SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Like most disruptions in the past, the advent of ecommerce has been framed as a battle between online convenience and the traditional brick and mortar experience: your couch or the mall.

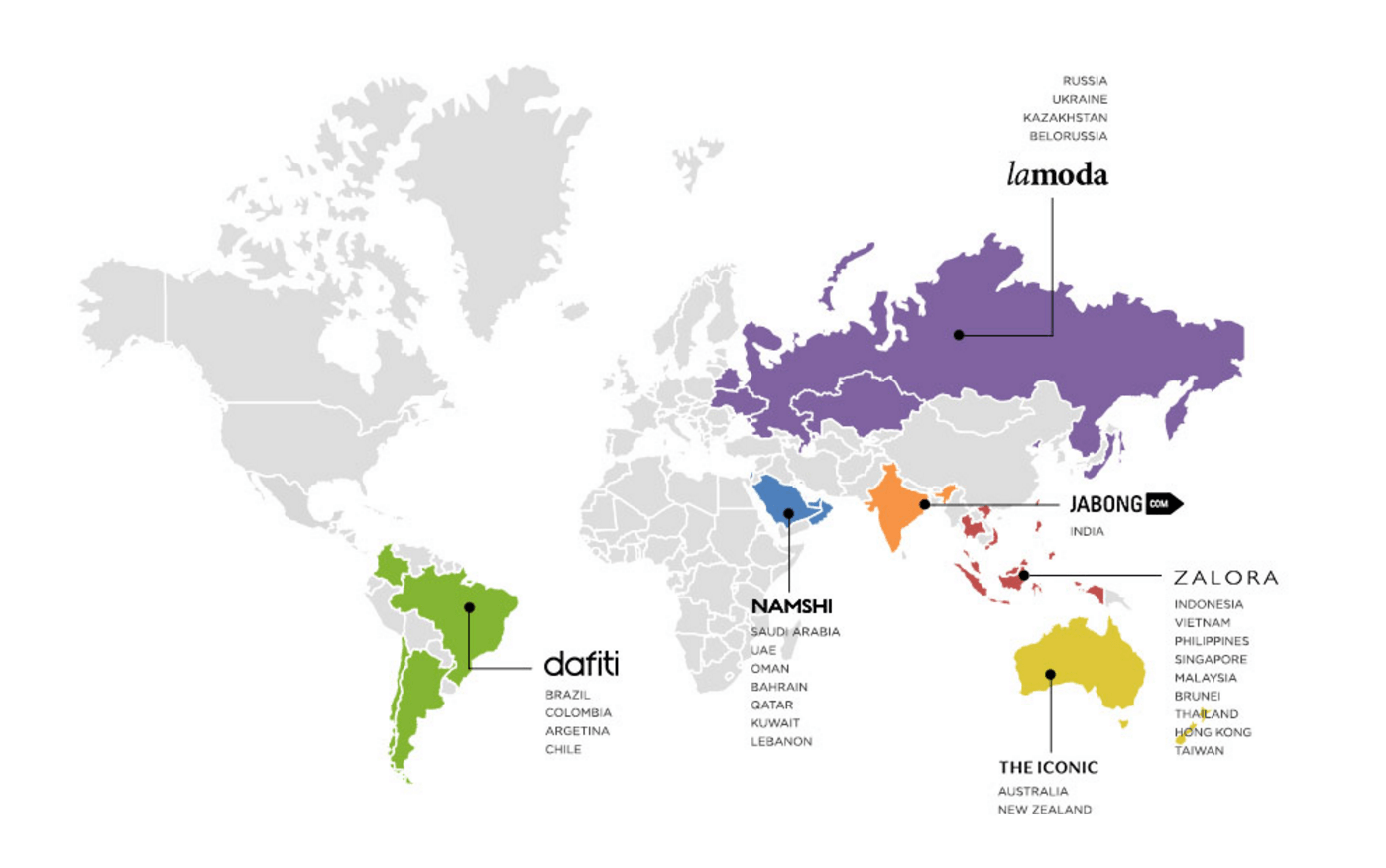

Ecommerce has played its part as the upstart in this battle, with brands such as Lazada and Zalora coming from nowhere a few years ago to winding their way into the public consciousness.

Despite this, ecommerce currently accounts for only about 1% of the local retail market. However, as Paulo Campos III, founder and CEO of fashion retailer site Zalora Philippines pointed out, “Where it’s going – that’s the exciting part.”

“If you believe that the concept of ecommerce is universal, and not just a western country thing, then the experience of other countries provides a glimpse of what’s in store for the country,” he said in an exclusive interview with Rappler.

In the US and EU, ecommerce now represents about 8-10% of the retail market including big names like Amazon.com.

But more relevant to the Philippines is its success closer to home.

“China is the shining story of ecommerce in emerging markets and and somehow validates the thesis that ecommerce is a global, universal thing and that it’s going to happen eventually here and everywhere else,” Campos said.

Indeed, some of China’s best known companies, including the record holder for biggest IPO ever, Alibaba, are built upon ecommerce and already have 6-7% of China’s giant retail market.

But its success there doesn’t guarantee it would work here, especially in a country where malls have become the de facto townsquares.

This is especially true of a firm like Zalora that plays in the fashion space where the fit and feel of clothes are so essential to the buyer.

Unlike Uber

Setting up shop in the country in 2012, initially as a venture of Rocket Internet, Zalora has since grown to become the leading fashion-focused ecommerce platform in the country, averaging around 200,000 users per day.

To visualize this, that’s about on par with the amount of daily foot traffic the big malls get, Campos said.

Yet, he doesn’t see this as a signal that malls will soon be disrupted in a way Uber has done to taxis around the world.

“Filipinos will continue to go to the mall in the large numbers they do now. Culturally, the mall is more than just a place to go to buy stuff, it’s where people hang out, cool off and even go to Mass,” he said.

“In terms of how I see the development of the brand, we’re moving to an omni-channel experience,” Campos explained.

For example, someone goes to the store to check out an item but then does the research online and then might go back to the store or they can just buy from the site.

“This omni-channel experience means that ecommerce and the mall will coexist and in fact reinforce each other in a harmonious way,” he said.

Consumer patterns

Another interesting point about this relationship lies in consumer patterns.

Campos pointed out that Zalora sales are highest on Wednesday and Thursday, while they are lowest, at only 50% of the highest days, on Saturday and Sunday.

Within a day, sales are highest between 1 pm and 4 pm and are lowest between 6 pm and 8 pm. This has been true for every week for 4 years.

These patterns are the exact opposite of sales patterns in the offline world.

“What I tell our brand partners is that when customers are in the mall, they are shopping with you. When they’re not in the mall like during downtime at the office that’s when people are shopping with us,” Campos said.

“People are shopping with us on hump day and 1-4 pm, taking advantage of fast Internet at the office. Somehow it’s complementary,” he said.

He also pointed out that Zalora’s retail brand partners also found that online shopping doesn’t cannibalize sales. It’s just one way of reaching out to customers at another time and through a different channel.

This blending of both worlds can already be seen in individual brands that all have their own ecommerce websites. You can buy Nikes online but that doesn’t mean they’ve closed down their stores.

Local retailers like Bench and SSI, both of which sell through Zalora, already have online ecommerce sites, although Campos is confident that they will continue to sell on Zalora.

“Customers who are shopping for a specific brand can go to its website directly, and those shopping around looking for many brands can go to Zalora. Brands are basically doubling their retailing channels through us,” he said.

To facilitate this, Campos said that Zalora sells everything at suggested retail price (SRP). This means nothing will ever be cheaper or more expensive in the mall than on the site, and when an item goes on sale offline, it does so online as well.

Digital department store

Campos said that what Zalora brings to the table for consumers, besides convenience, is the ability to browse established brands while getting exposed to new ones.

“About half of our brands, 750, are mall brands that work together with us on a virtual inventory basis or a marketplace basis. The other half are independent brands, the SMEs [small and medium-sized enterprises], and entrepreneurs that don’t have the scale to work with us like the big brands do,” Campos said.

He added that while they have the top 20 online retail sellers, they don’t have a store so most consumers have never heard of them. On top of that, Zalora also has its own brand that encompasses about 20% of sales.

He also pointed out that many users visit the site as an information resource to check on product alternatives and get reviews on different items.

Tip of the iceberg

Approaching its 4th anniversary in the Philippines, Campos said that Zalora is profitable on a unit economics basis. But at the moment it is sacrificing profitability for the bigger battle for market share.

Far from traditional retailers, Campos said that the main challenge facing Zalora, as well as other big ecommerce players, is getting consumers comfortable with buying online, which is why it is channeling money into various marketing efforts.

These efforts include the pop-up stores they had last year as well as hosting a Zalora Style Awards Ceremony to be held on April 7, and a regional model scouting competition to mark its 4th anniversary.

Just getting consumers online is also proving to be tricky with Campos sharing that they are still fighting a battle on educating Filipinos on how to use mobile data.

“I recently saw a Google study that showed that among all our peers in Southeast Asia, we use Internet on a fewer number of days per month than any other ASEAN country and significantly so,” he shared.

“Out of 30 days, only 80% use it 1-5 days a month. So this phenomenon of being constantly connected or being a digital native is not true for most people in the country,” Campos added.

Even potential customers who are connected are hampered by poor network infrastructure.

“We have the benefit of comparing all the ASEAN countries that have Zalora side by side and through the comparison you can really see that we really do have an inordinately slow mobile Internet speed even compared to Indonesia or Vietnam,” he said.

On the flipside, Campos pointed out that 40 million Philippine users have access to the Internet now, and the number is expected to go up to 75 million in the next two years. If the Internet improves in the next few years, this would bring huge potential to online businesses.

With Internet speeds improving, the firm is hoping that as more and more consumers become digital natives, they would eventually get comfortable browsing the site from anywhere.

Maybe even while hanging out in a mall. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.