SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The country’s metal production dropped by 23% to P108.21 billion last year – an exact reversal of the growth enjoyed in 2014 – dragged by the downward trend in world ore prices.

The Mines and Geosciences Bureau (MGB) said in a statement that metallic production value in 2015 went down by 23% from 2014’s P140.15 billion. This means 2015’s performance lagged behind by P31.94 billion.

This lackluster performance was due to the lower world metal prices brought about by excess supply and weaker global trade, the attached agency of Department of Environment and Natural Resources (DENR) said.

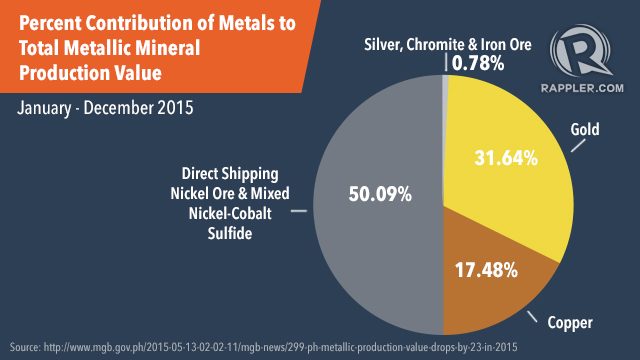

“The leading metals like gold, silver, copper and nickel all incurred sharp declines,” MGB Director Leo Jasareno said. (READ: Aquino half-hearted about mining?)

DENR said biggest losers in 2015 were the base metals nickel and copper, with shortfalls of 29% and 19%, respectively.

“From an average price of $7.56 per pound in 2014, nickel price dipped to $5.34 per pound, down by US$2.22,” data from DENR read.

The agency said nickel in February 2011 was traded by as high as $12.83 per pound.

“Since then nickel has dropped steadily. Similarly, copper price was down from an average price of $3.06 per pound in 2014 to $2.48 per pound,” Jasareno explained.

Leading metal prices incurred sharp declines

The MGB said gold and silver posted 8.35% and 17.62% losses, respectively.

Gold price declined to $1,163.59 per troy ounce in 2015, compared to $1,269.57 a year ago.

Silver price likewise dropped to $15.72 per troy ounce in 2015, from $19.08 in 2014.

But despite lower metal prices, gold and silver posted growth in their respective production records in 2015.

Gold enjoyed 12% and 4% increases in volume and value, respectively, to 20,643 kilograms (valued at P34.24 billion), from 18,423 kilograms (worth P32.97 billion).

The production volume and value of silver also grew by 29% and 5%, respectively, to 29,780 kilograms (worth P647.02 million) in 2015, up from 23,005 kilograms (around P616.44 million) in 2014.

The base metals – nickel, copper, chromite, and iron ore – suffered setbacks both in production volume and value in 2015, the MGB said. (READ: Philex ends 2015 with higher income despite lower metal prices)

“The base metals are always vulnerable to economic slowdown mainly because they thrive on the degree of economic activities across the globe. As it is, China, which accounted for the largest metal consumption in the past 10 years or so, has resoundingly been reducing its demand for the said metals,” the agency explained.

China has been the country’s major market for nickel, copper, chromite, and iron ore.

MGB said both nickel direct shipping ore and mixed nickel-cobalt sulfide reported lower mine and plant output, mainly because of the weakened global demand for the metal.

To date, the country hosts 44 operating metallic mines: 27 nickel mines, 6 gold mines with silver as co-product, 3 copper mines with gold and silver as co-products, 3 chromite mines, and 5 iron mines. These are in addition to the numerous small-scale gold mining operations.

According to the MGB, the top 10 mining projects and mineral processing plants in 2015 were:

- Didipio Copper Gold Project of Oceana Gold Philippines, Incorporated (P12.24 billion);

- Toledo Copper Operations of Carmen Copper Corporation (P11.12 billion);

- Coral Bay High Pressure Acid Leach Project of Coral Bay Nickel Corporation (P10.4 billion);

- Padcal Copper-Gold Project in Benguet of Philex Mining Corporation (P9.35 billion);

- Masbate Gold Project of Filminera Mining Corporation and Philippines Gold Processing and Refining Corporation (P9.27 billion);

- Taganito HPAL Nickel Corporation’s project in Surigao del Norte (P7.07 billion);

- Mindanao Mineral Processing and Refining Project of Philsaga Mining Corporation and Mindanao Mineral Processing and Refining Corporation (P5.74 billion);

- Cagdianao Nickel Project of Platinum Group Metals Corporation (P5.18 billion);

- Claver Nickel Project of Taganito Mining Corporation (P5.17 billion); as well as

- Rio Tuba Nickel Project of Rio Tuba Nickel Mining Corporation (P3.69 billion).

– Rappler.com

(Mining concept image from Shutterstock)

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.