SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I have to admit that the past week has had me more concerned about my car basement wallowing under a hellish, “conjurain” type scenario than the PSEi submerging below that psychological threshold floor of 6,000.

There is something about the raw chaos of nature that makes you momentarily forget the minute daily pain associated with a gradually depreciating #MyHusbandStockPortfolio.

Perhaps those TV images of our kababayans hunkered down in temporary storm shelters make the pain of a few thousand pesos lost in a sudden market downturn seem just too trivial.

It’s not that paranormal experts can do anything to counter a PSEi “ghost month,” mainly because this seasonal weakness actually has nothing to do with the paranormal.

Yes, we really are talking here of alive and kicking foreign fund managers who hit the beach during summer with their families, sipping salty tequilas while licking their wounds – but not necessarily in that order.

These big buyers thereafter leave a “buy order” vacuum that is hard to be replicated by even our highest paid call-center agents buying online and in the thousands.

In any case, while the floods may have receded, it still remains unclear what direction the PSEi will take.

For instance, I have heard varied market analyses and interpretations from my regular PSEi homies, many of whom now just “tweet” foregoing our occasional Starbucks meet-ups somewhere.

Many from their tweets just expect a retest of our June lows, while others see a much lower PSEi 5,200 target on this down wave.

You see in Elliot Wave (EW) Theory, Wave 4-A (the first down wave) which was last week of June, was followed by the standard uptrending Wave 4-B, which brought us slightly pass a PSEi level of 6,800.

However, there was something in that trepid PSEi rise that was unconvincing in terms of both volume and breadth.

So for many pundits, that rise to 6,800 isn’t our much awaited and bigger “uptrending Wave 5” yet. It seems we are still within a down Wave 4 (with its waves A-B-C zigzag).

What this all means is that Wave 4-C is typically a much more pronounced “climactic” down wave, and if indeed we are on this EW wave, then a much lower bottom of PSEi 5,200 is the likely target.

Frankly, I am positioned in both camps, not because I am carefully hedging my bets on a widely read social media site, but simply because it’s not my game to worry about flaky short-term charts anyways, ala Warren Buffet.

What is important for us all is really the long-term chart of the PSEi – Wave 5 being here or still out there, notwithstanding.

Long-term prospects

And on PSEi’s long term prospects, I have to say it is getting sexier by the day.

Take this for example. Just recently, JP Morgan finally agreed with global bond behemoth PIMCO’s assessment of US growth.

More specifically, and according to both houses, the “new normal” of 2% US long-term average growth has just been downgraded to 1.75%.

Which says a lot since this is a much lower revised outlook on US long-term growth, and it actually never happened before, not since post-war US became our global Elvis.

According to Michael Feroli, JPMorgan’s Chief US Economist “United States’ future isn’t what it used to be.”

Declining productivity gains and a smaller labor force should cap US average growth pace over the long run.

It seems that “greying” America as finally caught up with it as less people are now working, or have left the labor force and maybe semi-retired since that sub-prime crisis.

Specifically, Feroli mentioned lower productivity and its aging workforce as the likely suspects.

In contrast, the Philippines “new normal” is beginning to look more like 6% to 7% economic growth year in and year out.

And yes, even without stimulus. With our economic growth story being an outlier even for Asia, and helped by our potential labor force and demographics base of 70% being below 25 years of age, I frankly can’t see how the PSEi (or even MSCI’s Philippine ETF traded $EPHE shares) cannot but outperform many Asian bourses, if not the United States of America as well.

Dollar inflows

What we have now is clearly an “out of the box” economic paradigm where almost $3 billion in monthly cash flows are now “conjuraining” into the system, coming from unlevered, globally recession-proof BPO and OFW receipts.

These “conjuraining” dollar inflows are mopped up, or at least attempted to be mopped up by the BSP, which is only the last to find out that clever foreigners are actually arbitraging on the interest rates of the SDAs, borrowing weak, interest-free yen and placing in pesos.

So now this humongous P1.4 trillion in SDA monies have been freed up, not to mention IMA placements that may soon have nowhere to go – just like murky flood water in Metro Manila.

If none of these are medium-term bullish on the PSEi, then I might as well repackage myself as some middle-aged rapper somewhere, and get more luck attracting believers.

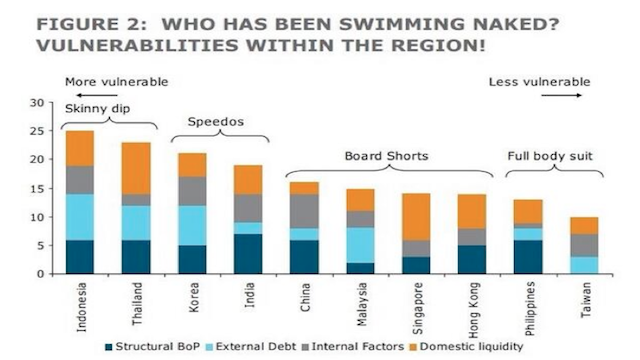

In any case, if I havn’t been able to convince you yet, perhaps this chart from ANZ Bank and tweeted by pretty EEM and $EPHE follower @denise_law shows clearly who is actually swimming naked in Asia.

If the chart below can actually help you push that “buy” bottom when the PSEi eventually bottoms out before that feared FED “tapering off” meeting in September, then you may be looking forward to a merrier Christmas. Of course, you would also owe me a glass of ice cold beer.

– Rappler.com

The author is Managing Director for Corporate Finance for the Center for Global Best Practices (CGBP). He was connected with PNB Capital & Investment Corp. as President & CEO and with Punongbayan & Arraulo, where he set up the first P&A/Ernst & Young Corporate Finance practice in the Philippines in 2001. Tony is active on Twitter for stock market newbies: @Tony88981.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.