SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines (UPDATED) – The Philippine Stock Exchange (PSE), the second best performing in Asia next to Bangkok’s, ended 2012 with a bang: It has broken through new record highs 38 times, posted record amount of equity raised, and marked the 4th straight year its annual closing level rose.

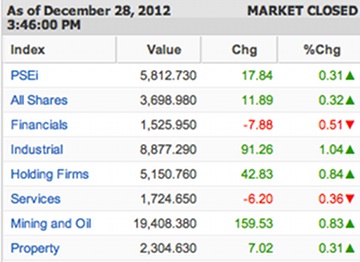

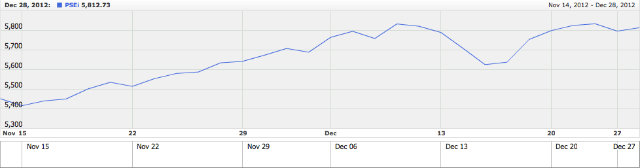

When the stock market closed on Friday, December 28, the last day of trading before ushering in the New Year, the PSE index (PSEi) settled at 5,812.73, a 33% year-to-date gain that eclipsed 2011’s annual growth of 4.1%.

In 2012, market capitalization soared 32%, and the average daily volumes was at its highest.

The PSEi also made its mark as the second best performing in Asia Pacific next to Thailand, which finished with a 36.3% year-to-date yield.

The PSEi was up 17.84 points on Friday, up 0.31% from Thursday’s close of 5,794.89 points. A total of 3.71 billion shares worth P7.9 billion changed hands.

‘Dragon year’

In an interview with ANC, IGC Securities Senior Investment Officer Peter Lee said 2012 was a dragon year for the Philippines. Among the reasons why the PSE index performed exceedingly well this year was the overall confidence on emerging economies at the very start of the year.

Lee said with the Philippine economy surviving what was called the Global Financial Crisis 2 in 2011, this became an impetus for investors to take a look at Philippine stocks.

“2012 was truly a dragon year that brought us good fortune. It was up 33% for the yearend. Actually we overcome many challenges this year, the market outperformed tremendously. In 2011, we survived what people call the Global Financial Crisis #2 and we entered the year [2012] with a lot of hope, there was a lot of optimism, in particular, about the Philippine market,” Lee said.

Lee added that another factor is the reduction of external risks to the Philippine economy, which included the worsening of the Euro crisis and the weakening of the United States economy.

He explained that July 22 was turning point this year, after which the PSE index rallied non-stop. That was when external risks to growth and investments were laid to rest with the announcement of the European Central Bank (ECB) that it will do whatever it takes to save the euro.

Lee added that the US economy, on the other hand, was already improving and growing at around 3%. He said that this has diminished the risk of seeing another US recession to 26%.

The outlook for 2013 remains positive despite the uncertainties on the US fiscal cliff issue. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.