SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

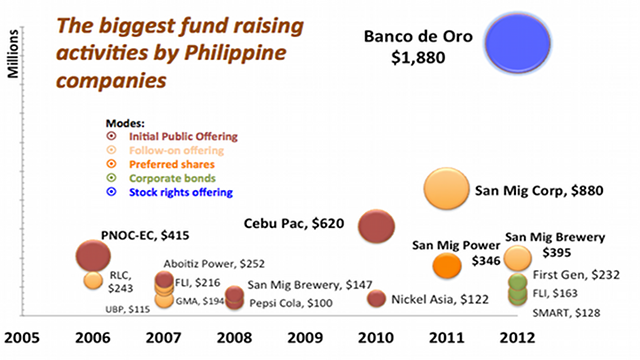

MANILA, Philippines – Banco De Oro (BDO), the country’s largest bank by assets, has raised P43.5 billion (over $1 billion) from an “oversubscribed” stock rights issue, it said in a statement on Monday, July 2.

The bank said the fresh capital “provides a comfortable buffer to the more stringent Basel III requirements expected to be implemented” by the central bank.

It said the funds also makes it “better-positioned… to fulfill its medium-term growth objectives and take advantage of the positive outlook on the Philippine economy.”

BDO sold 895.2 million shares for P48.60 each, raising a total of P43.5 billion in the Philippines’ biggest equity transaction, which closed on June 27.

It said the offer was oversubscribed, with shareholders applying for shares beyond their entitlement.

Citi, Deutsche Bank and JP Morgan were the joint global lead managers and underwriters for the issue. United Overseas Bank was co-lead manager and underwriter while BDO Capital & Investment Corp was domestic underwriter.

BDO earlier said it wants to collaborate with other local financial institutions in raising a $1-billion fund that will bankroll infrastructure projects under the government’s Public-Private Partnership (PPP) scheme. There are so far 22 PPP projects lined up for bidding as of this year.

The bank is controlled by SM Investments Corp, the holding firm of the country’s richest man, Henry Sy.

At 10:15 am Monday, its shares were traded at P63.35 apiece in the market. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.