SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Philippine Stock Exchange (PSE) saw an extended sell-off in line with regional markets pricing the likely end of US Fed stimulus, as well as the rising interest rates in China.

MANILA, Philippines – The Philippine Stock Exchange (PSE) saw an extended sell-off in line with regional markets pricing the likely end of US Fed stimulus, as well as the rising interest rates in China.

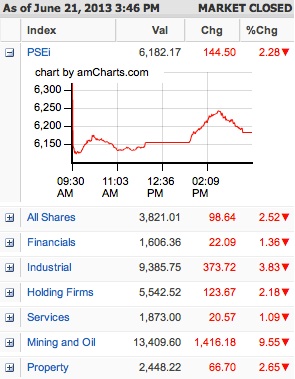

On Friday, June 21, the PSE main index fell 2.28% or 144.50 points to close at 6,182.17.

The day’s drop for the PSEi, which had struck record highs on several occasions this 2013, was the steepest in the June 21 among indices in the region.

The PSEi, shed 0.96% for the week, the 5th straight week of decline.

All counters finished in the red, led by the mining and oil counter (down 9.55 points). Decliners beat advancers, 141 to 31, with a total of 3.41 billion stocks worth P12.97 billion changing hands.

Foreign buying stood at P6.85 billion and selling at P9.12 billion.

On the other hand, the peso opened P44.00 against the US dollar Friday morning, trading within the P43.64 to P44.17 range. Without Friday’s gain, its fall in the past 5 days would have been the steepest in the last 3 years.

It eventually closed 8-centavos stronger at P43.72 to the dollar from its 17-month-low P43.80 finish on Thursday, June 20.

Other markets

Asian markets mostly fell further on Friday, amid steep losses on Wall Street after the US Federal Reserve signaled a possible end to its multi-billion-dollar stimulus program.

Below was the June 21 performance of the indices in the region

- Manila: -2.28%

- Jakarta: -1.77%

- Seoul: -1.49%

- Taipei: -1.34%

- Hon Hai: -0.99%

- Wellington: -0.81%

- Hong Kong: -0.59%

- Shanghai: -0.52%

- Sydney: -0.41%

- Tokyo : +1.66%

The losses are part of a global correction in equities and commodities, which have enjoyed strong rallies since the Fed unveiled its bond-buying scheme, called quantitative easing (QE), in September.

Markets have been in turmoil since May as talk mounted that the Fed would pull the plug on its $85-billion-a-month QE, which was put in place to help kick-start the US economy.

A series of upbeat US indicators added to those concerns and Fed chief Ben Bernanke confirmed dealers’ fears Wednesday, June 19, when he said the central bank would begin to limit the spending this year if the economy continues to pick up.

He also suggested the whole scheme could be wound up by mid-2014.

Michael Hewson, senior market analyst at CMC Markets UK, called the markets’ reaction “a classic case of perverse logic,” given that Bernanke was clearly signaling stronger US growth.

On Wall Street, the Dow sank 2.3%, or 354 points, its largest points loss since November 2011, while the S&P 500 lost 2.5% and the Nasdaq tumbled 2.3%. The markets had lost around 1%on Wednesday soon after Bernanke’s announcement.

“US shares had been advancing for so long — almost without a serious pullback — that it was almost about time we finally saw one,” Kenichi Hirano, market adviser at Tachibana Securities in Tokyo, told Dow Jones Newswires.

Markets in emerging economies were also badly hit as traders who had ploughed in cash looking for better returns retreated to the safety of the United States.

Currencies, commodities

However, the greenback rallied on expectations that fewer dollars will be sloshing around financial markets if the Fed rolls back QE.

It bought 97.90 yen Friday, compared with 97.27 yen in New York late Thursday. It was also well up from the 95.50 yen in Tokyo Wednesday before the Fed decision.

The euro traded at $1.3222 in Asia from $1.3223, and 129.39 yen compared with 128.83 yen.

Gold prices have lost around 7% since Bernanke’s announcement as the stronger dollar makes the precious metal less attractive.

Bullion fetched $1,296.30 per ounce by 0815 GMT, from $1,303.35 late Thursday.

Fresh evidence of a slowdown in China added to risk-aversion, with a closely watched manufacturing survey showing slower activity in June.

On oil markets New York’s main contract, West Texas Intermediate (WTI) light sweet crude for delivery in August, was flat at $95.40 a barrel and Brent North Sea crude for August delivery gained 49 cents to $102.64. – Rappler.com and Agence France-Presse

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.