SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Filipino consumers do not count Colgate as among the 10 most-bought brands in the country, unlike the rest of the Asian markets and in the global ranking where the toothpaste brand corners the top and the second highest post, respectively.

In the first Brand Footprint households survey by research firm Kantar Worldpanel, Colgate placed 13th in the Philippines, edged out by food, personal care, milk and condiments brands.

This survey does not reflect the same results that the previous Consumer Coping Behavior Survey of research firm Social Weather Stations (SWS) previously released, highlighting toiletries as a staple, or a product they cannot live without, or consider as “absolutely necessary.”

Toothpaste ranked 3rd in Metro Manila and Luzon, and 1st in Visayas and Mindanao as the product Filipino households cannot do without. Colgate was among the top brands considered must-haves, along with Close Up and Hapee.

How Colgate fared in the Brand Footprint ranking just reflects how the other brands are doing better. “Colgate is bought less often compared to those that made it in the top 10,” Luz Barra, Commercial Director of Kantar Worldpanel, explained to Rappler.

TOP 10 FMCG BRANDS in the PHILIPPINES in terms of “Brand Footprint”

| RANK | BRAND | CONSUMER REACH POINTS (Million) | PENETRATION | FREQUENCY OF PURCHASE | CONSUMER REACH POINTS (% growth, 2012 v 2011) |

| 1 | NESCAFE | 985 | 94.3% | 54 | -7% |

| 2 | LUCKY ME | 957 | 98.1% | 50 | -11% |

| 3 | SURF | 538 | 88.4% | 31 | -4% |

| 4 | MILO | 497 | 86.2% | 30 | 2% |

| 5 | AJINOMOTO | 459 | 86.2% | 27 | -2% |

| 6 | BEAR BRAND | 449 | 87.9% | 26 | 4% |

| 7 | PALMOLIVE | 444 | 82.7% | 28 | 7% |

| 8 | SILVER SWAN | 421 | 81% | 27 | 6% |

| 9 | OISHI | 417 | 87% | 25 | 6% |

| 10 | SAFEGUARD | 384 | 93.3% | 21 | 2% |

Colgate remains a “strong” brand in the Philippines, with 93% of the households purchasing it at least once in 2012, and with an average consumer buying it 18 times a year, Barra added.

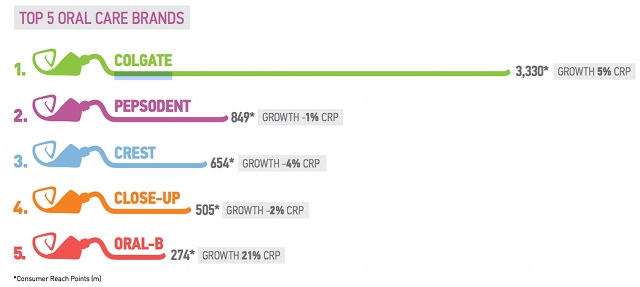

In its report, Kantar noted that competitors, like Unilever’s Pepsodent toothpaste brand, has been closing the gap on Colgate in the Philippines, India and Indonesia.

TOP 10 BRANDS in ASIA:

| RANK | BRAND | CONSUMER REACH POINTS | PENETRATION | FREQUENCY OF PURCHASE | CONSUMER REACH POINTS |

| 1 | COLGATE | 2,002 | 62.6% | 6 | 7% |

| 2 | LIFEBUOY | 1,732 | 41.1% | 8 | 1% |

| 3 | NESCAFE | 1,464 | 23.7% | 12 | -4% |

| 4 | PANTENE | 1,150 | 34% | 7 | 1% |

| 5 | LUX | 856 | 44.2% | 4 | -9% |

| 6 | SURF | 844 | 17.7% | 9 | -2% |

| 7 | MAGGI | 836 | 23.4% | 7 | 12% |

| 8 | PEPSODENT | 831 | 20.8% | 8 | -1% |

| 9 | TIDE | 812 | 34.9% | 5 | 13% |

| 10 | AJINOMOTO | 756 | 9.5% | 15 | -1% |

Brands like Colgate are doing well particularly in Asia where there is a growing interest in health and beauty products over food and beverage products, the Brand Footprint report said.

“Brands are responding to, and benefiting from, changes in habits and affluence – for instance, the growing interest in health and beauty. They are adapting to local markets…Colgate builds awareness and sales with small pack sizes which encourage trial,” the report stated.

Beauty products account for 21 of the global Top 50 Brand Footprint ranking. In Asia it accounts for 20.

India is another key emerging territory for Colgate’s successful global marketing initiative Oral Care Month. The campaign, a partnership with the Indian Dental Association, is designed to boost awareness of oral health and covers 6 Indian cities.

“It is working: Colgate achieved the number one position in Brand Equity’s Most Trusted Brands in India survey,” the report stated.

According to the survey, future opportunities for the brand to grow its global reach will come from China where the brand has toothpaste, manual brushes and mouthwashes. “The use of toothpaste in China is becoming more frequent, and consumers are beginning to look for extra value such as whitening and sensitive variations,” the report stated.

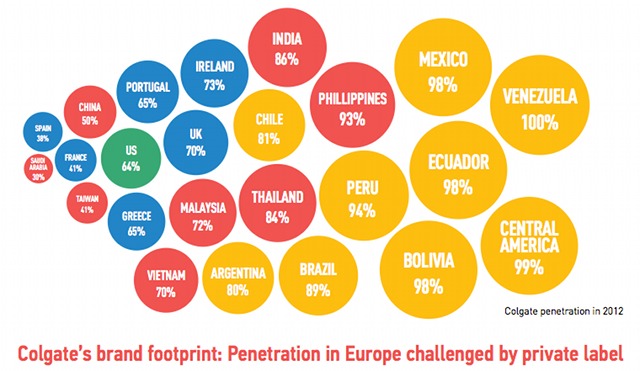

This gradual increase in penetration and consumption within the oral care category has helped Colgate attain the number two position in the global Brand Footprint ranking, achieving 3.3 billion Consumer Reach Points and entering more homes (65%) than Coca-Cola (44%).

TOP 10 BRANDS in WORLD:

| RANK | BRAND | CONSUMER REACH POINTS | PENETRATION | FREQUENCY OF PURCHASE | CONSUMER REACH POINTS |

| 1 | COCA-COLA | 5,295 | 43.9% | 14.7 | 0% |

| 2 | COLGATE | 3,330 | 65.4% | 6.2 | 5% |

| 3 | NESCAFE | 2,270 | 26% | 10.6 | -2% |

| 4 | PEPSI | 1,797 | 27.9% | 7.9 | 2% |

| 5 | LIFEBUOY | 1,751 | 27.3% | 7.8 | 1% |

| 6 | MAGGI | 1,580 | 26.7% | 7.2 | 4% |

| 7 | KNORR | 1,290 | 27.6% | 5.7 | 1% |

| 8 | PEPSODENT | 831 | 20.8% | 8 | -1% |

| 9 | TIDE | 812 | 34.9% | 5 | 13% |

| 10 | AJINOMOTO | 756 | 9.5% | 15 | -1% |

Colgate is the only brand bought by more than half the world’s households, especially those in the developing economies.

– Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.