SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines [UPDATED] – The Aquino administration welcomed the passing of an “amended” excise tax reform bill at the committee level of the House of Representatives, moving this priority legislation closer to becoming a law by end-2012 and generating additional revenues of P33 billion a year.

In a statement on Wednesday, May 9, the government stressed that the House Committee on Ways and Means’ approval of House Bill 5727, which seeks to rationalize excise taxes on alcohol and cigarette products, is a “landmark” move.

The bill…is a priority measure of the administration that has hurdled a significant step in the legislative process. The initiatives to reform the excise tax system started 15 years ago and it is only under this administration…that such a legislative measure has been approved,” the Palace added in a statement.

“We look forward to having this bill passed by next month, and enacted into law within the year,” said Finance Secretary Cesar Purisima who has pushed for this legislation.

Tiered and inflation indexed

There were 46 votes were cast at the House committee in favor of the “substitute” excise tax reform bill, while 14 opposed it.

Cavite Rep. Joseph Emilio Abaya, who was the main proponent of the Palace-backed bill, agreed to amend the sin tax on tobacco products from unitary tax system to two tier.

Under “substitute” bill, there will be two tiers for cigarettes while distilled spirits and fermented liquor will have 3.

Indexation will be 8% for every two years.

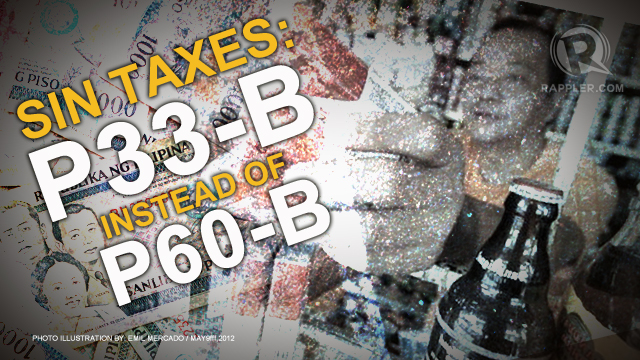

Finance Assistance Secretary Ma. Teresa Habitan said amended version will translate to P33 billion in additional revenues.

This is lower than the original version, which was supposed to add some P60 billion for the universal health care program.

Different sides

Previously, business groups and former health and finance officials called for the swift passing of the House Bill 5727 authored by Abaya that simplifies the excise tax system, which currently favors local brands, and indexes the taxes against annual inflation.

Pegging taxes to inflation ensures that taxes are adjusted to reflect yearly fluctuations in the price of goods and services.

The bill is positioned to improve the government’s fiscal health — through an additional annual revenue — and to reduce health care costs associated with the ills of smoking and drinking.

These groups likewise stresed that the tiered system is a violation of the World Trade Organization principles by equalizing the rates on alcohol products.

“It will also demonstrate the country’s commitment to open and fair competition, as well as its respectful compliance to international agreements,” the Makati Business Club said.

Groups that opposed the unitary and inflation-indexed sin tax versino of the Abaya bill included the Northern Luzon Alliance (NLA), which is composed of House representatives from tobacco-growing regions. They previously expressed concerned that implementing and “excessive increase in tax rates may result in the demise of the country’s tobacco industry.”

Sin tax collections in 2011 declined by roughly 20% to P25.4 billion from the year before, the biggest drop so far.

“This is the worst fall yet in for our tobacco sin tax revenues. It’s a tell-tale sign that the system is structurally defective. That’s why we need the Abaya reform bill to fix this,” Finance Undersecretary Jeremias Paul previously said.

The Finance Department has estimated that at least P 19.5 billion has been lost in revenues from 2006 to 2010 given the current sin tax system. – Rappler.com

For related stories, read:

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.