SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines (UPDATED) – The Court of Tax Appeals (CTA) has approved the motion of Jeane Napoles, who is facing a P17-million tax evasion case, to be allowed to travel to Bali, Indonesia, for a 7-day trip.

The younger Napoles, daughter of suspected pork barrel scam mastermind Janet Napoles, is out on a P50,000 bail. She has secured a waiver from the court to not appear in her hearings, which resumed on Wednesday, March 22.

(Editor’s note: We earlier called the 7-day trip a “vacation.” But the CTA website does not describe the trip as a vacation; it just said it approved on March 15 Napoles’ 7-day trip that will happen on April 22-29. We regret the error)

Her lawyer indicated their plans to exhaust all legal means to have the charges dropped.

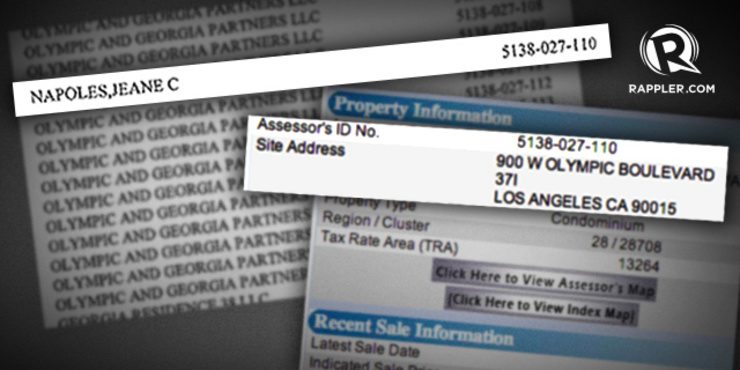

Jeane is facing the tax charges for her ownership of a luxurious apartment in Los Angeles, California, worth P54.73 million (about $1.2 million) and co-ownership of two farm lots in Pangasinan worth P1.49 million (about $35,000). (READ: Napoles daughter owns P80-M LA property)

The Bureau of Internal Revenue (BIR) said Jeane did not file any income tax from 2011-2012 that would match her ownership of the properties. BIR said Jeane also did not declare the properties as gifts.

Her parents, Janet and Jaime Napoles, already filed a counter-affidavit saying their daughter acquired those properties only as a gift. (READ: Napoles couple on tax evasion: Blame us, not Jeane)

The prosecution on Wedneday presented as witness Florante Aninag, former district officer of the Pasig branch of BIR, where Jeane is registered as a taxpayer.

Aninag testified that Jeane acquired her Tax Identification Number (TIN) in November 2008.

Napoles’ lawyer Ian Encarnacion cross-examined Aninag to re-establish their defense that Jeane had no source of income and therefore could not be held liable for tax evasion.

Encarnacion said a person as young as 7 years old can acquire a TIN by virtue of Executive Order (EO) 98, which allows the registration of a one-time taxpayer. “She wanted to get a TIN because she applied for a driver’s license,” Encarnacion said.

Encarnacion insisted that Jeane has had no sufficient source of income, and is, in fact, unemployed to this day.

Encarnacion said he had moved for the prosecution to rest their case, but the court allowed them to present two more witnesses. Hearing will resume on May 10.

Encarnacion took over Jeane’s case after Stephen David bowed out.

David’s wife Lanee David was appointed deputy commissioner of the BIR by President Rodrigo Duterte. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.