SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – A World Bank survey, whose results were announced on Wednesday, October 21, showed that 23 million adult acknowledge that their households run out of money for food and other necessary items either “sometimes” (29%) or “regularly” (26%).

The survey, entitled “Enhancing Financial Capability and Inclusion in the Philippines – A Demand-side Assessment,” showed that among those earning more than P50,000 ($1,076) a month, 23% said that they run short of money for basic necessities.

It also showed that 6 of 10 Filipinos or 59% said they plan how they spend the money they earn or receive.

Results further revealed that 57% of those who plan or budget their expenses said they have money left after paying for basic expenditures, compared to 42% of those who do not plan their spending.

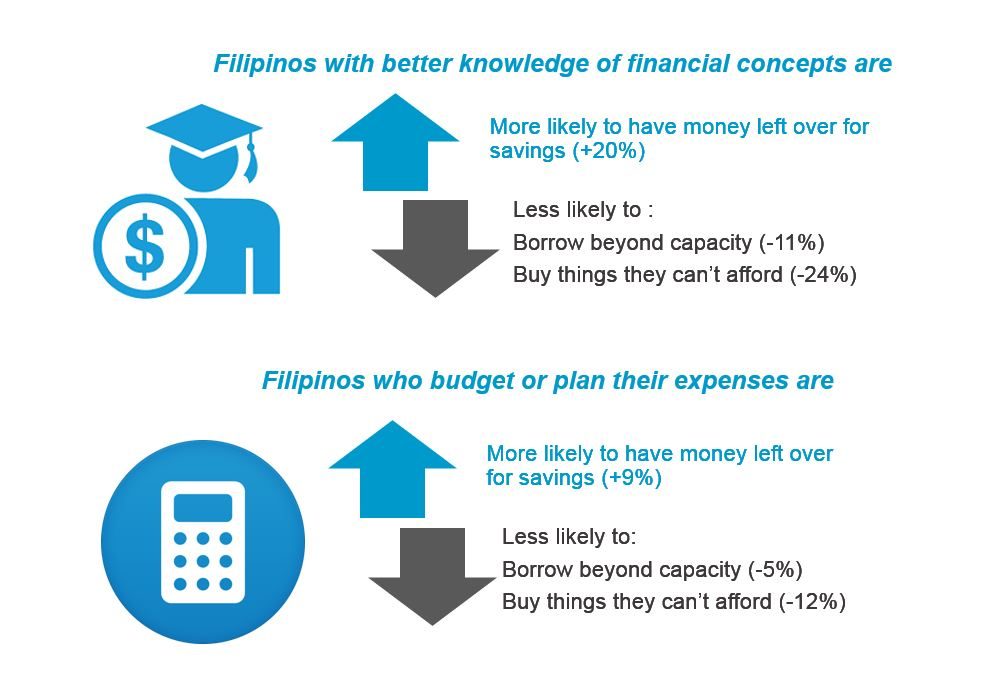

“The findings show that people who budget and know financial concepts better seem to be more likely to save and less likely to borrow beyond their limits and buy things they can’t afford,” said Nataliya Mylenko, World Bank senior financial sector specialist who supervised the survey.

Conducted from February to September 2014, the survey aimed to assess people’s financial literacy or capability in managing their day-to-day finances, as well as their access to formal financial institutions like banks.

It was the first survey of its kind conducted in the Philippines and will serve as a baseline for future studies on the subject.

The silver lining in the findings, the World Bank said, is that knowledge of financial matters directly relates to having money left after paying for basic necessities. There are also significant opportunities to be gained by expanding financial literacy and inclusion in the Philippines.

“The positive thing about the findings is that people can do something personally about it that is relatively easy,” she said.

Unbanked

Filipinos are also more likely to use informal credit and saving services than formal financial services. Only 4% of respondents reported having a mortgage, 5% have a credit card, and 10% used other credit products from a formal financial institution. (READ: Financial inclusion: Cornerstone of sustainable growth in Asia)

At the same time, more than a 3rd rely on informal savings and credit.

Among the households that reported they run short of money for basic necessities, the use of credit is near universal – 94% borrow to cover costs.

The survey also showed that about 20 million Filipino adults reported that they save money. But of this number, only 10 million have bank accounts.

The most commonly reported obstacles to owning bank accounts are:

- Not having enough money (20%)

- Lack of need for an account (18%)

- Lack of trust (17%)

- Distance (16%)

- Lack of documents (10%)

- “The bank doesn’t treat people well” (9%)

- High cost (9%)

“Almost all, 98%, of those who save but don’t have bank accounts earn less than P50,000 ($1,076) a month,” Mylenko added. (READ: More poor Filipinos own financial accounts – BSP)

Solutions on the horizon

The results, Mylenko said, indicate the need to develop financial products (like micro deposits) that meet the needs of consumers, particularly the lower-income groups.

The rise of financial technology or “fintech” companies offering innovative solutions such as paying through load has helped in this regard, Mylenko said, although its momentum has slowed in recent times due to many different options being offered.

Still, due to the logistical challenges that the archipelago presents, these fintech solutions remain the most feasible way to bridge the gap, she said.

Initiatives are also being made to address this on the national level, Mylenko pointed out, adding that the Bangko Sentral ng Pilipinas (BSP) launched the country’s national financial inclusion strategy in July of this year. (READ: PH 1st in financial inclusion in Asia, 3rd in world)

“This will be a very important platform for coordinating policy and programs for achieving greater financial inclusion and improving financial education,” she said.

Previously, each government department focused on different aspects of financial matters and now the efforts will have an overall direction, she said. This is crucial, as improving financial literacy does not only help with household savings but has a knock-on effect in the greater economy as well.

“If people have more knowledge about money matters, this can help them access financial services. Promoting financial literacy is therefore important to achieve greater financial inclusion and boost the growth of micro and small enterprises,” said World Bank Country Director Motoo Konishi. – Rappler.com

US$1 = P46.49

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.