SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The House of Representatives started debates on House Bill Number 5636, the measure containing the first batch of tax reforms being proposed by the administration of President Rodrigo Duterte.

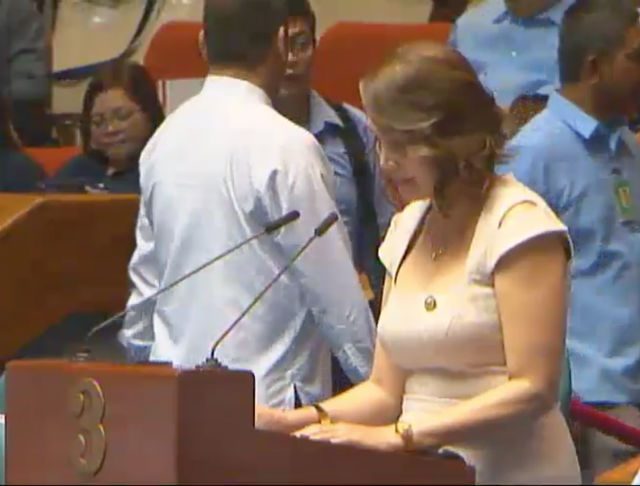

As House ways and means committee chairperson, Quirino Representative Dakila Cua sponsored the bill for 2nd reading on Tuesday, May 23. Nueva Ecija 1st District Representative Estrellita Suansing also delivered her sponsorship speech for sugar-sweetened beverage taxes.

Here is the full text of Suansing’s speech as provided by her office.

***

Mr Speaker, honorable colleagues, I rise today to sponsor House Bill Number 5636, othewise known as the Tax Reform for Acceleration and Inclusion, which is envisioned to enhance progressivity of our tax system through the rationalization of the internal revenue system. I would like to specifically sponsor the proposed excise tax on sugar-sweetened beverages, which should be holistically viewed as a health measure more than a tax measure. There have been numerous studies that link the intake of excessive sugar with overweight and obesity. In the Philippines, the upward trend in the incidence of obesity, diabetes, and other non-communicable diseases is very evident.

Under the proposed bill, an excise tax of P10 for every liter of sugar-sweetened beverage shall be levied to curb the consumption and promote the intake of healthier beverage products. As that old saying goes, “An ounce of prevention is worth a pound of cure.” Based on estimates of the Department of Finance, the government is expected to gain ove P47 billion annually from the collection of this tax.

Under the proposed bill, 15% of the tax to be collected shall be earmarked to benefit the sugar farmers and advance their self-reliance through projects that will improve their productivity, offer alternative sources of livelihood and farming systems, and, ultimately, uplift their living conditions. The entire 85% shall accrue to the General Fund to support the efforts of the Department of Health in operationalizing and monitoring of non-tax measures that will prevent non-communicable diseases, including advocacy measures that will curb lifestyle-related risk factors.

This tax measure will likewise provide sports facilities and access to potable drinking water in public schools throughout the country. Do we not want sports facilities in our public schools that will enhance our youth’s analytical thinking, build their character, and develop their leadership qualities?

More importantly, proceeds of this tax will allow the expansion and development of our school-based feeding program, which will ultimately eliminate poverty and malnutrition that impair childhood development. Programs on obseity, overweight, and dental caries are to be launched using funds generated from the SSB tax. Many of us may not know, but excessive intake of sugar-sweetened beverage is a leading cause of dental caries and tooth decay, and, in the Philippines, 97% of our school age children are affected by tooth decay, according to the National Oral Health Survey.

The SSB tax shall likewise provide for access to potable drinking water in public places. It is said that the Philippines is very rich in water resource. Ironically, we do not have the facilities that will provide free potable drinking water in public places. And finally, Mr Speaker, the SSB tax will provide for proper nutrition labelling to ensure the safety, efficacy, and quality of health products as defined in the Food and Administration Act of 2009.

Mr Speaker, distinguished colleagues, this measure is a bold step that will jumpstart the promotion of a healthier lifestyle and redound to the introduction of other non-tax measures that will practically rein in the incidence of overweight, obesity, and diabetes in the country. With this proposed law, the government can fast track the country’s development agenda and ensure that the fruits of economic progress trickle down to the poorest of the poor and the marginalized sectors.

We are elected legislators tasked to provide our people with laws that will ensure their well-being, welfare, security, and health. It is our duty to transform our society into a cohesive force that will lead our people to a better tomorrow. As that great Champion of the Masses by the name of Ramon Magsaysay once said, “Those who have less in life should have more in law.” Scholars have always noted that history belongs not to the many who stubbornly refuse to yield to change, but to the few who dare cross the threshold towards progress. I fervently hope that we will also contribute in improving the tax reform package and agree that taxes will energize the engines of growth and fuel economic development.

Mr Speaker, I seek the support of this estimable chamber for the immediate passage of the whole Tax Reform for Acceleration and Inclusion without alteration to proposed economic reforms so that the government can introduce meaningful social and cultural transformations designed to uplift the living conditions of our people.

Thank you, Mr Speaker. Thank you, honorable colleagues! – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.