SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – What do 4 columnists of competing Philippine newspapers have in common? Their columns on the sin tax bill pending in the Senate bear similar content and form — all critical of Sen Franklin Drilon and his move to push for higher taxes on cigarettes and alcohol.

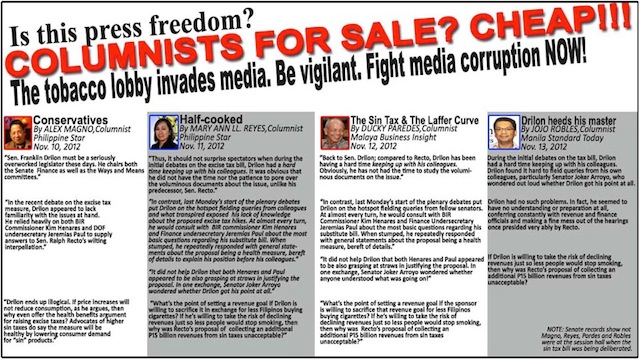

Columnists Alex Magno (Philippine Star), Ducky Paredes (Malaya Business Insight), Jojo Robles (Manila Standard Today), and Mary Ann Reyes (Philippine Star) have come under fire online after a poster showing their similar anti-sin tax columns circulated on Facebook.

The columns, which were published in succession from Saturday, November 10, to Tuesday, November 13, are critical of Drilon, who became the acting chairman of the Senate Ways and Means committee after Sen Ralph Recto resigned from the post. Recto quit following criticism of the latter’s “watered-down” committee report that placed revenues at P15 billion to P20 billion. Lobbyists for higher sin taxes have accused Recto of toeing the line of cigarette and alcohol companies, a claim he has repeatedly denied.

The government originally aimed to raise at most P60-B in tax revenues from the bill, though officials are now saying P40-B would be acceptable.

Bearing similar lines and ideas, the 4 columns portrayed Drilon as an ill-prepared and incompetent chairman compared to Recto.

As of Wednesday 3 pm, November 14, the columns were still on the media outfits’ respective websites, thus making it easy for readers to check the authenticity of the images in the poster that’s been shared on social media.

Senate records showed that the columnists were not present during the hearings, but their columns gave the impression that they were there.

In the columns, Drilon was portrayed as an ill-equipped leader of the committee handling deliberations on the bill, and who had to constantly consult Bureau of Internal Revenue Kim Henares and Department of Finance Undersecretary Jeremias Paul for details. The columnists compared him to Recto, who was described in the columns as more knowledgeable of the issue.

Philippine Star columnist Alex Magno, in his November 10 column titled “Conservatives,” wrote that Drilon “must be a seriously overworked legislator” due to pressures from being the chair of both the Senate Finance and the Ways and Means committees.

Similar observations were made by Magno’s fellow Philippine Star columnist Mary Ann Reyes in her November 11 column titled “Half-cooked,” as well as by Paredes in his November 12 column “The Sin Tax and the Laffer Curve,” and Robles in his November 13 column “Drilon heeds his master.”

For example, Reyes, Paredes, and Robles used exactly the same line in describing how Drilon performed in one deliberation. All 3 wrote that Drilon “had a hard time keeping up with his colleagues” during the debates on the bill.

Reyes and Paredes both used the phrase “voluminous documents” in their articles.

Reyes wrote:

“And with his new role as acting chairman of the Committee on Ways and Means, he has the responsibility of coming up with a fair measure that would impose excise tax rate increases on tobacco and alcohol products.

These tasks are overwhelming even for a veteran legislator like Drilon.

Thus, it should not surprise spectators when during the initial debates on the excise tax bill, Drilon had a hard time keeping up with his colleagues. It was obvious that he did not have the time nor the patience to pore over the voluminous documents about the issue, unlike his predecessor, Sen. Ralph Recto.”

Paredes wrote:

Thus, Senator Drilon now has his hands full chairing two powerful committees—the Committee on Finance and on Ways and Means.

As head of the finance committee, he has the urgent task of swiftly steering to passage the 2013 General Appropriations bill with a little over a month to go before the Senate shifts to campaign mode for next year’s midterm elections. For his new role as acting chairman of the committee on ways and means, he has the responsibility of coming up with a fair measure that would impose excise tax rate increases on tobacco and alcohol products.

And in a later paragraph:

Back to Sen. Drilon. Compared to Recto, Drilon has been having a hard time keeping up with his colleagues. Obviously, he has not had the time to study the voluminous documents on the issue.

Robles wrote:

“Drilon became chairman of the Senate ways and means committee once headed by Senator Ralph Recto, who gave it up in reaction to intense pressure from Malacañang. Recto had studied the sin tax measure well and was inadvertently giving President Noynoy Aquino’s finance and health officials—who couldn’t get their acts together on whether the issue was revenue or health—a tough time.

Drilon had no such problems. In fact, he seemed to have no understanding or preparation at all, conferring constantly with revenue and finance officials and making a fine mess out of the hearings once presided very ably by Recto.

During the initial debates on the tax bill, Drilon had a hard time keeping up with his colleagues. Drilon found it hard to field queries from his own colleagues, particularly Senator Joker Arroyo, who wondered out loud whether Drilon got his point at all.”

Same paragraphs

Some portions of Reyes’ and Paredes’ columns even bore the exact same paragraphs.

Reyes wrote:

“In contrast, last Monday’s start of the plenary debates put Drilon on the hotspot fielding queries from colleagues and what transpired exposed his lack of knowledge about the proposed excise tax hikes. At almost every turn, he would consult with Bureau of Internal Revenue (BIR) commissioner Kim Henares and Finance undersecretary Jeremias Paul about the most basic questions regarding his substitute bill. When stumped, he repeatedly responded with general statements about the proposal being a health measure, bereft of details to explain his position before his colleagues.”

“It did not help Drilon that both Henares and Paul appeared to be also grasping at straws in justifying the proposal. In one exchange, Senator Joker Arroyo wondered whether Drilon got his point at all.”

On the other hand, Paredes wrote in his column that came out a day after Reyes’:

“In contrast, last Monday’s start of the plenary debates put Drilon on the hotspot fielding queries from fellow senators. At almost every turn, he would consult with Bureau of Internal Revenue (BIR) Commissioner Kim Henares and Finance Undersecretary Jeremias Paul about the most basic questions regarding his substitute bill. When stumped, he repeatedly responded with general statements about the proposal being a health measure, bereft of details.”

“It did not help Drilon that both Henares and Paul appeared to be also grasping at straws in justifying the proposal. In one exchange, Senator Joker Arroyo wondered whether anyone understood what was going on!”

‘I can’t explain it’

Asked to explain, Paredes said he’s not aware that his column bears resemblance to the work of other columnists.

“I cannot explain it. I am not copying anybody. I usually write on my own,” he told Rappler in a phone interview.

“I don’t read other columns. I don’t copy other columns. I don’t know what you’re talking about,” he added.

Magno for his part refused to comment, saying he has not seen the image that’s been shared on Facebook.

“No reaction. I haven’t seen the ano,” he said. Pressed further, Magno, who was coughing all throughout the phone interview, said that he was having a hard time speaking.

“Sorry wala akong boses e (Sorry I don’t have a voice),” he said.

Paredes cried foul over accusations of media corruption.

“You are accusing me of being biased and I don’t think that’s fair,” he said.

Golf buddies

Reyes refused to comment on why Paredes’ column contained the exact same sentences as hers and why Magno’s and Robles’ columns were similar in content. She said they’re all her friends.

All 4 of them belong to the same circle of journalists “who regularly play golf together,” Reyes said, and because of that, get to share materials with each other.

“We belong to the same group. We sometimes share documents. It’s possible that if you do that, you also raise the same points,” she said.

“It’s not uncommon that the columnists sometimes share or raise the same points because it’s also possible that you read or share his opinion without plagiarizing. It’s also possible you believe in what he writes about,” she added.

Reyes also questioned the motivations of those who circulated the image.

“I’m just concerned about the motivation about of the people who are trying to raise this. If they’re saying that there’s a tobacco lobby, there’s also an anti-tobacco lobby and we all know that. And I’ve also encountered materials,” she said.

“As columnists, we have to make a stand. I hope they also respect our opinions,” she said.

Rappler tried to get in contact with Robles but failed.

The better man?

In the columns, Recto was described as the exact opposite of Drilon. Paredes wrote that Recto’s report was “realistic, reasonable and responsible” while Reyes said the senator “was ready with tough, probing questions.”

Robles wrote that Drilon made “a fine mess out of the hearings once presided very ably by Recto” while Paredes said that although he had no idea “whether or not Senator Recto was in league with any lobbyists,” he agreed with him “that prior to any increase in taxes, one has to understand the Laffer Curve,” an economic theory that shows the relationship between government revenue from tax and taxation rates.

All 4 columnists also raised issues about the value of the sin tax bill as a health measure.

Magno wrote that Drilon “ends up illogical” because the senator claimed that the price increases will not reduce consumption. On the other hand, Reyes, Paredes and Robles questioned why Recto’s proposal to collect P15 billion in revenues was deemed unacceptable when Drilon was willing to hike up prices in exchange for declining revenues just so people would stop smoking.

The columns have sparked online outrage, with netizens saying that the lobbyists against the passage of the sin tax bill have invaded mainstream media.

Is this a case of plagiarism or lobby money at work? @sintaxph #SinTax twitter.com/FakeJakeShakes…

— Jake Idris Codeniera (@FakeJakeShakes) November 13, 2012

Sintax.ph, a group advocating the passage of the sin tax bill, has been distributing the poster through their social media accounts.

@rapplerdotcom What’s happened to PH journalism that this could happen–and that we’re letting them get away with it? sintax.ph/?p=295

— Pass Sin Tax Bill (@sintaxph) November 14, 2012

Drilon’s chief of staff, Oscar Yabes, said that he had planned on writing to the editors of the broadsheets where the columns were published for the inaccurate portrayal of Drilon’s performance as chairman.

“I don’t have the authority to speak on the issue, but if the articles had the same points, maybe, just maybe, it shows that they don’t have the [essential facts about the bill],” Yabes said.

It is no secret that the failure to legislate a sin tax law in the country is rooted in a strong industry lobby.

When House passed its version of the sin tax bill, which projected government revenues of P31 billion to P33 billion, the event marked the first time in more than 15 years that a sin tax bill made it beyond committee level.

The anti-tobacco lobby has likewise been strong, aggressive and well-funded.

The sin tax bill is one of President Benigno Aquino III’s priority bills. It has been tapped to help finance the universal healthcare program. –Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.