SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines — Ramon Ang, the president and COO of San Miguel Corp, blasted a report that hinted the country’s biggest business group is at risk of defaulting on its debts.

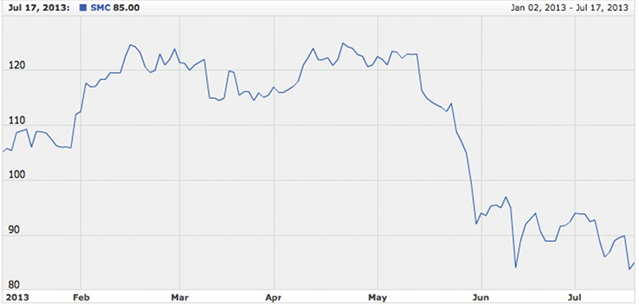

The diversified conglomerate’s shares sank to new lows since Rigoberto Tiglao’s piece in Manila Times entitled “IMF warns of conglomerate’s default” was published on January 14.

On Wednesday, July 17, San Miguel’s share price dropped to as low as P76.40 per share, a 52-week low.

Only after Ang declared in a Bloomberg interview that he will propose to San Miguel’s board a share buy back did the shares recover in the afternoon trade. It eventually closed at P85 per share, the lowest since Oct. 2010. The day before, it closed at P83.75.

Tiglao’s article “frightened the investing public,” Ang told Bloomberg. “I will go to the board to protect the investing public…At worst, we can buy back all the stocks and make the company private.”

In a press statement Wednesday afternoon, Ang said it is “unfortunate that certain people have taken advantage of that information to fabricate and spread malicious stories and sow panic in the market to the detriment of our shareholders and the investing public.”

The diversified group saw its shares register a 19% decline this year, the second steepest loss in the Philippine Stock Exchange Index.

Ang said that management will “hold accountable” those behind the “unjust assault on San Miguel’s financial reputation.”

IMF risk assessment

Tiglao based his report on the “risk assessment matrix” of the International Monetary Fund’s (IMF) report published in April. The multilateral lender’s 74-page report was based on its staff’s discussions with Philippine authorities in January.

In its risk matrix, the IMF said there is a “low” risk of a “default by a highly-leveraged domestic conglomerate” on its foreign and domestic loans. Due to the conglomerate’s size, the IMF noted that a default may increase “systemic risks” and cause a domestic credit crunch.

The lender then recommended to the Bangko Sentral ng Pilipinas to “roll back” the single borrower limits for petroleum purchases and financing of big-ticket infrastructure projects under the Public-Private Partnership scheme of the Aquino government.

San Miguel’s share price started to slump as rumors spread that IMF’s and Tiglao’s reports were referring to it. San Miguel controls giant oil retailer and refiner Petron Corp and is actively participating in several PPP project bids.

“There was no identification of a particular company,” IMF resident representative Shanaka Jayanath Peiris stressed in a July 17 emailed statement.

Ang added: “We would like to clarify that the conglomerate…referred to [in the] IMF report was not [San Miguel].”

‘Conglomerate maps’

Tiglao mentioned the “conglomerate maps” IMF said BSP has been preparing to determine concentration of loans to a few borrowers.

He cited “BSP sources” in explaining that the “conglomerate maps” are meant to “penetrate the ‘corporate layering’ done by several conglomerates to evade banking regulations on the single-borrowers limit (SBL).”

The SBL is meant to limit the loan exposure of a bank to a single borrower — or to a group of companies. It reduces the risk that a default by that borrower will bring the bank down.

“It’s been quite obvious that this conglomerate, which has been expanding too rapidly is doing so through huge bank loans, and we can’t figure out how it is complying with the SBL,” Tiglao quoted his unnamed source as saying.

San Miguel has been among the most aggressive in expanding and diversifying in the past 7 years. From its traditional food and beverage business, it has since added power, oil, mining, infrastructure, aviation, telecommunications, media, and other capital-intensive ventures to its portfolio.

‘Subjective’ assessment

IMF’s Peiris stressed that the lender’s report was based on “the staff’s subjective assessment of the risks.”

He highlighted that the report identified other more pressing risks, including external shocks from the fiscal and growth issues of the EU, US, as well as the capital inflow reversals affecting emerging markets.

Tiglao’s report reflects a recurring rumor that has been making the rounds in Manila’s financial community in the past years. The rumor has been unverified.

Even in private discussions, Bangko Sentral officials shrugged off these talks.

BSP Governor Amando Tetango told Bloomberg Wednesday that they continue to “monitor risks and look at possible stress points. He stressed that the Philippine banking system “can absorb significant writedowns.”

Financially strong

Ang firmly maintained his optimistic outlook on the company’ future financial prospects.

“As of the first quarter of this year, [San Miguel’s] consolidated cash and cash equivalent stood at P152.3 billion while its gearing ratio, at 3.1x net debt to EBITDA, is lower than the 5.5x stipulated in its loan covenants,” he emphasized.

At end-2012, it disclosed that its interest bearing debt reached P375.5 billion.

To raise additional capital for its expansion and diversification plans, San Miguel officials have previously announced they are mulling selling the following stakes in these ventures:

- power generation (SMC Global Power Holdings Inc.): 49% stake

- banking (Bank of Commerce): 40%

- power distribution (Manila Electric Co. or Meralco): 32%

In a previous interview, Ang had said that it expects its revenues to reach $50 billion by 2018 as it acquires new businesses and expands existing ones. This is nearly 3 times what San Miguel made in 2011, when it ended the year with $17.5 billion in revenues. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.