SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

SINGAPORE – The world’s second largest economy is churning out more and more billionaires.

On Monday, October 27, Forbes released its annual Forbes China Rich List, which shows new trends – from a significant increase in the number of newcomers to the type of industries that top the list of 400.

“The list shows there’s plenty of opportunity to make new fortunes in China. It shows the economy is market-driven and smart people are getting themselves into interesting businesses,” said Russel Flannery, senior editor and Shanghai bureau chief of Forbes who has been compiling the Forbes China Rich List since 2004. Rappler interviewed Flannery on the sidelines of the Forbes CEO Conference here.

Below are the top 5 things you need to know about this year’s China Rich List:

1. ‘Explosive growth’ of number of billionaires

From 168 just a year ago, this year’s list boasts 242 Chinese billionaires, 74 more than in 2013, an “explosive growth” that exhibits a “huge amount of momentum in China,” Flannery said.

“A lot of the skepticism about China is overblown,” Flannery said. “It is one of the most pro-growth governments in the world. Government have a lot of reasons to do what it can to keep the economy in a good growth trajectory.”

Flannery noted that more than 90 of China’s wealthiest are not in last year’s list, as they are either returnees or newcomers. “That’s a lot of change for 400 people and some of that is because of IPOs, relative weakening of real estate, backdoor listings in the domestic market but also in Hong Kong,” he said.

This year, the cut-off to make the top 400 rose further from $600 million last year to $700 million.

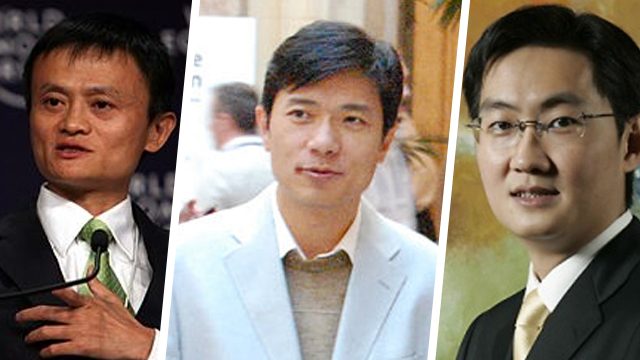

2. Top 3 richest are Internet entrepreneurs

There is much money to be made on the Internet. The Chinese Internet trio – Alibaba, Baidu and Tencent – top the list of China’s richest, in that order, putting technology companies above traditional industries for the first time in China’s history.

Jack Ma of Alibaba is ranked the richest man in China for the first time, his net worth soaring from $7.1 billion to $19.5 billion, after his e-commerce powerhouse became the biggest IPO in the world on the New York Stock Exchange.

Robin Li, the 45-year-old Chariman of Baidu, China’s number one search engine, is right behind Ma, his net worth rising from $11.1 billion the year before to $14.7 billion, after his Nasdaq-traded shares hit record highs.

At third place is Ma Huateng (or Pony Ma) of Tencent, which generates online games and messaging services such as WeChat. Huateng is worth $14.7 billion, from $11.1 billion last year.

The rest of the top 10 include Wang Jianlin ($13.2 billion, real estate), Li Hejun ($13 billion, renewable energy), Zong Qinghou ($11 billion, beverages), Wang Wenyin ($10 billion, metals), Lei Jun ($9.1 billion, smartphones), He Xiangjian ($7.5 billion, appliances), and Liu Qiangdong ($7.1 billion, e-commerce).

3. E-commerce is China’s territory

Internet entrepreneurs topping the list emphasizes an important trend: e-commerce may soon be dominated by China.

“China is seizing great opportunity for itself in e-commerce in the same way the US led the world in PCs, semi conductors, and hardware-related software during the PC era,” Flannery said. “It may very well be that China can get a lion’s share of the wealth in what is generated with e-commerce.”

As early as now, Flannery pointed out that these Chinese web entrepreneurs are beginning to surpass the wealth of US tech icons like Microsoft co-founder Paul Allen, Google’s Ed Schmidt, and Facebook’s Sheryl Sandberg.

“The most important thing is what Jack Ma symbolizes. He symbolizes e-commerce and China’s leap and growth of e-commerce, the leap into that realm and willingness to embrace new technology,” he added.

What makes China so successful in this field? Flannery said the reason is “manyfold.”

“Urbanization provides good framework, [the new] generation has great social passion for buying things online and through mobile phones, and US shopping habits are more ingrained,” he said. “China is showing to be more adaptive, with a great willingness to experiment with online purchasing.”

4. Former industries down

But while technology is on an upward trajectory, some industries have suffered in recent years. The list shows a drop in real estate fortunes, with last year’s number 1 – Wang Jianlin who made his money from real estate through the Dalian Wanda Group – being surpassed by the 3 tech giants and is now number 4.

Flannery said “investors are concerned about the return they’re going to be getting from real estate in China,” hence the drop. He pointed out that many of these companies are trading quite low.

“By our calculus the number of people we identified as primarily getting their wealth from real estate has declined to about 50 from 72 a year ago (out of 400). Wealth is not growing so much in real estate and we can see the impact of government policies to curb speculations very clearly,” he said.

While Flannery acknowledged that “government’s priorities have changed” and wealth creation doesn’t appear to be coming from real estate, Flannery was hesitant to say the decreasing trend would persist over the long term.

“GDP growth will still be very good in the next years, still impressive. That will generate a lot of demand for property,” he said. “It’s a mixed picture. In some markets, where theres a shortage of land, I think that market will still be quite good. Big developers want to pay for government auctioned land.”

Other industries that have seen a mixed year include the auto industry, said Flannery, which was a big star last year but has seen local stocks go down.

5. Breadth of opportunities

While specific industries such as technology, real estate and auto rake in money, the list also shows an interesting fact: there is a breadth of opportunities to make money in emerging China.

For instance, soy sauce maker Pang Kang is a newcomer on the list, with his net worth priced at $2.6 billion.

Flannery also called attention to an overlooked industry that he predicts will experience continued growth: the pharmaceutical industry. Of the top 400 billionaires, about 48 are from this industry – twice as much as IT and harware.

“China has one of the 3rd world largest pharmaceutical industries in the world, because of an ageing population it seems likely that will be generating good wealth and returns in years to come.”

US businessmen are of course taking notice of the boundless opportunities. Ten years ago, Flannery said American companies working with Chinese investors were not exactly part of the picture. That has changed.

“American start-up companies are more interested in getting money from Chinese investors because they hope it will help them get into the China market somehow,” Flannery said.

“China is beating the odds,” he said, adding he wouldn’t bet on forecasts of critics that China will collapse eventually. “There’s change, evolution, interesting people trying to build interesting businesses. I’m confident things will work themselves out.” – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.