SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

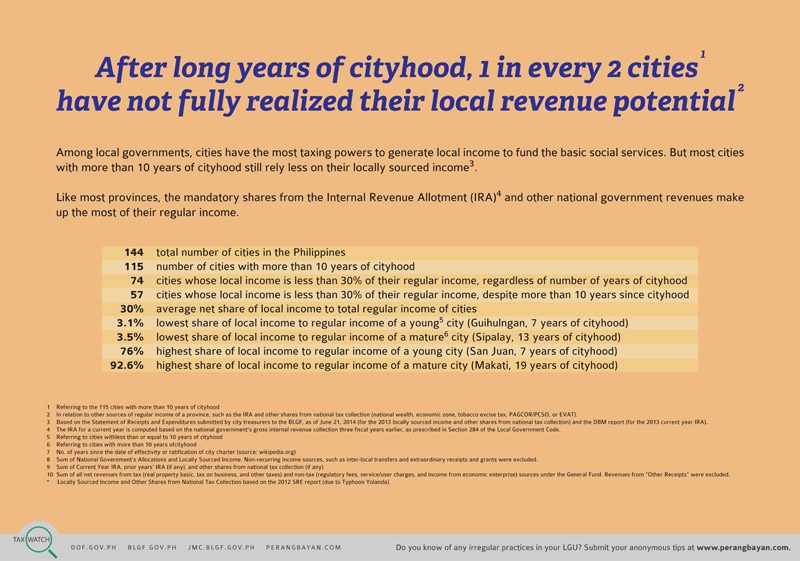

MANILA, Philippines – One in every 2 cities in the country has not fully realized local revenue potential after long years of cityhood, the Department of Finance (DOF) and Bureau of Local Governance Finance (BLGF) showed in their latest tax watch ad released Wednesday, June 25.

Out of 144 cities in the country, 115 have been cities for more than 10 years. These cities still rely less on their locally sourced income, DOF-BLGF said.

Locally sourced income is income other than the Internal Revenue Allotment (IRA) and share in national tax collection (national wealth, economic zone, tobacco excise tax, Philippine Amusement and Gaming Corporation, Philippine Charity Sweepstakes Office revenues, and expanded Value Added Tax).

“Among local governments, cities have the most taxing powers to generate local income to fund basic services,” DOF-BLGF pointed out.

Like most provinces, the IRA and other national government revenues make up most of cities’ income, the tax watch ad showed.

The average net share of local income to the annual regular income (ARI) of cities in 2013 was 30%.

Out of 144 cities, there were 74 whose local income was less than 30% of their ARI last year, regardless of the number of years of cityhood.

Meanwhile, there were 57 cities whose local income was less than 30% of their ARI, despite more than 10 years of cityhood.

Among young cities, the lowest share of local income to ARI was 3.1%. The 7-year-old city of Guihulngan in Negros Oriental only generated P12.05 million ($274,331) as locally sourced income in 2013 versus the national government allocation of P379.20 million ($8.63 million). Its estimated ARI that year was P391.25 million ($8.91 million).

The 7-year-old city of San Juan in the National Capital Region generated the highest share of local income to ARI at 76% or P775.11 million ($17.65 million), versus the national government allocation of P244.33 million (P5.56 million). Its estimated ARI in 2013 was P1.019 billion ($23.20 million).

Among mature cities, the lowest share of local income to ARI was 3.5%. The 13-year-old city of Sipalay in Negros Occidental only generated P12.60 million ($286,852) local income in 2013, versus the national government allocation of P349.94 million ($7.97 million). Its estimated IRA was P362.54 million ($8.25 million).

The 19-year-old city of Makati in generated the highest share of local income to ARI at 92.6% or P8.83 billion ($201.02 million), versus the national government allocation of P709.43 million ($16.15 million). Its estimated ARI was P9.54 billion ($217.19 million).

The oldest city in the country, 113-year-old Manila generated 75.5% local income share to ARI. Its local income stood at P5.41 billion ($123.16 million) versus the national government allocation of P1.74 billion ($39.61 million). Its estimated ARI was P7.15 billion ($162.78 million).

The amounts were based on the statements of receipts and expenditures (SREs) submitted by the city treasurers to the BLGF as of June 21, 2014 (for the 2013 locally sourced income and shares in national tax collection) and the Department of Budget and Management report (for the 2013 IRA).

The 2012 SRE report was used for cities and provinces hit by Super Typhoon Yolanda.

Like in its previous tax watch ads, DOF-BLGF stressed that when local government units collect low revenues, they fail to maximize their capacity to spend on basic services for their people.

“Local communities can be better served if LGUs become self-reliant communities,” DOF-BLGF reminded.

Meanwhile, the League of Provinces of the Philippines slammed the DOF-BLGF for its tax watch ad released June 18. The league said provinces are not living off the national government allocation and that the IRA is constitutionally due them. – Rappler.com

Makati skyline and magnifying glass over the word tax images from Shutterstock

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.