SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

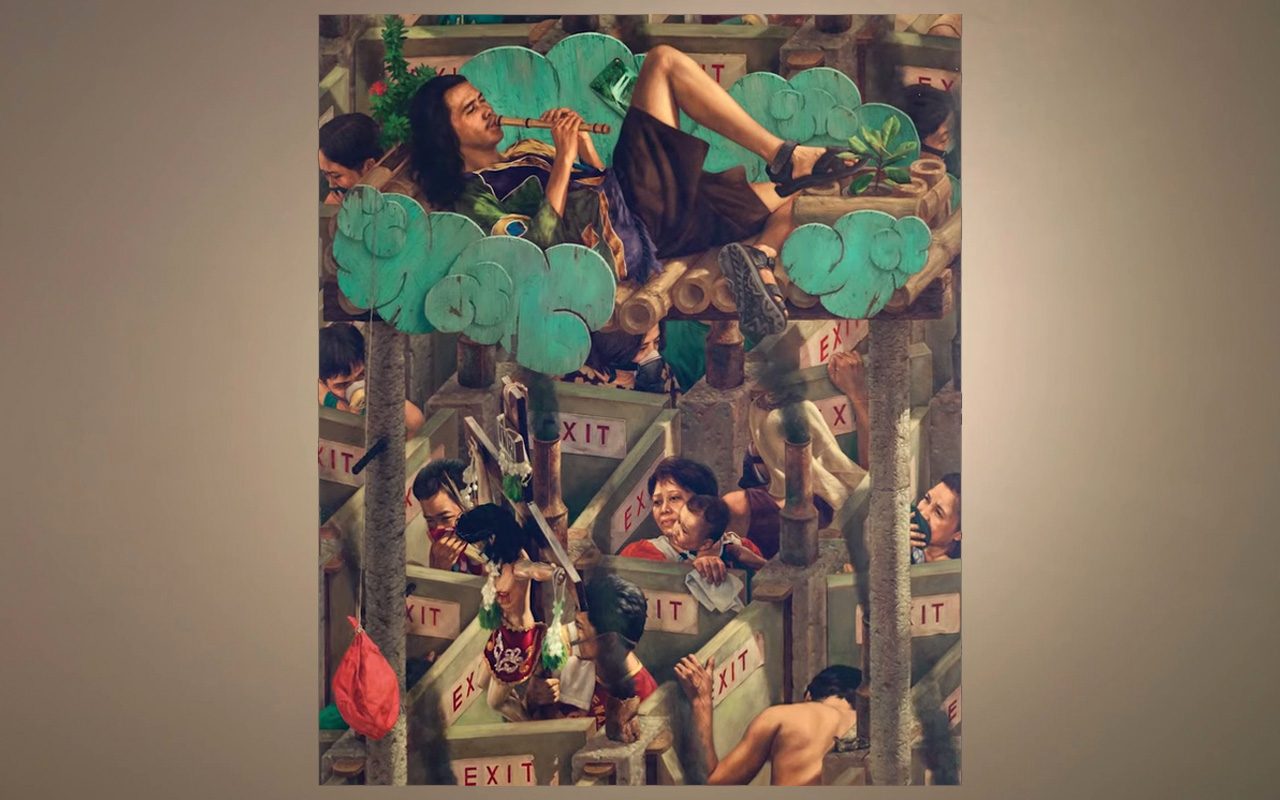

MANILA, Philippines – Alfredo Esquillo Jr’s “Eksit sa Itaas” (1998) had traveled the world before it made its way back to the Philippines, into the artist’s first solo exhibition, and into the hands of a former owner. In March, it fetched P2.4 million ($51,649.44) at an auction.

The masterpiece now hangs in the office of Januario Jesus Atencio III, chief executive of low-cost housing developer 8990 Holdings. It fits into a room filled with artworks by pioneer and present artists who are known to command higher prices in the market.

There are the likes of Atencio, avid collectors who buy a piece for the sheer pleasure of looking at it. They spend less time mulling monetary returns. If they unload art, they do so after a long time.

Sheer pleasure, serious money

When the financial world extended its reach outside securities and real estate, there came an art-investment market to speak of.

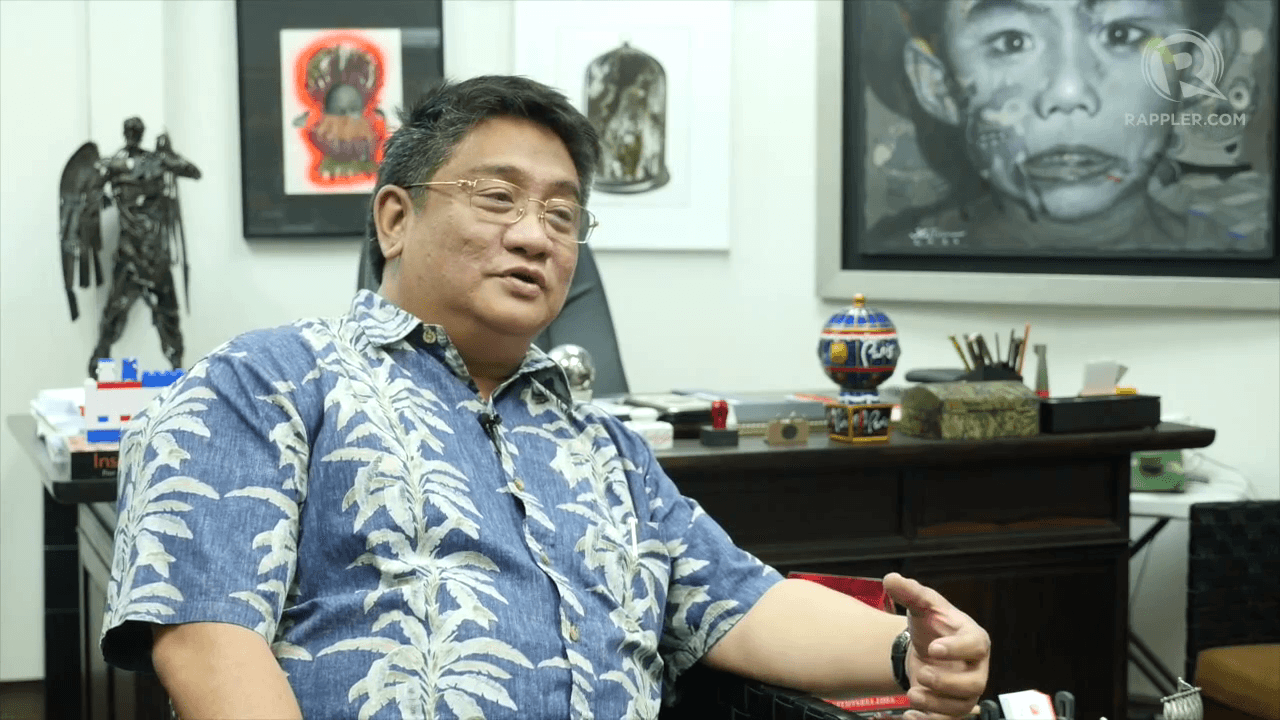

“In the almost 6 years we have been in existence, [we have] been approached by a lot of financial institutions, both local and international. Private banks for example,” said Ramon E.S. Lerma, chief adviser at Salcedo Auctions, which helped sell the Esquillo painting.

The remarkably booming art scene continues to encourage investors to bet on Philippine art.

The highest-performing Filipino work that went under the hammer, Hernando Ruiz Ocampo’s “Pagoda” (1967), fetched about P36 million ($774,918.71), including buyer’s premium also at Salcedo Auctions in March.

“The returns that one derives from acquiring and, at some stage, unloading art outpace a lot of more traditional investment [vehicles] as well as less traditional ones such as property or jewelry,” Lerma said.

“For the very important works, a 10% [annual net returns]. That’s standard,” he added.

There are the exceptional cases.

Take another H.R. Ocampo painting. Initially valued at P800,000 (P17,219.64), it increased to P5 million ($107,621.55) in a span of at least 5 years.

Ronald Ventura, whom Forbes Philippines hailed “the most expensive living artist in Philippine art,” used to sell his works under the P100,000 ($2,152.43) mark. After more than a decade, they are fetching between P5 million ($107,621.50) and over P10 million (P215,243) for certain scales.

Long-term strategy

There is a connection that one feels to an artwork from the get-go that one may not feel toward a company or a property.

Riel Hilario, curator at Pinto Art Museum in Antipolo, Rizal, referred to this as elective affinity.

“One should always start with collecting pieces that one enjoys. I think that’s a prerequisite,” Lerma quipped.

Sharing the same sentiment, Atencio said, “Before you can even successfully invest in art, I think you have to love art. I think that comes first.”

Yet, Lerma stressed that investment in art is like investment in securities or real estate. Knowing the fundamentals is key, especially if one is considering long-term value.

“One arrives at a certain level of aesthetic judgment from years of experience and exposure. Having studied the field for a very long time, being exposed to artists, knowing the scene, not just locally but internationally, help one in having an enhanced experience or appreciation of the works that are presented,” he said.

![AUCTIONEER. “In the almost 6 years we have been in existence, [we have] been approached by a lot of financial institutions, both local and international. Private banks for example,” says Ramon E.S. Lerma, chief adviser at Salcedo Auctions.](https://www.rappler.com/tachyon/r3-assets/8645BDB9043C4511857069E2C59573A0/img/528377DFF7C945C49E03FDB7401C83BB/investing-art-20150918-001.png)

For starters

First-time collectors or investors who are not familiar with Filipino art can seek knowledge and advice from the auction houses, collectives, galleries, and museums that exist in the country.

Since the terrain is complex and nuanced, there are factors that must always go into the selection of a piece.

Determining the place of the artist in the development of Philippine art is foremost. As Hilario put it, “you can invest in art by supporting the artist.”

It is also about understanding the story behind the piece – how far has it traveled in the world or in the country, and what insights does it offer about the way Filipinos live and how are these depicted?

The state of the economy, which is one of the most vibrant in Asia, is another consideration.

Certain perceptions of the local art by foreigners can also have direct effects on the buying prices.

Six to 8 years ago, many outsiders had started looking at the unexplored art and culture in Southeast Asia. As they demand for rare finds locally, they also drive prices up as the art market remains speculative.

Lerma advised investors and collectors alike to not be confined by certain media. He said people in Asia tend to appreciate and value paintings on canvas more.

“People have this certain notion that works of paper are more delicate, less impervious to the elements,” he pointed out. “But I think works on paper, when properly framed and stored, have a high value of appreciation as works on canvas.”

“The Scream,” for example, a pastel work on board from a Norwegian collection, is valued at $130 million.

Real returns

For collectors like Atencio, it takes a long time before they unload art.

For the businessman, whose stake in the economy is chiefly in the housing sector, most parts of his collection have been with him for over 20 years.

But when he does part with some pieces, it is to simply rotate the artworks. He lets go of a piece in hopes that another owner will, in turn, be grabbed by it.

“I think that the real joy and, therefore, the real profits – if you can call it – that come from investing in art is the process by which you are able to identify an artwork – that process of acquiring it, enjoying it, looking at it so it inspires you to do better in business – or that you actually agree with the idea that the artist wants to portray,” Atencio said.

As such, evaluating and appraising the value of the artwork is best left to the pros.

“These amounts are not things that are just fished out of thin air just so people will be enticed to come to an auction,” Lerma said. “It helps that there is a trusted source that can help determine the value and potential of the work.” – Rappler.com

Shadz Loresco is a freelance business writer for both online and print. Follow her on Twitter: @shadzloresco.

$1 = P46.46

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.