SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines [UPDATED on April 4] – With the sealed deal between two of the country’s biggest and most high-profile businesses, a question nags: Will San Miguel Corp and Philippine Airlines (PAL) make an ideal marriage?

The reported deal involves the takeover by the diversifying conglomerate that controls the country’s largest and most profitable companies, of PAL, the country’s largest and Asia’s oldest carrier.

San Miguel and PAL were supposed to seal and announce details of their agreement on Tuesday afternoon, April 3, but was stalled after tycoon Lucio Tan reportedly want more time to study it. As later announced, the two groups inked an investment agreement in the evening of April 4.

The deal, worth around $500 million, involved a 49% stake of San Miguel Equity Investments Inc. in PAL and its budget arm AirPhil Express.

This is the first time the 2 business groups have forged a deal. They are “brewing” rivals with San Miguel owning a smaller but still majority stake in San Miguel Brewery, and billionaire Lucio Tan controlling Asia Brewery and Tanduay Holdings.

PAL is part of the empire of tycoon Lucio Tan, the second richest businessman in the Philippines. Tan acquired the airline in 1995 when PAL, a state-owned monopoly, was put up for privatization at the time the government was opening up the industry to competition.

Tan and San Miguel president Ramon Ang have reportedly formed a cozy business relationship, with Ang extending his help and expertise to Tan during crucial times in 2011, when the airline was going through another round of legal, labor and political roller-coaster.

The Tan group reportedly decided to favor Ang’s deal offer over that of Manuel V. Pangilinan’s group, which wanted to acquire all of PAL.

Earlier, the reported $500 million deal between PAL and San Miguel allegedly involves the acquisition of only 45% to 49% stake in PAL Holdings, the airline’s parent firm, and another holding firm that owns majority stake in AirPhil Express, the airline’s budget arm.

Paternalistic approach

A quick review of what’s at stake for both entities shows a mixed bag.

The benefits of a new investor with deep pockets or access to one is obvious to PAL, which needs fund for its 5-year refleeting and modernization program.

Asia’s first airline, which had been bleeding from its cycle of labor and financial woes, needs fresh funds to survive an industry that has been growing leaps and bounds.

San Miguel, on the other hand, is diversifying away from its core food and brewery business — which competes with Lucio Tan’s own Asia Brewery Inc. — and into heavy industries that are expected to bring higher growth.

Manila’s businessmen initially described that San Miguel’s paternalistic management style may help bring to rest the perennial labor issues at PAL.

Recently, PAL outsourced 3 of its non-core units and the resulting lay-offs did not sit well with the restless employees. A labor strike caused temporary halting of flights in 2011.

But how would PAL fit into San Miguel’s future?

Synergies

San Miguel said forming synergies among its existing and planned ventures is what guides its decisions to enter into deals.

Among analysts in Manila, the top of mind point for synergy is via Petron Corp, the country’s biggest oil retailer and refiner that San Miguel acquired a direct and indirect stakes in in 2008.

Petron is a supplier of jet fuel to PAL. The financial wizards in Petron consider PAL a major customer and losing the oil giant as an account is considered a business risk.

PAL accounts for 4% of Petron’s total domestic sales volume. “Loss of these accounts will impact on the company’s sales volume,” according to Petron’s 2010 annual report.

Airlines are at the mercy of oil prices, which account for 30% to 40% of total operating costs. The profits of both PAL and its main competitor, Gokongwei-led Cebu Pacific, suffered double-digit dips in 2011 due to oil price fluctuations in the world market.

Skyrocketing jet fuel prices partly resulted in PAL’s net loses of $33.5 million in the October-December 2011 period. Jet fuel prices rose to $129.75 per barrel during the period from an average of $100.96 per barrel in the same period the previous year.

Getting PAL into the San Miguel-Petron fold will likely create a vertical integration, a business lingo for firms owning its downstream buyers.

San Miguel has previously acquired assets following a similar strategy. For example, it bought 3 small mines in Mindanao that supply coal to its power plants in Luzon.

Logistics and roads

PAL, aside from ferrying passengers by air, also carries cargo, a logistics business San Miguel is not a stranger to. San Miguel has a port-based logistics business under its belt and has recently been active in road infrastructure, a crucial component of a logistics business.

San Miguel has a minority stake in the private concessionaire of the Manila North Harbour port, which is located in the country’s busiest sea port.

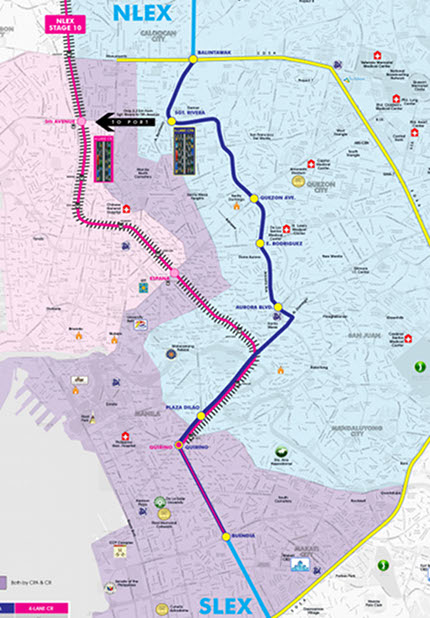

North Harbour has been eyed as one of the beneficiaries of an elevated connector road between the North Luzon Expressway (NLEx) and the South Luzon Expressway (SLEx) since the tollroad makes ferrying goods more convenient from points outside the capital, including those coming from Clark.

Incidentally, San Miguel has entered into a partnership with the local arm of Citra Group, an Indonesia-based group that built and operate the Skyway, an elevated toll road over the SLEx that is part of the road system connecting Manila to the southern areas.

The planned road systems under the Citra-San Miguel partnership not only connect to the Manila port but also to the Ninoy Aquino International Airport (NAIA) in the capital.

PAL is currently operating its domestic and international flights exclusively at the Terminal 2 of NAIA.

Airports and airlines

While ports and road systems complement a logistics business, these, however, have not been crucial among aviation leaders.

In the aviation sector, airports and airlines are complicated businesses on their own, according to Brendan Sobie, analyst and Southeast Asia chief representative at the Centre for Asia Pacific Aviation.

Airlines operate under a complicated maze of international agreements, majority of them still forged based on bilateral negotiations with countries an airline is aiming to land in or depart from, Sobie explained to Rappler.

Even the number of seats and make of an airline’s aircraft are highly regulated.

A San Miguel unit currently operates the Godofredo P. Ramos airport in Caticlan, the main gateway to the world-famous Boracay Island.

San Miguel is investing about $300 million to modernize and set up new tourism amenities in the Caticlan airport.

The conglomerate has also expressed interest to participate in the public bidding for the airport contracts under the public-private partnership scheme for infrastructure projects.

So far, this marriage between the 2 business groups has these ingredients. But as in all marriages, the odds for a success or failure have yet to be tested. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.