SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

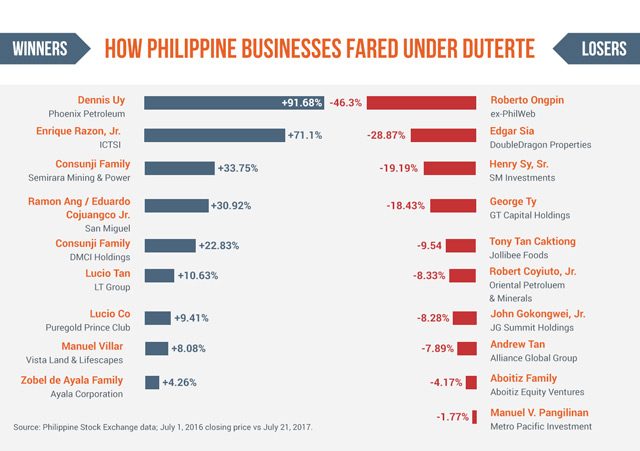

MANILA, Philippines – Majority of the Philippines’ most valuable companies have continued their growth trajectory that started to build up even before President Rodrigo Duterte took office in 2016.

A year into Duterte’s 6-year term, the firebrand leader has partly made good on his promise that he will leave businessmen on their own as he focuses on his pet issues, like the war on drugs and terror.

But his tirades against owners of some of the biggest companies, and his vocal support and admiration for a select group of businessmen, have caused some shock or awe at the Philippine Stock Exchange. Investors bet their money on companies led by a family or business groups they consider potential winners or losers.

As Duterte delivered his State of the Nation Address (SONA) on Monday afternoon, July 24, Rappler took a look at how the stock price of the Philippines’ largest and most valuable companies performed in the first year of the Duterte administration.

Reaped rewards

Phoenix Petroleum Phillippines Incorporated was the best performing stock in the past year. It is led by Dennis Uy, a businessman from Davao and a longtime friend of President Duterte.

Phoenix’s stock price increased a whopping 92% from P6.25 apiece on July 1, 2016, to P11.98 as of Friday, July 21, data from the PSE showed.

Uy was one of the biggest contributors to the campaign of Duterte, his provincemate. To show his appreciation, Duterte visited the Philippine Stock Exchange for the first time as Chief Executive during the 10th year listing anniversary of Phoenix Petroleum. (READ: Duterte visits PSE for campaign donor Dennis Uy, and Duterte’s friend,creates P100-M Mutual fund for government troops)

Aside from Uy’s association with Duterte, the country’s richest family, the Sys, has also partnered with him in acquiring control of logistics firm 2GO. (READ: How SM Investments acquired a stake in 2GO)

Uy has been aggressive in growing his business portfolio via a series of acquisitions, including the purchase of Petronas Energy Philippines Incorporated and Duta Incorporated as well as Enderun Colleges ealier in the month. In addition to this, Uy’s shipping and logistics arm Chelsea Logistics Holdings Corporation will soon debut on the PSE on August 8.

Other winners in the past year include the International Container Terminal Services Incorporated (ICTSI), the listed firm of ports and casino tycoon Enrique Razon Jr.

ICTSI’s stock price grew a spectacular 71% from P61.95 in July 2016, to P106 apiece a year later.

Diversified conglomerate San Miguel Corporation is among the best performers as well. Led by businessman Ramon Ang, San Miguel’s stock reached P103.1, an impressive 31% climb from P78.75, its price when Duterte took office in 2016.

Like Uy, Ang has been cited as a Duterte campaign donor. Duterte also referred to Ang as a “fast friend,” as the businessman has made donations and sponsored various facilities that support the President’s initiatives. (READ: Meet Ramon Ang, Filipino billionaire and Duterte’s friend)

LT Group, Incorporated also performed well. The listed holding firm of airline, drinks, and cigarettes tycoon Lucio Tan grew a respectable 10.63% from P15.8 a year ago to P17.48 by market close on July 21.

Tan is among the first high-profile businessmen who congratulated Duterte in Davao after it the results of the May 2016 election came out. Duterte has been lukewarm to Tan, even calling him out and challenging him last April for unpaid taxes.

Among the other listed firms that reaped rewards over the first year of Duterte’s presidency are the Consunji family’s Semirara Mining and Power Corporation as well as DMCI Holdings, Incoprorated, the listed firm of infrastructure and mining tycoon David Consunji.

Semirara Mining and Power Corporation’s stock price climbed from P125.6 apiece to P168, growing 33.75%. Meanwhile, DMCI’s stock price increased 22.83% from P12.7 to P15.6 per share as of Friday, July 21.

Property firm Vista Land and Lifescapes, Incorporated, led by former Senate President Manuel Villar Jr; and Ayala Corporation, the oldest conglomerate in the country led by the Ayala family ,also fared well over the last year. Their stock prices grew 8.08%, and 4.26%, respectively.

Losers

Philweb Corporation, most closely associated with property and mining tycoon Roberto Ongpin, took the biggest hit.

The gaming services firm fell 46.3% in the past year. Its stock was priced P19 in July last year and closed at P10.2 on Friday, July 21.

Duterte singled out Ongpin in the early months of his presidency as an oligarch he wants to destroy. This led Ongpin to give up his stakes in Philweb, which was up for renewal of its contract with the government casino regulator.

Ongpin, a former trade minister under strongman Marcos, is also facing various legal battles to keep his stake in listed mining firm Atok Big Wedge. (READ: Could Duterte’s approach to China ultimately make Ongpin richer?)

DoubleDragon Properties Corporation led by Edgar Sia, the country’s youngest dollar billionaire, also experienced a decline. The builder of community malls in the countryside under the CityMall brand decreased 28.87% from P62 to P47.2 apiece over the past year.

DoubleDragon was coming from a high base. After it went public in 2014, it surged up to 2,500% through January this year. Bloomberg considered it among the best performing stocks in the world.

Sy-led SM Investments Corporation likewise saw a decrease in its stock price, falling 19.19% from P990 to P800. SM Investments is the holding company of the country’s richest man, Henry Sy Sr. (READ: Doing business under Duterte? Philippines’ richest family shows how)

GT Capital Holdings Incorporated, the holding firm of banking and power tycoon George Ty, fell about 18.43% in the same period – from P1,465 apiece to P1,195.

The holding firm hit a low of P1,084 in November 2016, and was dragged down by a recent scandal that rocked its banking unit Metrobank Corporation. The National Bureau of Investigation nabbed an executive of the country’s second largest bank for alleged involvement in a P900-million fraud case. (READ: Metrobank loses P14 million in market value amid fraud issue)

Alliance Global Group Incorporated was not spared. The holding firm saw a decline not due to property tycoon Andrew Tan’s links to Duterte, but because Tan’s firms took a hit after a lone gunman carried out an attack on its casino-entertainment property, Resorts World Manila.

The June incident, which left 38 people dead, pulled down the stock price of Travellers International, Incorporated, a subsidiary of Alliance Global and operator of Resorts World Manila. (READ: Resorts World Manila loses P7-B in market value a week since attack)

The parent company’s shares fell 7.89% from P15.2 apiece to P14 during the year-long period.

Other companies whose stock price underperformed in the last year include Tan Caktiong-led food giant Jollibee Foods Corporation (down 9.54%) and JG Summit Holdings Incorporated (down 8.28%) of John Gokongwei Jr, the country’s 2nd richest man. JG Summit’s food and drinks subsidiary, Universal Robina Corporation, is still recovering from the unexpected recall of its beverage brands for exceeding the lead content prescribed by regulators in Vietnam.

Power and food conglomerate Aboitiz Equity Ventures, Incorporated (down 4.17%) and Manuel V. Pangilinan-led infrastructure and hospitals conglomerate Metro Pacific Investments Coroporation (down 1.77%) also underperformed from July 2016 to July this year.

As the last year has proved to be noteworthy for many of the country’s biggest industries, the Duterte administration has continued to share its plans to further improve the Philippine economy.

The economic promises and commitments announced include Duterte’s Build, Build, Build infrastructure program and the long-awaited comprehensive tax reform program.

If Duterte fulfills his promises on the economic front, any of the country’s top firms can partake of the rewards that go along with them. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.