SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

DAVAO CITY, Philippines – The Duterte administration has revealed more about the tax reforms it plans to put in place in the next few years.

Incoming Finance Secretary Carlos “Sonny” Dominguez outlined the planned reforms in his presentation to more than 300 representatives of the Philippine business community on the first day of the Sulong Pilipinas conference held in Davao City on Monday, June 20.

These reforms were also included in outgoing Finance Secretary Cesar Purisima’s comprehensive tax reform program, which he presented to Dominguez as part of their transition process.

“The new administration will definitely review the tax system, initially to update the income tax brackets and eventually to lower corporate and individual tax rates. We wish to see our workers having more disposable income to do as they wish,” Dominguez said.

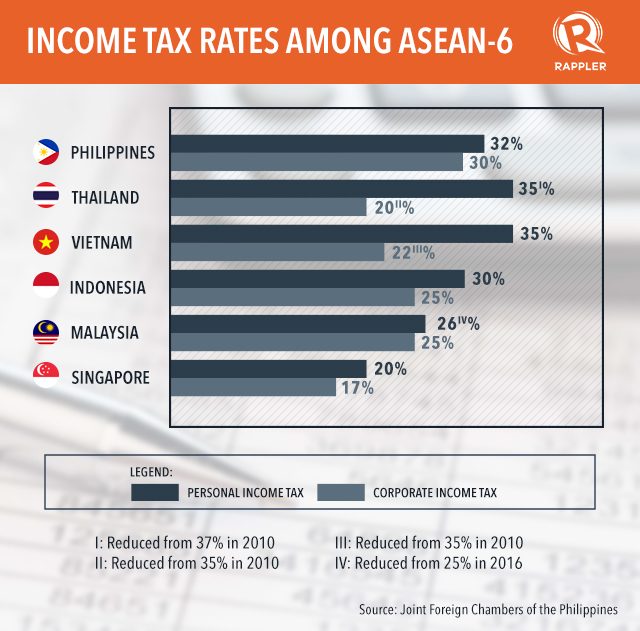

Of particular interest to the business community would be the administration’s plans for corporate tax, which remains the highest among the top economies in the Association of Southeast Asian Nations (ASEAN).

“Our corporate tax rates will be adjusted to be competitive with the rest of the region to make our economy more competitive for investments. We hope to broaden the tax base even more to compensate for lower rates,” Dominguez explained.

Other reforms he presented included the all-in P1 million income tax exemption, rationalizing fiscal incentives, expanding the VAT base, and indexing oil excise taxes to inflation.

Prioritizing

Dominguez also said that he is leaning towards getting the easier reforms done first as opposed to trying to do them all at once.

Indexing excise tax on fuel to inflation, he pointed out, is one such low-hanging fruit, adding that “it has not been adjusted through the years and now is the time to adjust that since the price of fuel is not very high.”

Incoming Budget Secretary Benjamin Diokno agreed with the assessment, saying: “The price of petroleum products has gone down and we lost a lot of revenues from that. We should use fuel oil more efficiently and not lose a lot of taxes from fuel oil.”

Academics studying the issue have forecasted that adjusting fuel tax could have the same effect that sin tax has on health by netting the government an additional P20 billion.

The additional income would help as well since the incoming administration has vowed to raise deficit spending in order to speed up infrastructure projects.

For his part, Purisima said he is convinced that there is enough confidence and fiscal space to support a “more expansionary” fiscal policy stance. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.