SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

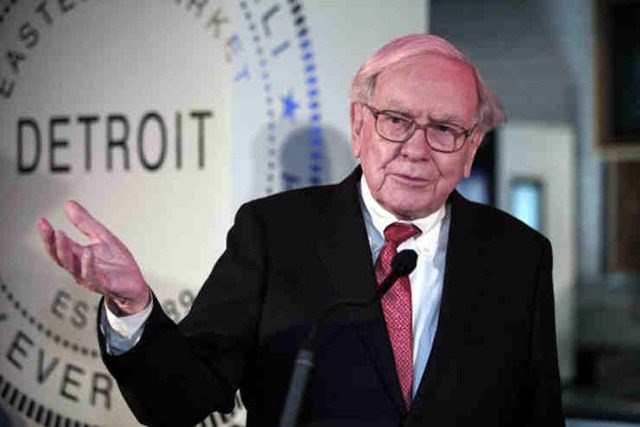

MANILA, Philippines – When a man worth $72.7 billion speaks, the whole word listens.

Acknowledged as the world’s most successful investor, Warren Buffett‘s investing strategy is often frowned upon simply because they are boring – until turbulent times happen like the volatility of global market.

Why not take solace from the man whose investing prowess has become legendary? Learning from the 3rd richest man in the world can be comforting.

Rule no. 1: Never lose money

Rule no. 2: Never forget rule no. 1

To be clear, Buffett had lost money. Even the greatest investor in the world goes through this. He lost $23 billion during the global financial crisis in 2008, and his firm Berkshire Hathaway lost its most revered AAA rating.

Buffett advises us to be informed when investing. He doesn’t want us to jump into the water without making sure the temperature’s fine. Research well and understand the investment you are about to venture in.

When investing, do proper and thorough research. People often overlook the risk management part, as most are focused on making money that they forgot that there is also a need to prevent losses.

Socks or stocks – Buy quality when marked down

Buffett advises us to buy when things are on sale – whether they are socks or stocks.

Why pay the full price when you can get a bargain? Take the 2008 global financial crisis: the stock prices of the largest listed companies in the country declined by half. This meant a 50% discount. But did their quality also decline by half? No.

In fact, the fundamentals of these listed firms remained solid – and even thrived in the years that came. This tip translated into profits and investors saw later on how undervalued these businesses were. For those who were brave enough to buy during that time, they tripled and even quadrupled the value of their holdings. (READ: 6 tips on stock investing by John Maxwell)

Be greedy when others are fearful (and vice versa)

Of all Buffett’s tips, this is the most popular and wisest.

Buffett advises investors to go against the herd. Herd mentality is common when the market reaches new heights.

When most people are buying stocks because they think prices will go even higher, that is when you have to be cautious. When the market has reached a euphoric stage, the point of maximum financial risk is also hit.

Remember that when things can’t seem to go wrong, that is when things will start to go wrong. When the market doesn’t seem to go down, that is when it will begin to go down.

On the flip side, just when there is no more hope for the stock market to rise, that is when financial opportunities are ubiquitous. If others are ready to throw in the towel and cut their losses, invest.

Buffett’s firm conviction that the stock market has always come out of crises is providential. The stock market runs in cycles. Deep corrections (or some would say crashes), like the one we are beset with, is part and parcel of being in the equities. It happened during the 1997-1998 Asian financial crisis, and during the 2008 global financial crisis. In both instances, stocks found a way to rally back up and hit new heights.

It’s not a question of if, but when. – Rappler.com

Got a question about personal finance? Tweet @rapplerdotcom or email us at business@rappler.com.

Kendrick Chua is a registered financial planner of RFP Philippines. He writes regularly about personal finance. He is also a Chinese language instructor, TV host, free runner, and violinist. To learn more about RFP, you may email info@rfp.ph.

Kendrick Chua is a registered financial planner of RFP Philippines. He writes regularly about personal finance. He is also a Chinese language instructor, TV host, free runner, and violinist. To learn more about RFP, you may email info@rfp.ph.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.