SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Overseas Filipino Workers (OFWs) pump in an enormous amount of money into the Philippine economy. But how are these remittances being put to use?

“We should make sure they are spent wisely,” said bestselling author, motivational speaker, and finance coach Randell Tiongson.

Tiongson, an advocate of financial literacy for OFWs 2004, said OFWs are in a difficult situation because they have to provide financial support to family members in the Philippines. “If the OFW fails to save enough money, they will come home after years of sacrificial work abroad with hardly any money or assets,” Tiongson said.

OFWs also lack job security. “An OFW can easily lose an employment contract just as fast as he gets one,” Tiongson said.

They are not also savvy enough to handle their finances. “Knowledge on investing and entrepreneurship is limited for many of the OFWs. Many of them lose hard-earned money to failed enterprises and even investment scams,” Tiongson added.

If OFWs become smarter about their money, they will save more, and this increase in savings will inevitably benefit the Philippine economy, Tiongson said.

“Financially-abled OFWs will be better and more stable productive members of society and their children will be guaranteed a brighter future,” Tiongson said.

Tiongson shares the following money-savvy tips for OFWs and their loved ones:

Avail of auto-debit programs. Because Filipinos earn more abroad than they would in the Philippines, there is the temptation to spend a lot more. This is problematic given that the cost of living is also generally higher in countries where there are high OFW populations.

To counter this, Tiongson said OFWs should commit to save part of their earnings through their bank. “For those who don’t have the discipline to save, go to the bank and enroll your accounts for auto-debit arrangements to help force you into saving,” he said.

The advice is also applicable when investing in mutual funds or Unit Investment Trust Funds (UITFs). Tiongson recommended enrolling these accounts into an auto-debit arrangement so that “you can build your investments on a more regular manner despite being away from the Philippines.”

Set a realistic budget for the whole family. Most of the time, an OFW sends remittances back to the Philippines in the hopes that the money will be put to good use. A realistic budget set for the whole family, according to Tiongson, would take much of the guesswork out of sending remittances.

“A good budget identifies needs and wants and emphasizing priorities on needs over wants is critical in their ability to save,” Tiongson said.

Tiongson also emphasized that it would be impractical to completely eliminate ‘wants’ from the equation.

Yet, a budget is only as good as how much you remain committed to it. Tiongson thus stressed the need to communicate proper money management to family members, no matter how difficult. Some of these can even be hard rules. “For instance, spending on non-essentials can only be made once money has been allocated and spent for necessities,” he said.

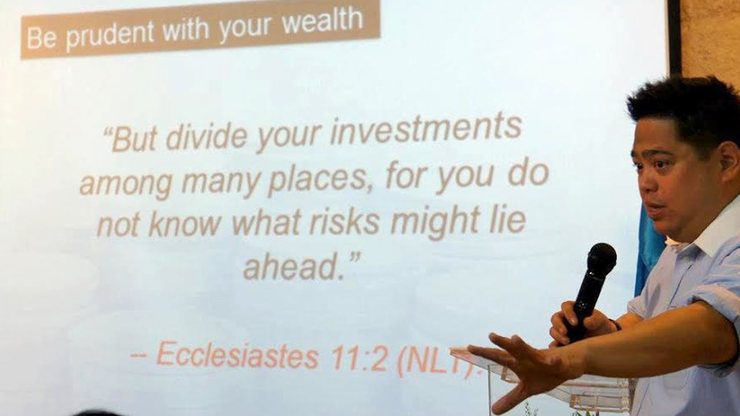

Start investing, no matter how small. When Tiongson gives investment advice to an OFW, he first carefully considers their investment objectives, risk tolerance, and time frame. Only then does he make appropriate recommendations, he said.

Still, Tiongson is not without broader recommendations, the first of which is that OFWs should begin investing, even if the initial amounts are small.

“Offhand, pooled funds like mutual funds and UITFs are good investment programs for the OFWs as they are simple to start with and fairly easy to understand,” he said.

Later on, OFWs can get into more complex investments like real estate, which Tiongson said is a good option for Filipinos looking for a passive income. They can rent out the property, even from abroad, since there are brokers who are always available and some condominiums even have an in-house property management for rentals.

Tiongson also encouraged entrepreneurship among OFWs, only when they have the knowledge base to compete in the particular industry. “Business can also be viable provided the OFW knows well enough the business he’s getting into and have trusted and competent people who will run the business in their absence,” he said.

Financial literacy outreach

As part of his advocacy, Tiongson is planning a finance conference for OFWs in the United Arab Emirates (UAE) in 2015, with a target of 500 attendees.

Tiongson said the success of the event will pave the way for similar programs in other countries with high concentration of OFWs, but he tends to focus on the social, rather than business, impact he can make.

“Providing them with quality seminars that go beyond motivation or selling to them will drastically enable the OFWs financially,” Tiongson said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.