SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Singapore’s rise from a relatively poor city-state with no natural resources to an economic powerhouse is one of the great success stories of the 20th century.

As it turns 50 on Sunday, August 9, Singaporeans can boast the 5th highest gross domestic product (GDP) per capita worldwide, according to the World Bank.

The World Bank also pegged average income for Singaporeans in 2014 at $55,150, a far cry from its average of less than $600 when it was expelled from the Malaysian federation in 1965.

Its rise proves that visionary planning and openness can go a long way in the global economy of today, and in the process, it may have provided some signposts for its neighbors like the Philippines.

Model for openness

“Singapore is a model of openness to the global economy,” said Dr. Benjamin Diokno, the budget secretary under former president Joseph Estrada.

The lack of resources forced Singapore to turn to the global economy and attract as much trade and investment as it could.

Today, it is one of the world’s top 4 financial centers, with a recent Towers Watson Asia study showing that Singapore hosts 41% of Asia-Pacific headquarters among 319 global Fortune 500 companies.

Diokno highlighted Singapore’s zero tariffs as something for the Philippines to adopt, noting that the city-state only taxes items that are adverse to health including tobacco, alcohol, and petroleum.

Not only will this encourage trade and investment, but it would help curb smuggling, he added.

No tariffs on imports makes it easier and thus more attractive for firms to import needed materials and would lower the price of foreign goods for consumers, boosting consumption.

“We are headed in that direction anyway, with the coming ASEAN integration that will eliminate all tariffs on imports between members,” he added.

Government premium

Most foreign investors cite stability and lack of corruption, despite its higher living costs, as their primary reasons for choosing Singapore over its more opaque neighbors.

This lack of corruption is illustrated quite clearly by Singapore’s ranking of 7 out of 175 nations in Transparency International’s Corruption Perceptions Index.

By contrast, its closes ASEAN competitor was Malaysia at 50, followed by the Philippines at 85. Diokno praised Singapore’s policy of keeping government pay competitive and often higher than a comparable private sector positions as a big factor in this.

“There is a premium associated with working for the government there that you just don’t get here and it means that often, the best and the brightest end up in government,” he said.

Federico Macaranas of the Asian Institute of Management’s ASEAN 2015 integration project, recommended that the government adopt a similar approach.

Singapore’s good governance through meritocracy and its anti-corruption drives is something we can emulate, he told Rappler.

One way to do would be increasing pay for government bureaucrats, he added.

Openness to foreign investors, along with political stability, has been the key growth

Singapore does not have the critical mass to grow the way China, India, or even the Philippines does, said Kristijonas Kabasinskas, an Accenture management consultant based in Singapore.

“Singapore has had its arms wide open welcoming foreign talents, capital, and cash and attracted them with tax breaks such as zero capital gains tax and ease of doing business,” he said.

Singapore also offers numerous tax incentives for foreign individuals and firms which has proved to be successful.

Five years ago, a foreigner could obtain a residence permit on arrival, added Kabasinskas, a Lithuanian national.

Today, by most estimates, 1 in 4 people in Singapore is a foreign national and foreign direct investment accounted for 21.9% of its 2014 GDP, based on World Bank estimates.

By contrast, foreign investors in the Philippines have long had to grapple with restrictions on investment in most industries, limiting them to a minority share of 40% in a venture.

This, they said, has vastly hindered foreign investment to the detriment of the country’s economy, affecting everything from the tourism industry to renewable energy.

Sound infrastructure

Infrastructure is another major factor in Singapore’s competitiveness, with the city-state ranking 2nd overall out of 144 countries in the World Economic Forum (WEF) 2014-2015 Global Competitiveness survey.

Singapore has shown a knack for planning ahead with infrastructure, exemplified by its main gateway Changi Airport. Already one of the world’s most efficient, the government is currently expanding it.

Terminal 4 is set for 2017, while Terminal 5 set for mid-2020s which will see its capacity rise to 50 million passengers a year.

It also features the world’s second busiest port, second only to China’s primary port of Shanghai.

Planning in advance has also led to the city-state being dubbed the ”garden city.”

“Foreign capital is attracted to efficiently run and layed out space. And Manila is lacking in it, although Bonifacio Global City is an example of good urban planning and bodes well for the cities’ future,” Kabasinskas said.

Investing in people

Singapore’s greatest investment, however, is in its people as it continues down the path toward being an innovation-based economy.

“Something Singapore has invested well in for years is not the Marina Bay Sands or Sentosa Island, but human capital,” shared Kabasinskas.

Education has a massive spillover effect lasting generations, he added.

Singapore ranks second in the WEF’s higher education rankings and ranked 9th in the United Nations Human Development Index with a average of 3.3% of GDP spent on education.

It has also carved out a niche for itself in recent years as a destination for higher learning to attract both talented foreigners, making it an additional source of revenue.

Higher-learning institutions such as Massachusetts Institute of Technology, University of Pennsylvania, INSEAD, and the University of Chicago have all set up satellite campuses in Singapore.

“The Philippines services-based economy needs to ensure higher education is publicly available and not just for a privileged few,” Kabasinskas said.

Guide for the Philippines

It is on this note that the Philippines can take heart.

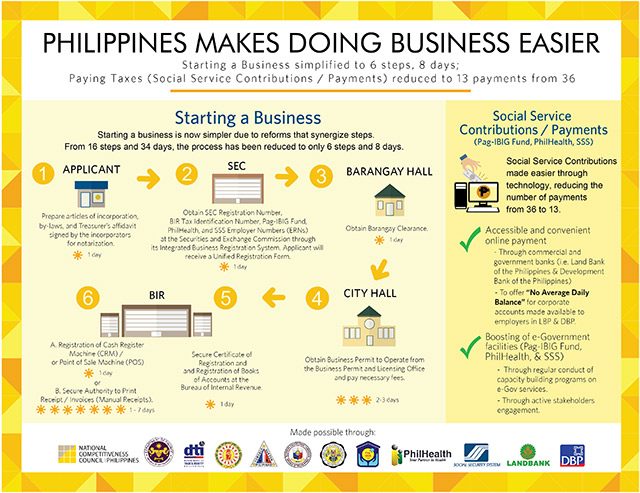

The Philippines has made great strides recently in global competitiveness, reducing the time it takes to start a business to 8 days and 6 steps and earning the distinction from the WEF as the world’s most improved country since 2010.

The vast differences in both countries demographics and geography make a direct comparison between the two impossible, but sensible policies like Singapore implements can serve as guide to the Philippines, which is now planting its feet in the global competitiveness arena.

After all, Singapore managed to achieve its stunning economic rise with a highly-educated population of 5.4 million and little natural resources.

Imagine what a country like the Philippines can achieve, with its natural resources and a population of more than 100 million. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.