SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Changes to the current tax system don’t just promise less monthly tax. It could also mean an additional P20 billion for spending on social programs and lesser traffic in the bargain.

“We could earn up to P20 billion pesos by adjusting fuel excise tax to inflation,” said Anton Ragos of the Action for Economic Reforms (AER), an NGO composed of academics that studies possible economic reforms.

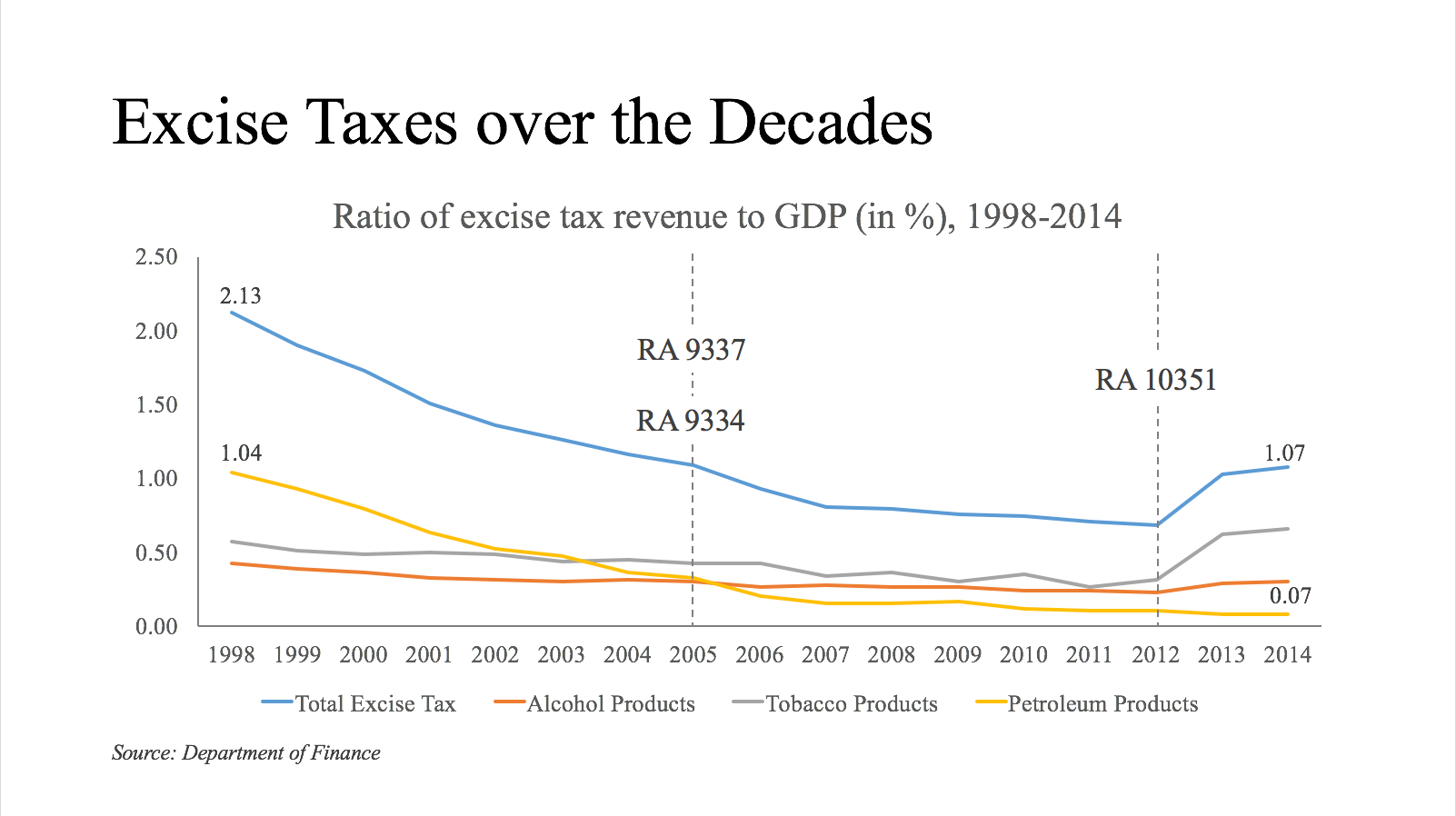

Taxes on gasoline at the pumps haven’t been adjusted since 1998, Ragos explained, and it’s part of the reason why the take on excise tax on a whole fell from 2.13% of GDP in 1998 to 1.07% in 2014.

Excise taxes, unlike the percentage driven Value-Added Tax (VAT), are taxes imposed on certain products in set amounts such as alcohol or cigarettes.

In fact, the revenue derived from excise tax has been continuous since 1998 until the imposition of the Sin Tax in 2012 whereby it rebounded to above 1% in 2014, Ragos said.

Lessons learned from Sin Tax

It’s the success of the sin tax that has led efforts to find similar measures to improve government revenue and services.

Based on data from the Department of Finance (DOF), the sin tax generated P142 billion in government revenue last year.

But that doesn’t tell the whole story since the proceeds from it goes to public health care services.

The sin tax’s most obvious benefit is the revenue it has generated for the Department of Health (DOH), which had a budget of P87 billion in 2015, the highest it has ever been and more than double what it was in 2012. PhilHealth has also expanded its membership by 185% since the sin tax was started.

Ragos pointed out that the sin tax has also been a major cause in the decline of smoking in the country with the number of estimated smokers decreasing from 32.7% of the population in 1998 to 23.7% in 2015.

“That’s the kind of lesson we would like to adopt to for possible tax reforms we would like to pursue in the future,” Ragos said.

Besides the fuel excise tax, other excise taxes proposed with fiscal and social benefits benefits in mind are a soda tax to help control obesity and diabetes, as well as a carbon tax to reduce individual carbon footprint.

Price to pay

That isn’t to say that these social benefits come free and consumers would pay it at gas stations.

Adjusting fuel excise taxes for inflation would result in a price increase due to tax at the pumps at an average of P5.38 pesos for gasoline and P3.84 for diesel based on inflation figures from 2014, Ragos said.

The World Bank, however, had previously advocated indexing the tax for inflation to take advantage of low global oil prices which has led to much cheaper gasoline and diesel at the pumps.

Since 2014, the oil price has dropped by more than 70%, and domestically it has resulted in a series of cuts in flag down rates for jeepneys and taxis.

While global oil prices have started climbing incrementally again early in the year, recent failed talks between OPEC members this week have once again pushed them downwards.

More impact on rich, not poor

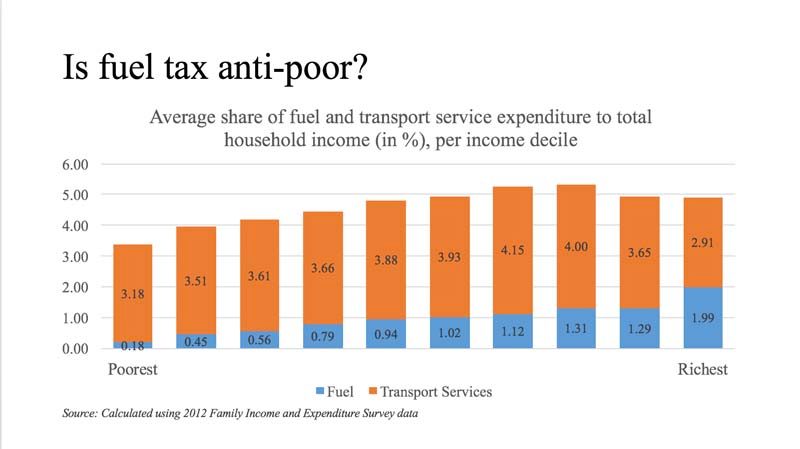

Analysts have also in the past discouraged raising taxes on fuel as it hurts the poor, but AER pointed out that based on its studies, the increased fuel tax would have greater affect on richer households than poorer ones.

“Looking at spending pattern, the richest consume more of fuel products. Almost at 2% of total household income compared to the poor where its only 0.18% of household income,” Ragos said.

He emphasized: “We’re not saying the poor won’t be affected but its not true that they will be the most affected. They consume it the least and the burden of paying it is on higher households”.

It would also have the affect of encouraging people to use public transportation which would help reduce the number of vehicles on the road. It could also lead to better infrastructure.

“We can use the P20 billion to improve services and infrastructure. The important lesson right now is that , although taxes are a burden but if we are unable to fund the necessary infrastructure or services that we want there is also a cost to us such as massive traffic,” Ragos said.

He added that additional measures could be taken to soften the blow such as using some of the additional revenue generated to subisidize public transport providers.

Part of package of reforms

AER conceded that the issue should be looked at further as raising fuel could lead to secondary inflation which would affect the poor.

The DOF agreed with this assessment with Director Elsa Agustin pointing out that its own reseach also shows that increasing fuel excise tax would affect the rich more than the poor.

Agustin added, though that despite this: “The excise tax reform on oil products must be inclusive of the comprehensive tax reform package that we are planning to submit to the next administration. It won’t be a standalone proposal.”

As for income tax, the DOF director also emphasized that “there’s no debate as far as income tax is concerned. We recognize that there’s a need to restructure both personal and corporate income tax but again it shouldn’t be piecemeal”.

Both Agustin and Ragos were speaking as part of a comprehensive dialogue on tax reform hosted by the Tax Management Association of the Philippines (TMAP) on April 20.

The event is part of the the groups efforts to highlight the need for tax reform ahead of May elections, said TMAP president Benedict Tugonon.

To increase awareness ahead of the transition of power, TMAP has sent out a survey on tax reforms to the presidential, vice-presidential as well as senate candidates.

The survey poses 24 questions for the aspiring leaders covering various tax policy questions ranging from income tax reform, VAT, Excise tax, Estate Tax, and Tax Administration and the group hopes to have the answers by April 26.

“If we get the candidates to commit to tax reform and the new President is open to reforms then there’s a very big chance that we can really see these proposed tax reforms issues discussed in the halls of congress,” Tugonon said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.