SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Members of the House Makabayan bloc branded as “anti-poor” the Department of Finance’s (DOF) first package of tax reforms submitted to the 17th Congress.

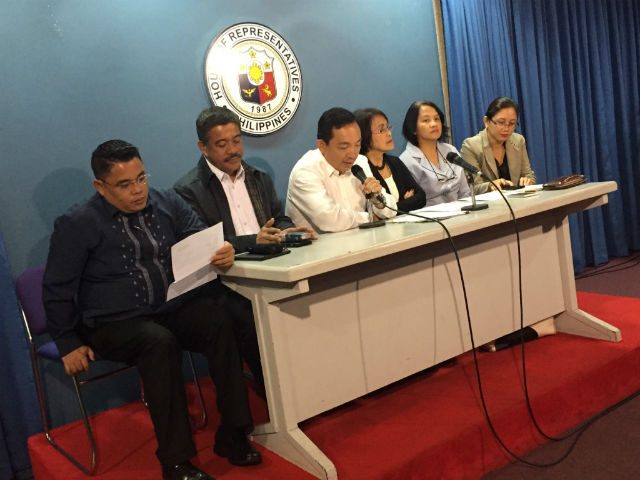

“The tax reform proposal of the Department of Finance is glaringly, very blatant anti-poor. And worse, very detrimental to the interest of our farmers, our workers,” Anakpawis Representative Arnel Casilao said in a press conference on Thursday, September 29.

The DOF’s first batch of proposed tax reforms includes the restructuring of the personal income tax system and the expansion of the value added tax (VAT) base by reducing the coverage of its exemptions.

The maximum rate of personal income tax will be reduced over time from the current 32% to 25%, except for high income earners.

But the DOF is proposing an increase on fuel excise tax and the restructuring of the excise tax on automobiles, except for buses, trucks, cargo vans, jeeps, jeepney substitutes, and special purpose vehicles.

The tax reform package also includes a proposal to exempt those earning less than P250,000 from tax payment.

The House committee on ways and means is expected to tackle the House bill that would incorporate the DOF’s proposal. Quirino Representative Dakila Cua, House committee chair, said they plan to review the tax reform package and file the measure within 10 days.

For ACT Teachers Representative Antonio Tinio, the proposed tax reform package remains a “burden” on ordinary Filipinos.

“So from 0% sa not over P250,000 na income annually, ang susunod na level na will be an income tax rate at 20% agad….Para sa akin, masyadong mabigat pa rin ang magiging income tax burden lalo na para sa mga lower- and middle-income earners, ‘yung mga ordinaryong empleyado,” he said.

(So from 0% for those earning not over P250,000 annual income, the next level of the tax rate is at 20%….For me, this remains a huge income tax burden for the lower- and middle-income earners, the ordinary employees.)

Bayan Muna Representative Carlos Isagani Zarate also said the tax exemption for those earning P250,000 annually should be increased to those earning P396,390 a year.

“Under our proposal House Bill 333, we use the amount of P396,390.00 as the minimum figure of tax exemption because this is the basic living salary needed by a family,” said Zarate, citing a study by Ibon Foundation.

‘Domino effect’

THE DOF estimated that the proposed tax reforms would cost the government P173.8 billion in foregone revenues, but it plans to offset the amount through potential gains from the following revenue-enhancing reforms:

- P200 billion from raising fuel excise tax

- P164.4 billion from broadening the tax base through VAT-based expansion

- P18 billion for an excise tax to be applied to sweets

- P33.8 billion from rationalizing fiscal incentives

Gabriela Women’s Party Representative Emmi De Jesus called the tax reform package as “anti-people” as it plans to remove some of the VAT exemptions enjoyed by senior citizens, persons with disabilities, and other sectors. (READ: Removal of seniors’ VAT exemptions ‘counter-productive’ – lawmakers)

Zarate also warned against the trickle-down effect of hiking taxes on fuel products.

“Alam naman nating itong domino effect nitong diesel [na] P6. ‘Pag pinatong mo ‘yan kada litro, talagang magka-cascade ‘yung epekto sa mamamayan,” he said.

(We know the domino effect of imposing this tax on diesel. If we impose that per liter, the effect will cascade down to the citizens.)

How about tax collection efficiency?

Speaker Pantaleon Alvarez also expressed some reservations on the DOF’s tax reform package as well., saying its proposed bill failed to address the problem of tax collection efficiency.

“Napansin ko naman kahapon, wala namang provision doon na mag-aadres doon sa efficiency doon sa tax collection. Dapat bigyan din natin ng [pansin ito at] tutukan din natin iyan dahil maraming nasasayang. Marami ring nakaka-evade ng tamang pagbayad ng buwis. Wala akong nakitang probisyon na ganoon,” said Alvarez.

(I noticed yesterday that there was no provision on the efficiency of tax collection. We should closely watch this because a huge amount is lost. Many also evade tax [ayment. I didn’t see provisions on these issues.)

For his part, Alvarez reassured the public that the House would scrutinize the DOF’s proposal and that it would remove provisions that would hinder the improvement of Filipinos’ lives.

“‘Yung House of Representatives pala, hindi po ito magiging rubber-stamp ng administrasyon (The House of Representatives will not be a rubber-stamp of the administration),” he said.

“I said before na rest assured na kami po ay magiging (that we will) always be on the side of the people. Hindi po natin papayagan na itong mga ganitong panukala ay aming palulusutin dito sa House of Representatives (We will not allow bills like this to get past the House of Representatives),” said Alvarez, referring to measures that would not improve people’s lives, in general. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.