SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The benchmark index at the Philippine Stock Index closed at a new record high on Wednesday, March 14.

The PSEi closed at 5,050.99, up 45.24 points or 0.90%, surpassing its previous high of 5,030.58 on March 5.

This is the 12th time this 2012 that the PSEi reached all-time highs.

Since the start of 2012, the PSE index has gained 15.5%.

In his recent visit to the stock exchange on March 6, President Aquino celebrated these historic highs and even challenged brokers to reach the 6,000 mark.

The index is an economic indicator of investor sentiments on the Philippines and in particular stock issues.

New intra-day high

Intraday, the PSEi reached a new all-time high at 5,070.20 also on March 14, breaching the previous high of 5,039.29 on March 6.

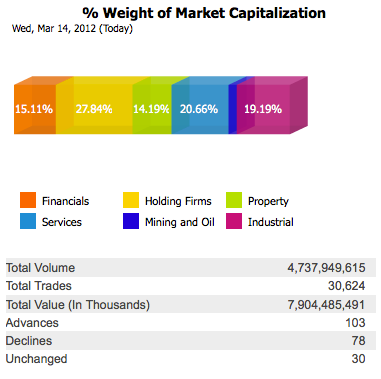

A total of 4.74 billion stocks worth P7.9 billion changed hands. Net foreign buying was at P764 million.

The broader all-shares index gained 22.44 points or 0.67% to 3,388.49.

Advancers led decliners, 103 to 78, while 30 stocks were unchanged.

Good news here and elsewhere

Hans Sicat, the PSE president and chief executive officer, attributed the March 14 record highs to trends happening outside the Philippines.

“Positive reports from the US Federal Reserve on the viability of the US banking sector have boosted markets worldwide,” said Sicat.

“A continuing trend of good news on the US economy is surely helping the record-setting advance of our market behind the upbeat sentiment on the Philippine economy” Sicat added.

Overnight, the Dow Jones industrial average gained 217.97 points or 1.68% to 13,177.68, its highest close since December 31, 2007. The Nasdaq composite index also closed above 3,000 for the first time since December 2000.

Banks led the rally in Wall Street after the central bank announced that 15 of the 19 largest financial firms had enough capital to weather a severe recession.

This coupled with the Fed’s expectations of falling unemployment and higher retail sales fueled the optimism in global markets.

Analyst Astro del Castillo agreed. “The string of good news overseas seems to show that indeed the US economy is recovering and this triggered the so-called optimism among local investors. The US is our largest trading partner. Definitely, we will benefit from its recovery,” he said.

Locally, improving export figures in January and expectations of a credit upgrade continued to prop up investor sentiment.

“We’re seeing fruits of the combined efforts to institute changes and reforms. Corporates are reporting good numbers so investors [are] coming in the market as encouraged by government initiatives,” said Eduardo Francisco, president of BDO Capital and Investment Corp. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.