SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines — After the US Federal Reserve decided not to raise interest rates, the Philippine peso recorded gains against the dollar on Friday, September 19, and is expected to remain strong and to weather concerns over sluggish global growth.

The Philippine peso rose two-and-a-half centavos to close at P46.415 per dollar from its P46.44 finish versus the greenback in the previous session.

This was after the US Central Bank played hard to get and decided to put off the increase in interest rates later this year at the conclusion of its two-day policy meeting.

The US Federal Reserve, however, said it will likely hike interest rates sometime this year “when it sees further improvement in the labor market.”

“The Fed’s decision will have relatively low impact on our exchange rate as whatever depreciation we are anticipating as a result of a Fed rate increase has been overtaken by fear of the foreign portfolio money from Asia and emerging markets as basket of investment,” a research associate from Research, Education, and Institutional Development (REID) Foundation, Ronilo Balbieran, said in an e-mail.

The Philippine peso has depreciated already as a result of hot money of foreign funds flowing out, resulting in less supply of dollars.

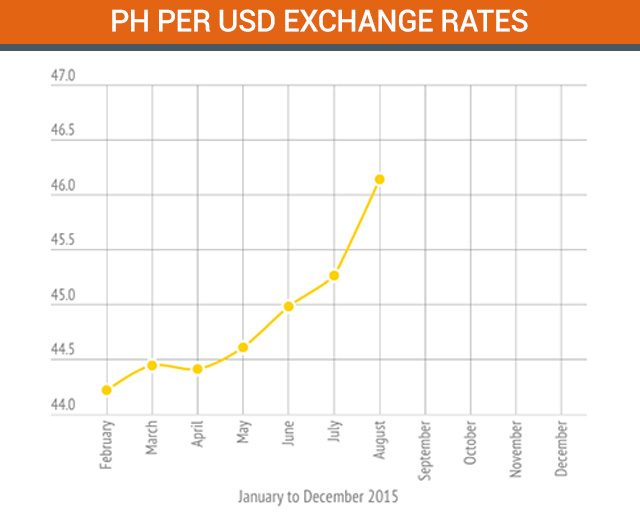

This made the peso weaker already by around 5% compared to July, August, September last year, and January this year, the REID Foundation research associate said.

If “the national government will be successful in moving the infrastructure budget into actual disbursements, [we will be able to increase the] supply of pesos and its circulation,” Balbieran said.

The Philippine peso will be tracking the movement of regional currencies as the current scenario is for global events to dictate market sentiment, Bank of the Philippine Islands (BPI) associate economist Nicholas Mapa said in an e-mail interview.

The local unit, along with the Indian rupee, is expected to still track the rest of emerging markets but will not be subject to the same violent swings the world has seen in other currencies whose central banks have either less gross international reserves or a weaker external position, the BPI economist explained.

“The Philippines has superior foreign exchange reserves and a current account surplus – two major factors that will help the country weather the current global environment with the Fed set to hike rates (sometime this year) and China slowing,” Mapa told Rappler.

According to Balbieran, he sees the exchange rate averaging between P46.7/$1 to P47.3/$1 throughout the year.

Exchange rate, as a policy tool, is subject to the final decision of the Bangko Sentral ng Pilipinas (BSP) to intervene in the market, given its tendency to favor an appreciation rather than a weaker peso.

“It may be noted that the peso is the currency that depreciated the least among our neighbors over the last two to three years in their attempt to protect their exporters and domestic manufacturing sector. Thus, even if the feared contagion becomes bigger and influences a depreciation towards P48-P50/$1, we can reasonably expect that the BSP will intervene,” Balbieran said.

As of now, the Philippines is closely monitoring signals as to when and by how much the US Federal Reserve will hike interest rates, keeping rates near zero since the financial crisis in December 2008.

“By keeping it near zero, consumers will think it’s cheap to borrow money and increase consumption, like buy a car, which in turn will boost US economy,” Balbieran explained. — Rappler.com

$1=P46.51

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.