SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Philex Minng Corp. swung to a net loss in 2012 due to the closure of its mine in Tuba, Benguet and a cut in the potential output of its oil exploration unit.

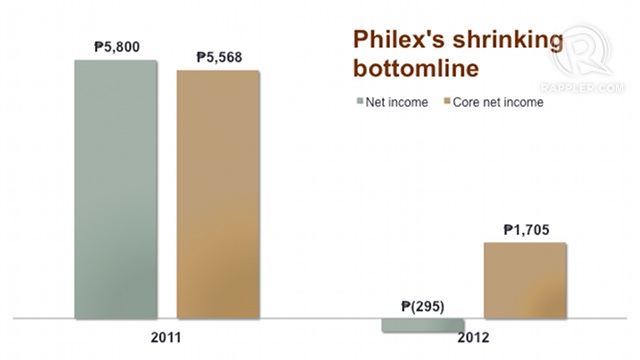

Philex, a unit of Hong Kong-based First Pacific Co. Ltd. led by businessman Manuel Pangilinan, booked a net loss of P294.63 million in 2012, reversing its P5.8 billion net income in 2011.

Padcal mine

The company’s bottom line was hit by a substantial decline in revenues from Padcal mine, which was ordered closed by government in August after one of its tailings ponds leaked.

Eroding the gains in 2012 were the funds set aside for the following:

- P1.034 billion for the Mining Act-related fines the government slapped on the company. (Philex paid this in full on February 18 to the Mines and Geosciences Bureau. Days before, or on February 12, Philex received US$25 million (about P1 billion) in claims settlement from its pollution legal liability insurance policy.)

- P413 million provision for the rehabilitation of mine spill-affected areas and upcoming penalties for assessed Clean Water Act violations.

Excluding these loss provisions, however, Philex recorded a core net income of P1.705 billion, down 69% from P5.57 billion in 2011.

“We are at a situation where we can regard Philex’s lower core income for the year as not entirely negative, considering the prolonged suspension of our Padcal operations,” Pangilinan, Chairman and CEO, said in a statement.

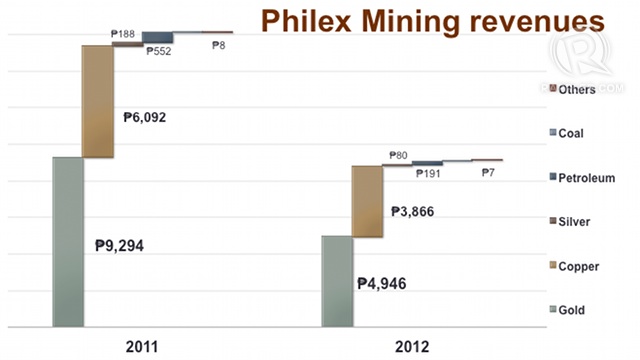

Philex’s operating income fell 57% to P3.35 billion in 2012 as Padcal came to a halt for almost the entire second half of the year.

Ore mined plunged to 5.5 million tons—71,297 ounces of gold and 22.3 million pounds of copper—from 9.5 million tons in 2011.

Writing off oil, coal assets

Losses incurred by 64.79%-owned subsidiary Philex Petroleum Corp. also weighed on earnings.

Philex Petroleum reported a net loss of P1.086 billion in 2012, versus a net income of P538 million in 2011. In a disclosure on February 22, Philex Petroleum said it wrote off P966.88 million in 2012, broken down as follows:

- P388.63 million of the investment made in an oil and gas project under Service Contract No. 40 (SC 40), which covers the north Cebu oil field, where it has a participating interest through unit Forum Energy Plc. The write off was based on a recent independent assessment of SC 40’s potential resources.

- P578.25 million of the assets in Brixton, a wholly-owned subsidiary that holds COC 130 (Coal Operating Contract) in Zamboanga Sibugay province.

Philex Petroleum is also engaged in the exploration of potential hydrocarbon resources in Service Contract 72 (SC 72), which covers the Recto Bank located in the disputed South China Sea (also West Philippine Sea).

No new mining contract

In 2012, First Pacific, which holds a 31.2% economic interest in Philex, gave the latter a loan worth up to US$200 million to fund its activities, including the exploration and development of the large-scale Silangan Project in Northern Mindanao.

The project covers the Boyongan and Bayugo deposits, which are currently under prefeasibility stage.

The no-new-mining-contract provision in the mining policy issued by the Aquino government in July (Executive Order 79) has added uncertainty to the Bayugo property. Bayugo does not have a Mineral Production Sharing Agreement (MPSA) yet with the government. The Boyongan property already has an MPSA.

New contracts will be issued only after Congress passes a law reforming the revenue-sharing scheme between government and mining companies.

Legislative work on the reform law is not a priority of the Aquino government.

Reopening of Padcal

For 2013, Pangilinan sees a rebound in the Philex’s group performance as soon as Padcal resumes operations.

“Since that regrettable tailings accident last August—where we immediately decided to shut down the mine—every effort has been made by Philex to remediate and rehabilitate the tailings pond and the affected areas, and restore operations and the environment to normalcy as quickly as we could.

“I believe we have gone a long way in the effort and that the performance of Philex will be restored,” he said.

On February 26, the government allowed Philex to reopen Padcal for up to 4 months to fill the void in its compromised tailings pond. Philex said this would prevent the pond from collapsing again.

“We have requested the MGB (Mines and Geosciences Bureau) to allow the mine to resume operations to fill the void left in the sinkhole, in order to beach the water away from the main embankment and ensure the stability of the overall tailings storage facility. Once Philex starts operations, things can be put back to normalcy,” said Eulalio Austin Jr., Philex President and COO.

The company needs the go signal of the Pollution Adjudication Board, apart from MGB’s, so it could resume operations. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.