SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Hiking mining taxes will make the Philippine tax regime less competitive internationally, warned a finance manager of Sagittarius Mines Inc. (SMI), the local unit of the world’s largest copper producer Xstrata that owns the Tampakan mine in South Cotabato.

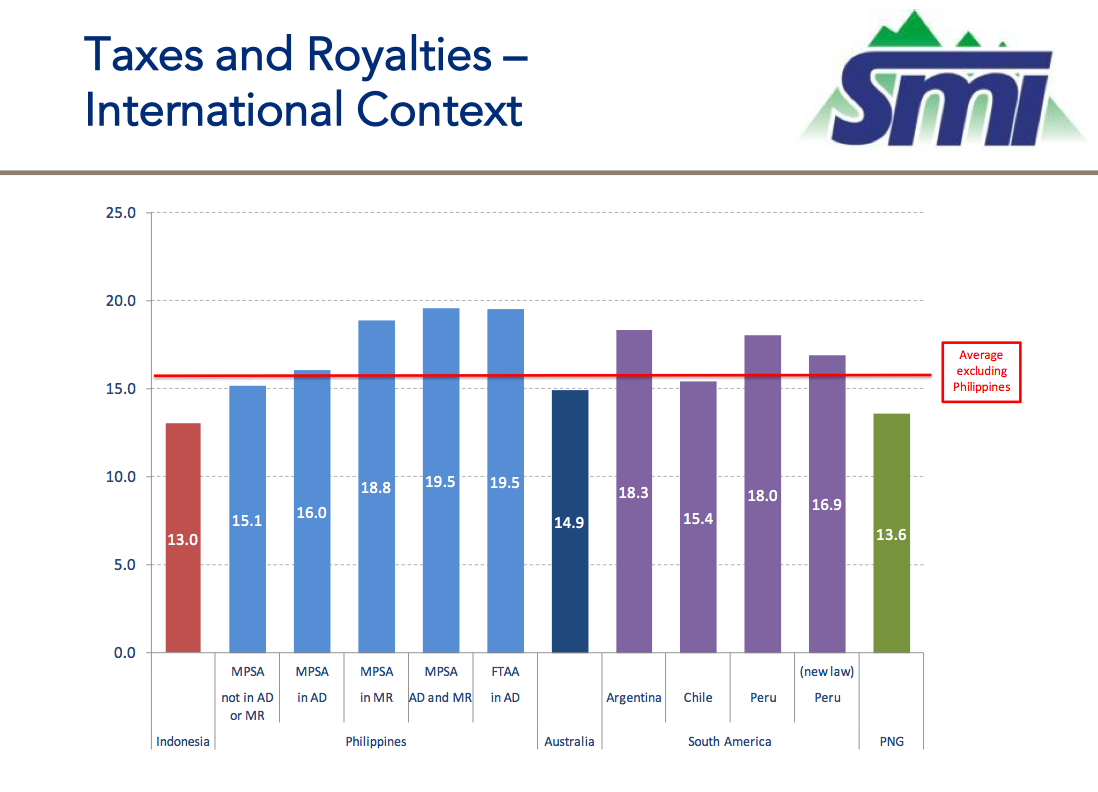

“Four out of the 5 Philippine regimes have a higher tax take, a higher revenue generation given the same revenue assumptions, than just about all the other nations around the world,” said SMI Finance & Commercial Manger Justin Hillier at a press briefing on Monday, June 4.

Among 7 active mining countries, he said the Philippines has the fourth-highest tax and royalty rates, next to Argentina (1st), Peru (2nd) and Chile (3rd). Following the Philippines are Australia, Papua New Guinea and Indonesia.

“In terms of actual tax take, the Philippines is doing pretty well under the current regime, any more than this will be a bit on the high side,” said Hillier.

The Aquino government is considering revising mining taxes as it finalizes its much awaited executive order on the country’s mining policy.

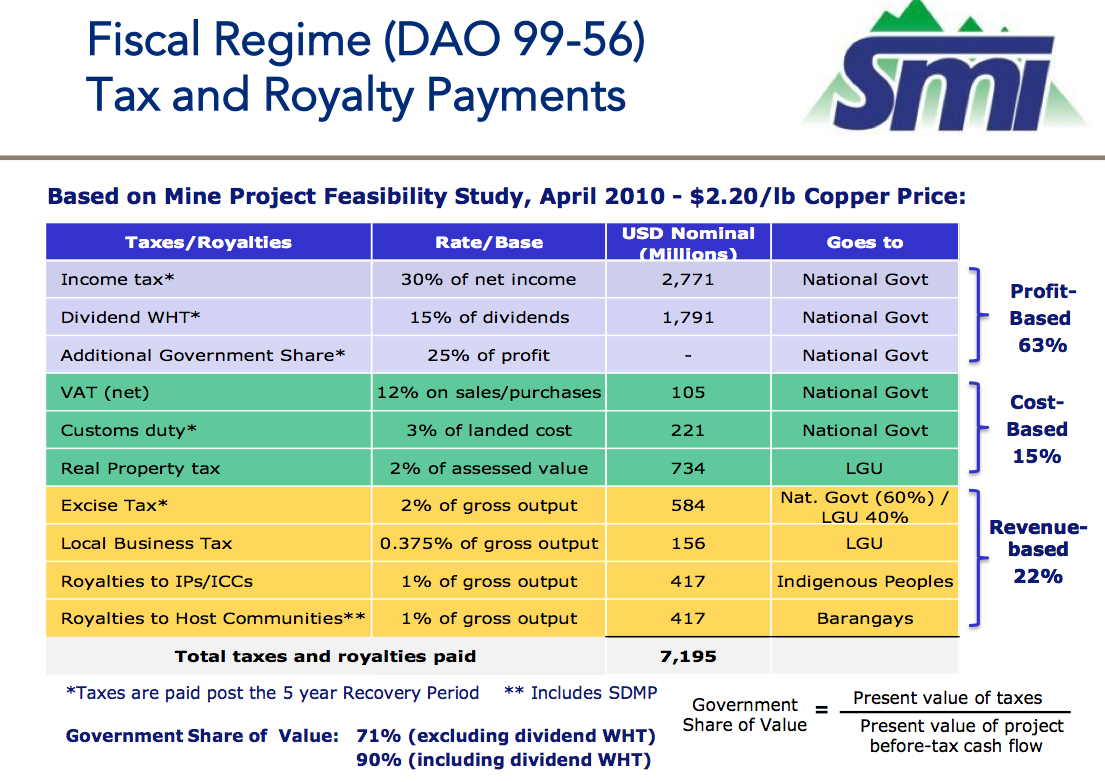

Currently there are two different tax structures mining companies operate under. The vast majority of mining firms in the country hold Mineral Production Sharing Agreements (MPSAs), which mandate that 2% excise taxes are paid to the government. Meanwhile, financial or technical assistance agreement (FTAA) like the one for Tampakan mine, mandate companies pay at least 50% of their net revenue to the government, on top of corporate income as well as withholding taxes, said Hillier.

Assuming copper maintains an average price of US$2.20 per pound and the current structure remains, the government stands to earn $7.2 billion from the Tampakan mine over its estimated 17 year life, said Hillier. That would mean government would get 71% of the value of the mine, he added.

Secretary Purisima has said he is more partial to FTAAs since government stands to earn more.

Foreign companies, like Switzerland-based Xstrata, which controls 62.5% of SMI, are leery of more taxes.

Tampakan mine, one of the largest copper deposits in the world, is already expected to add 1% to national GDP for every year that it operates, he pointed out.

“I think the industry would generally prefer less taxes to be paid, less individual taxes certainly and more profit-based taxes,” said Hillier.

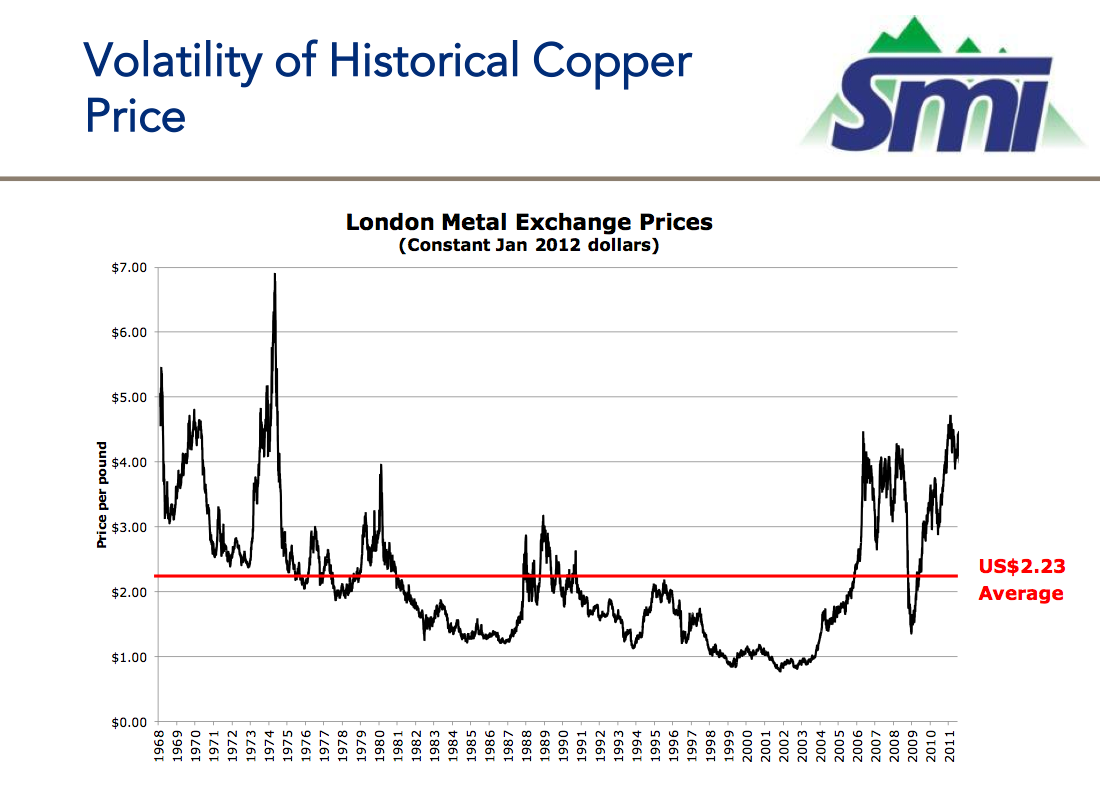

If taxes were not profit-based and copper fell below $2 per pound, Hillier said the company would spend more than it would earn over the life of the mine. Yet by the same logic, if copper prices were to shoot up, so would the company’s profits. Hillier says it’s not likely copper will drop below $2 per pound based on recent trends.

Still Secretary Purisima feels government should get more from mining. He told ABS-CBN that the government collected a “mere P2 billion from the industry in 2011” or about 0.2% of total taxes.

According to Purisima there are presently only 2 FTAAs. That means the majority of miners pay much less to the national government.

The government is still determining the best profit sharing structure. Meanwhile, mining companies, like SMI are hoping they decide soon either way so that they can keep their projects on track.

Hillier said that SMI would still target 2016 for start of production of the Tampakan mine. However, the company’s timetable could be pushed back given the number of permits it still has to obtain. On May 22, the Department of Environment and Natural Resources (DENR) denied SMI’s request for an environmental clearance certificate since a local South Cotabato provincial ordinance bans open-pit mining.

Hillier says the local ordinance is in conflict with national laws permuting open-pit mining and hopes the mining EO will clarify the law. “I think a stable regulatory environment is in order when you are looking at investing in a major project,” he said.

He explained that the government hasn’t been clear about its support for the mining industry. “The government needs to decide whether it does want mining,” he said. – Rappler.com

For the existing mining contracts in the Philippines, view this #WhyMining map.

How does mining affect you? Are you pro or against mining? Engage, discuss & take a stand! Visit Rappler’s #WhyMining microsite for the latest stories on issues affecting the mining sector. Join the conversation by emailing whymining@rappler.com your views on the issue.

For other views on mining, read:

| Yes to Mining | No to Mining |

More on #WhyMining:

- The Mining EO: A mixed bag

- Mining E.O. not perfect, but very good

- CONVERSATIONS: What are your thoughts on the mining EO? #WhyMining

- Mining E.O. pits gov’t vs local execs

- MAP: Mining in the Philippines

- Correcting lies and disinformation

- Stand for the environment

- How can mining work for Philippines?

- Mining is a social justice issue

- REPLAY: #WHYMINING

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.