SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

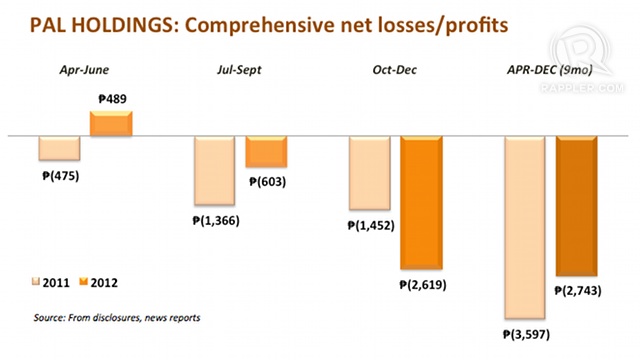

MANILA, Philippines – The parent of legacy carrier Philippine Airlines (PAL) reduced its comprehensive net losses by 24% to P2.7 billion in the first 9 months of its fiscal year ending December 2012 largely due to the stronger peso and cheaper jet fuel.

The October-to-December period (3rd quarter), however, saw PAL Holdings Inc.’s net losses balloon by 80% to P2.6 billion, effectively diluting the gains in the previous quarters, including profits made in April to June.

This shows that the ongoing refleeting program is taking its toll on the airline parent’s bottomline.

Here are the highlights of PAL Holdings’ April to December 2012 performance:

- Revenues reached P55.69 billion, up only 2.4% from a year ago’s P54.38 billion. Passenger revenues inched up 1.6%, while cargo was up 4% to P160.7 million.

- Expenses were controlled, reflecting a meager 0.8% increase to P58.43 billion from a year ago’s P57.97 billion. This was largely due to higher maintenance and general expenses that were offset by the reduction in flying operations.

- Maintenance was 17.8% costlier at P6.96 billion from the year ago’s P5.91 billion due to “higher aircraft, engine and component repair costs.”

- Consultancy, legal and management services rose 15.6%, hiking general and administrative expenses by 15.6% to P2.2 billion

- Fuel costs realized P198.3 million in savings due to decline in average jet fuel price per barrel to US$131.07 in 2012 from $133.42 in 2011.

- Total assets hit P95.37 billion at the end of December, rising from P71.78 billion in March.

Since PAL’s transactions and revenues are mostly denominated in dollars, the airline highlighted the effect of the peso appreciation to operations:

- Expenses for flying operations decreased by P524.3 million to P34.06 billion even if there was an increase in aircraft lease rentals from a sister airline, which was allocated 7 of the 11 Airbus A320 aircraft delivered to the group in 2012

- Aircraft and traffic servicing costs decreased to P7.19 billion, a P57 million difference

- Passenger service expenses dropped by P4.3 million. Had there been no change in exchange rate, passenger service expenses would have increased P103.8 million mainly due to higher costs of food on international flights.

The financial performance of PAL Holdings, based on the disclosure to the stock exchange on Friday, February 5, reflected the impact of the entry of diversified conglomerate San Miguel Corp., which in April 2012 acquired a minority but controlling stake in the airline group that tycoon Lucio Tan has been steering since the 1990’s.

Previously, PAL president Ramon Ang said PAL would be profitable by end of 2012 as it realizes savings from the delivery of new planes and as it maximizes its route network.

Refleeting program

PAL reported that 11 new planes were delivered during the 9 months, bringing its current fleet size to 64. It prepaid P18.76 billion for the new planes it ordered. This was funded by San Miguel Equity Investments, a subsidiary of San Miguel Corp., after it infused P17 billion in fresh capital into the airline.

Under San Miguel, PAL became another battleground for two rival global aircraft manufacturers: Boeing and Airbus. Both are pushing for major contracts in Asia.

PAL’s ongoing refleeting program sent not just aircraft executives scrambling for a piece of it, but also became a key reason for the diplomatic and trade visits of government officials from France and the UK.

During the October visit of French Prime Minister Jean-Marc Ayrault in Manila, he hinted that PAL has confirmed an order for 10 Airbus A330 jets on top of a purchase in the summer.” During the December visit of United Kingdom Member of Parliament (MP) Hugo Swire, he promised to extend assistance in the lifting of European Union’s ban on Philippine carriers — a thorn on the side of PAL, which has been eyeing to expand its route network to more long-haul destinations, its bread and butter.

PAL’s US$7 billion order from Airbus for 54 wide and narrow-bodied Airbus aircraft was the biggest airline deal in the country. At the time, PAL announced that, of the 54, it will purchase 10 A330-300 twin-aisle jets

The previous orders for Boeing planes were delayed but PAL took delivery of 3 of the 4 brand new Boeing 777-300ER aircraft committed for 2012. One recently delivered long-range Boeing 777 aircraft was used for the November 30 inaugural flight for the Manila-Toronto route relaunched in November. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.