MANILA, Philippines – A major player in the gaming industry wants the Supreme Court (SC) to rule that it has no legal obligation to pay income taxes when it comes to operations contracted with the government’s casino corporation.

Bloomberry Resorts and Hotels Inc (BRHI) filed on Tuesday, June 3, a 23-page petition for certiorari and prohibition to nullify a tax regulation subjecting the contractees and licensees of state firm Philippine Amusement and Gaming Corporation (PAGCOR) to income taxation.

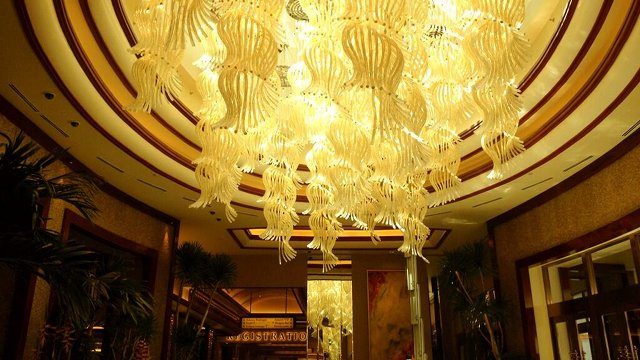

Together with its parent company, BHRI owns and operates Solaire Resort & Casino. Solaire is the first of 4 casino and gaming projects provisionally licensed by PAGCOR in the so-called Entertainment City, a government-sponsored economic development zone.

In its petition before the High Court, BHRI argued that imposing the 30% income tax on profit it derives from contracted operations with PAGCOR is “contrary to law” and is against national interest.

It said the 30% income tax would cripple the local gaming and leisure industries, which are “core components of the country’s tourism blueprint.”

It added that the tax exempt status of companies like BHRI in its gaming operations is what attracts investors, enabling the local industry to compete with foreign markets.

BHRI was assailing a provision in Revenue Memorandum Circular (RMC) No 33-2013 issued by the Bureau of Internal Revenue (BIR) on April 17, 2013 and released 7 days after.

BIR regulation contrary to law

BHRI said the provision in RMC 33-2013 requiring income tax from gaming operations contracted with PAGCOR goes against Presidential Decree (PD) 1869, which exempts PAGCOR and its contractees and licensees from taxes except a 5% franchise tax.

Republic Act (RA) 9487, a 2007 law considered as PAGCOR’s Charter, gave the state firm another 25 years to operate and adapted PD 1869.

As the law adapts PD 1869, BHRI argues the tax exemption outlined in the decree stands to this day.

But in its circular, BIR cited another law which Congress passed on April 1, 2005. It said RA 9337 took out PAGCOR from the list of tax-exempt government -owned and -controlled corporations (GOCCs).

In its petition however, BHRI claims the law BIR cites did not include private contractees and licensees of GOCCs in the lifting of the tax exempt status.

The casino operator further adds that the BIR cannot issue a measure that goes against what Congress has earlier enacted, pertaining to RA 9487.

“Indeed, administrative issuances must not override, supplant or modify the law, but must remain consistent with the law they intend to carry out. Only Congress can repeal or amend the law,” its petition read.

Temporary relief

Under its provisional license with PAGCOR to operate Solaire within Entertainment City, BRHI only pays the government agency license fees “in lieu of all taxes.”

The integrated casino and resort complex was granted a provisional license by PAGCOR on April 8, 2009. It opened on March 16, 2013.

The fees outlined in Solaire’s provisional license include: 15% of gross gaming revenues generated from High Roller Tables; 25% of gross gaming revenues generated from Non-high Roller Tables; 25% of gross gaming revenues generated from slot machines and electronic gaming machines; and 15% of gross gaming revenues generated from junket operation.

These fees already include the mandated 5% franchise tax under PAGCOR’s charter.

Under the assailed BIR regulation however, BHRI would have to pay the 30% corporate income tax. With the provisional license in place, the 30% income tax would be on top of the PAGCOR-imposed license fees.

For this reason, PAGCOR provided BHRI a temporary administrative relief in the form of a 5% deduction for each of the aforementioned component in its license fees.

However, BHRI argues before the Court that the administrative relief provided by PAGCOR is only temporary and “does not correct BIR’s grave error and usurpation of authority.”

National interest

BHRI said its appeal before the SC involves national interest as “the gaming business funded by private investors under license by PAGCOR is a new industry which is attracting substantial investor and tourist interest.”

It said Solaire alone has tourist visitations averaging at 10,351 daily as of 2013, with 5,000 new jobs produced and 1,500 more expected.

BHRI argued before the Court that the gaming industry propels the economy, citing the examples of Las Vegas and Macau. The Entertainment City seeks to follow the Las Vegas and Macau model, it added.

“The Philippine gaming industry has a long way to go in terms of revenue potential,” BHRI said.

BHRI appealed before the SC, arguing that it has no other available recourse to stop the implementation of the BIR regulation.

“… there is no appeal, nor other plain, speedy and adequate remedy in the ordinary course of law available to BRHI,” its petition read. – Rappler.com

There are no comments yet. Add your comment to start the conversation.