SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Spending is expected to double or triple this holiday season. Should we expect a tax holiday as well? What is a tax holiday and who will benefit from it?

Not in this administration. A tax holiday is a temporary period during which the government removes or reduces certain taxes like value added tax (VAT) and income taxes on individuals and businesses in certain area.

During super typhoon Yolanda, a tax holiday was proposed but immediately dismissed. This was supposed to encourage consumption and fast recovery of both households and business enterprises in the affected areas.

Is it related to the fiscal incentives granted to some businesses?

Yes. Through the fiscal incentives provided by the government to foreign investors and those in the special economic zones, an income tax holiday is granted to promote investments in the Philippines. (READ: Fiscal incentives bill: Is it really priority?)

It is all over the news that the Senate approved on second reading the bill that seeks to increase the 13th month pay exemption. Will this benefit a middle-income employee like me? Is it not biased to employees since self-employed individuals will not be able to enjoy this?

Yes. This is a tax relief to middle-income earners being taxed already at 30% to 32% due to the outdated and overly burdensome tax system. In 2013, P200 billion ($4.44 billion*) taxes were withheld from the compensation of all employees in our country. While we definitely have to empower our small and medium enterprises (SMEs), the working middle class also needs help as they are fixed income earners.

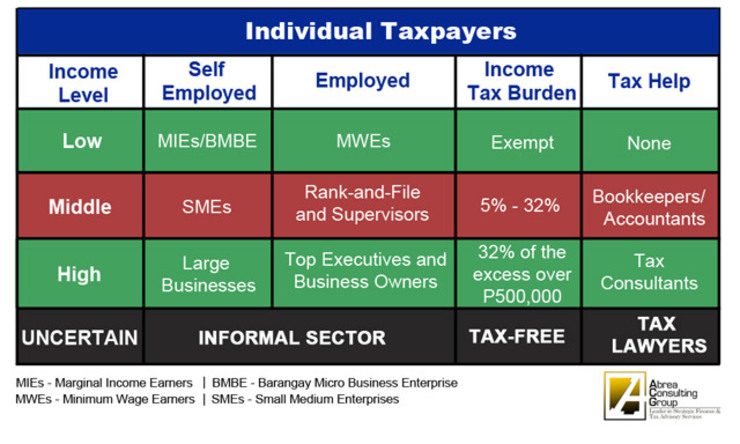

The table shows the income tax burden of individual taxpayers based on their income tax level and the tax help they get. Clearly, the loopholes in our tax system are being taken advantaged by those who can afford more tax help.

I heard the YesPinoy Foundation of Dingdong Dantes is organizing a charity event this December. If I support it financially or donate some of my inventory, can I claim it as deductible expense to reduce my taxable income?

Yes. Self-employed individuals, professionals or entrepreneurs alike, may donate their inventory or support charity events like the “Pamaskong handog para sa kabataan: It’s better to donate than to evade!” and avail of tax relief by claiming the donations as charitable contributions – a deductible expense to reduce taxable income.

As such, with your help, we will be bringing the joy of Christmas to 500 patients of the Philippine Children Medical Center (PCMC) in Quezon City. That’s why it is better to donate than to evade!

The effort is in partnership with CSR Philippines, YesPinoy Foundation is supported by the Abrea Consulting Group, Fully Booked Foundation, Mary Grace Café, Metrobank (ASSET) Alumni Scholars Association, Goldilocks, among other sponsors.

Got a question about taxes? #AskTheTaxWhiz! Tweet @rapplerdotcom or email us at business@rappler.com. – Rappler.com

Mon Abrea is a former BIR examiner and an advocate of genuine tax reform. He serves as chief strategy officer of the country’s first social consulting enterprise, the Abrea Consulting Group, which offers strategic finance and tax advisory services to businesses and professionals. Mon’s tax handbook, Got a Question About Taxes? Ask the Tax Whiz! is now available in bookstores nationwide. Follow Mon on Twitter: @askthetaxwhiz or visit his group’s Facebook page. You may also email him at consult@acg.ph.

*($1 = P45.04)

Red gift box image via Shutterstock

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.