SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Leading global digital payments firm Payoneer is opening an office in the Philippines to capitalize on the country’s thriving digital entrepreneurship scene.

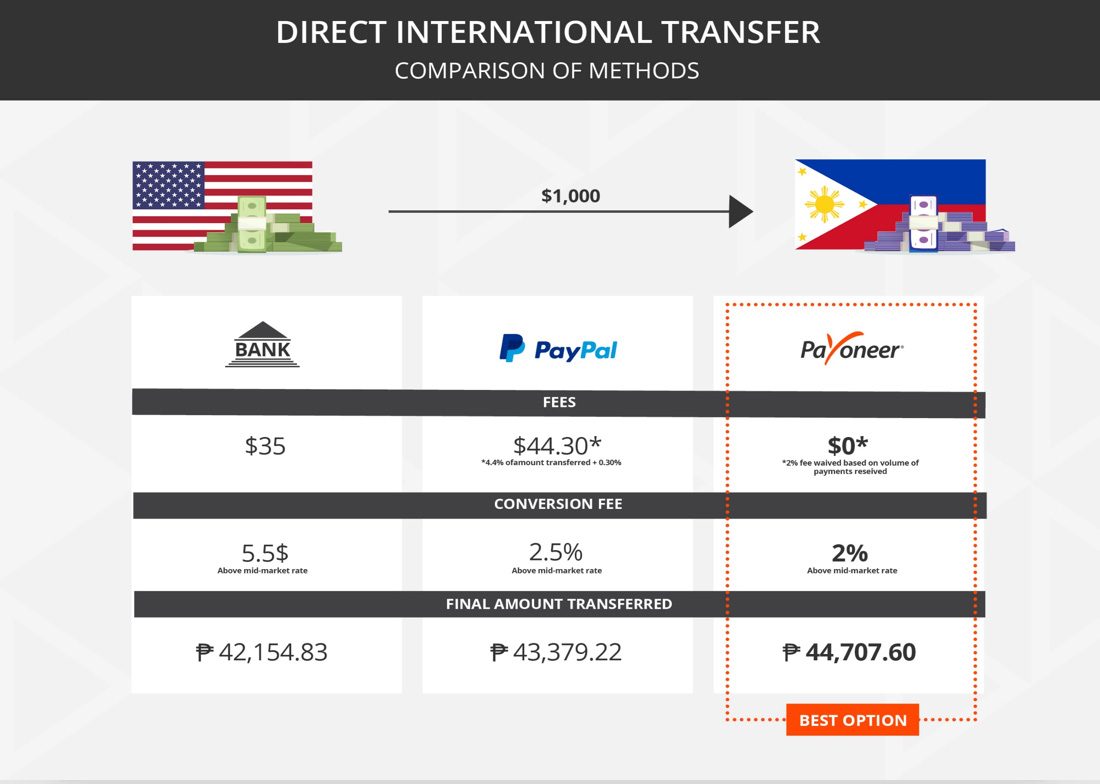

The New York-based fintech firm, founded in 2005, specializes in cross border business-to-business payments that, it says, offer better rates on foreign exchange and lower commission fees than traditional banks.

It has also provided payment solutions for firms such as Google, Amazon, and Airbnb.

“The platform has evolved over the decade and now we’re really built out as a full-fledged all-in-one solution for business-to-business cross-border payments,” said Payoneer’s Johnny Steel, global Vice President for Marketing, at the firm’s inauguration of its new office in Bonifacio Global City on Thursday, September 22.

“That really shows where our focus lies” he continued. “There are plenty of other good solutions there that handle the consumer side like Paypal, but we’re focused on business payments, especially those that need to make transaction across different countries.”

Facilitating digital entrepreneurs

Payoneer’s new Philippine office is the firm’s second satellite opening in Asia after Hong Kong, a fact that Steel said was a result of the country’s rapidly expanding outsourcing and service export market.

A 2015 World Bank report on the global opportunity in outsourcing showed that the outsourcing industry is set to generate $15 billion to $20 billion in revenues by 2020.

The same report found that the Philippines already comprises 18.6% of the global online workforce, and is among the top 5 countries for online outsourcing.

In particular, Payoneer sees vast potential among the country’s army of digital entrepreneurs, especially freelancers, including graphics design and marketing specialists and the ubiquitous Business Process Outsourcing or BPO market.

“The BPO market is very big and interesting to us because of the volumes of the payments and because they tend to be more savvy about rates and Forex conversion fees as there’s more at stake,” Steel said.

“On the other hand,” he continued, “there’s also a very long tail of digital freelancers and very small MSMEs and there’s so many of them that we think the market is underserved compared to bigger businesses.”

He also noted that because Payoneer’s service provides a proxy US bank account, it also allows entrepreneurs to gain access to international platforms, particularly Amazon, which requires a US bank account to receive earnings.

Leveling the playing field

Whether you’re freelancing on a platform such as Upwork or selling goods on Lazada or Amazon, you can get payments from global marketplaces using Payoneer’s platform, said Payoneer’s country manager for the Philippines, Miguel Warren.

Payoneer also offers billing services for direct clients and global receiving accounts which allow firms in other firms to pay in their local currency without need for an international wire transfer.

“This is key as it levels the playing field for small businesses and this is how larger firms receive their payments,” Warren said,

Once paid, the entrepreneur can access the funds through local withdrawals by linking the account to a Philippine bank.

Payoneer also offers a debit card that customers can use to withdraw cash from ATMS or use online for sites that accept Mastercard, as well as pay other freelancers or suppliers from funds already available.

“The market is growing fast in the country and we still think that we’re only touching the tip of the iceberg here. So part of opening the office is to create more awareness about rates,” Steel said.

“A lot of these people are simply unaware of what they are being charged by banks and other suppliers, “ he added. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.