesel (5.3% from 13.6%), and kerosene (3% from 9.6%),” NEDA Undersecretary for Policy and Planning Rosemarie Edillon said in a statement.

Good weather conditions

Edillon added that keeping inflation stable strengthens prospects of stronger domestic economic activity in the near-term.

“The significant decline in the probability of extreme weather disturbances due to El Niño and La Niña until the end of 2017 bodes well for agricultural production and commodity prices moving forward,” the NEDA official said.

She added that the government should make the most of good weather conditions to accelerate the implementation of climate change adaptation measures.

“Among the crucial ones are investing in infrastructure like catchment basins, advance atmospheric moisture extraction, and promoting water-saving technology. Rehabilitation of damaged irrigation systems and periodic maintenance will also ensure disaster and climate resiliency of the agriculture sector,” Edillon said.

But despite stable inflation levels, possible risks still have to be considered.

“On the external front, domestic prices may be affected as global financial market conditions adjust in response to the faster monetary policy normalization in the United States,” Edillon said.

She added that, domestically, the transitory impact of the proposed Comprehensive Tax Reform Program (CTRP) could push up inflation once implemented.

“We find it critical to have social safety nets to mitigate the short-run effects of the tax reform program. Nevertheless, the government needs to communicate well to the public the CTRP’s benefits especially in terms of productivity improvements which, in effect, will eventually result in lower inflation,” she said.

In January this year, the inflation rate clocked in at 2.7%. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.