SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

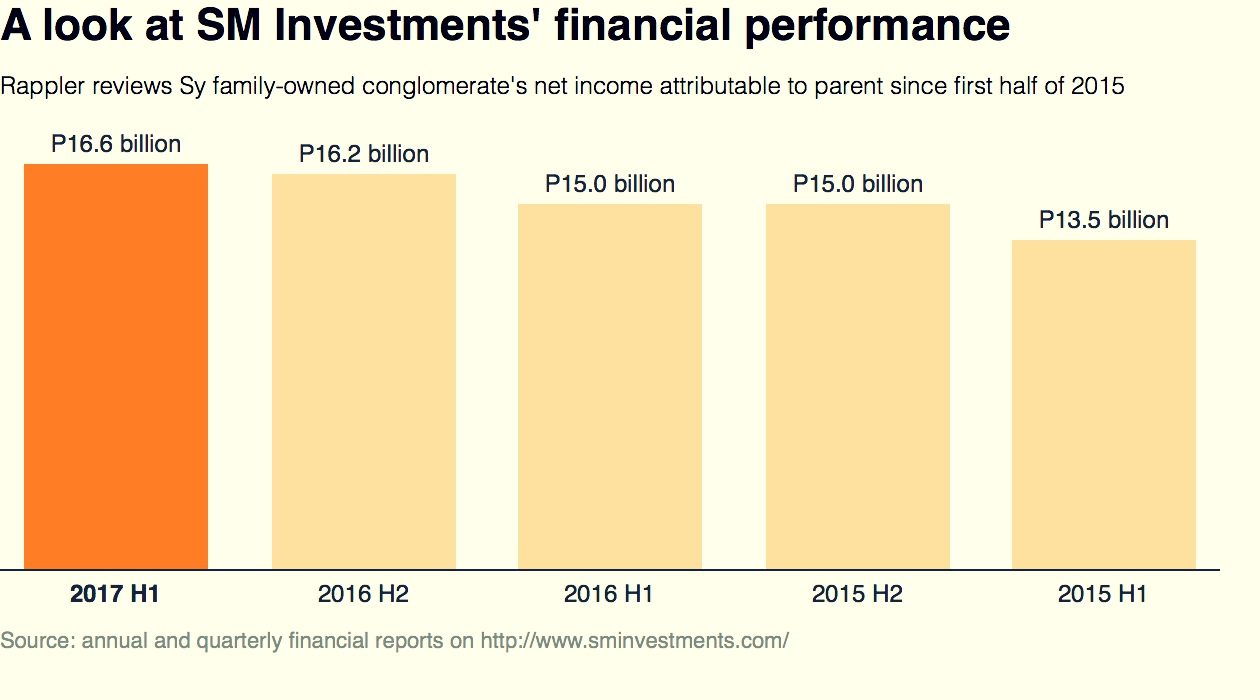

MANILA, Philippines – SM Investments Corporation, the conglomerate of the Philippines’ richest family, posted a 9% growth in net income to P16.6 billion in the 1st 6 months of 2017, boosted by strong contributions from core property, banking, and retail businesses.

Sy family-owned SM told the Philippine Stock Exchange (PSE) on Wednesday, August 9, that its consolidated revenues went up by 7% to P181.6 billion in the 1st half of the year, from P169.7 billion in the same period in 2016.

“Even without the benefits of an election year, we saw sustained growth across all our core businesses, driven by the strong economy and resilient consumer sentiment. SM will continue to capture this momentum through nationwide expansion and by investing in high growth opportunities,” SM president Frederic DyBuncio said in a statement.

SM Prime Holdings Incorporated, its property unit, contributed bulk of the conglomerate’s consolidated net income, closing at 42% in the 1st 6 months of 2017. This was followed by banks with 36% and retail with 22%. (READ: Doing business under Duterte? Philippines’ richest family shows how)

BDO Unibank Incorporated saw its 1st half net income grow to P13.3 billion, driven by the growth in loan portfolio, low-cost deposits, and higher recurring fee-based service income.

China Banking Corporation reported net income growth of 10% to P3.6 billion in the 1st half of 2017, driven by strong growth in its lending business and core recurring income.

Meanwhile, SM Retail’s net income rose by 6% to P5.2 billion in the 1st half of 2017, thanks to its aggressive expansion in both urban and rural communities.

Aside from its core businesses, SM continues to build its portfolio of investments to make the most of the Philippine economy’s strong fundamentals.

In its equity investments portfolio, Belle Corporation benefited from increased growth in the tourism sector, reporting consolidated net income growth of 93% to P1.8 billion.

As of end-June 2017, total assets of SM grew 17% to P916.3 billion. SM sustains its healthy balance sheet, with a conservative gearing ratio of 43% net debt to 57% equity. (READ: Investors swarm BDO’s largest stock rights offering)

Over the past few months, the conglomerate has increased its investments in its subsidiaries, with the P60-billion stock rights issue of BDO last January and P15 billion for China Bank last May; as well as its purchase of shares in 2GO Group Incorporated and Philippines Urban Living Solutions, the operator of dormitel chain MyTown. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.