SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Senate and the House of Representatives on Wednesday, December 13, ratified the bicameral conference committee report on the Tax Reform for Acceleration and Inclusion (TRAIN) bill, seeking to cut income taxes but adding levy on fuel, cars, mining, coal, and tobacco.

The bill will now be sent to President Rodrigo Duterte for signing into law. Once signed, the measure is set to be implemented by January 1, 2018.

In the House, no questions were asked before ratification, so the process took only one minute. ACT Teachers Representative Antonio Tinio tried to object due to lack of quorum but was not recognized by House Deputy Speaker Raneo Abu.

In a statement, Tinio denounced the TRAIN ratification as “a total farce and travesty of so-called representative democracy.”

“With barely 10 people on the floor and despite my very clear objections due to obvious lack of quorum, the presiding officer and majority floor leader proceeded to adopt the final report of the tax reform bill’s bicameral conference committee, copies of which were not even on hand,” he continued.

“Since there was no quorum and no actual vote was taken, the alleged ratification is clearly invalid. The brazen railroading of this TRAIN wreck on the poor exposes yet again the blatant disregard of the Duterte administration and its supermajority in Congress for even the most minimal standards of democracy.”

The opposite happened in the Senate, where senators Panfilo Lacson and Paolo Benigno Aquino IV objected to the motion to ratify the final version of the bill. In the end, with a vote of 16-4, the chamber ratified the bicam report. Only Lacson, Aquino, Risa Hontiveros, and Antonio Trillanes IV voted no.

There was also last-minute confusion involving the bicam report, after it was found that the House supposedly inserted a provision retaining the value-added tax (VAT) exemptions of locally produced coal, contrary to what the joint panel earlier approved. There were reportedly two bicam reports circulated to lawmakers.

The bicam agreed to increase the excise tax on coal from P10 to P50 for 2018, P100 for 2019, and P150 for 2020.

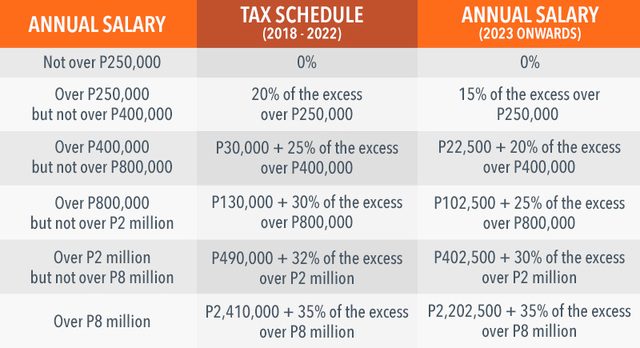

As for income taxes, lawmakers agreed to exempt from tax the first P250,000 annual income of Filipinos, whether compensation earners or self-employed, to increase their take-home pay starting January 1, 2018. This means those earning around P21,000 a month would no longer need to pay income taxes.

Fuel, sugar-sweetened drinks

To compensate for the loss of revenue, Congress decided to increase taxes on fuels such as gasoline, diesel, and liquefied petroleum gas (LPG), among others. This means higher prices for such commodities.

Diesel, which at present has no tax, would be imposed P2.50 per liter in 2018, P4.50 in 2019, and P6 in 2020.

LPG would have a tax of P1 in 2018, P2 in 2019, and P3 in 2020.

For gasoline, from the current tax of P4.35 per liter, it would be imposed a levy of P7 in 2018, P9 in 2019, and P10 in 2020.

For 2018, aviation gas would be taxed P4 per liter; asphalts P8 per kilogram; kerosene P3; naphtha P7; bunker fuel P2.50; lubricating oil P8; paraffin wax P8; and petcoke P2.50.

All petroleum products used as input, feedstock, raw materials for petrochem, and refining or as replacement fuel are tax-exempt.

Legislators also agreed to impose a tax of P6 per liter on drinks using sugar and artificial sweeteners and P12 on drinks using high fructose corn syrup. Milk and instant coffee are exempted.

Sin tax

The joint panel also decided to increase the prices of tobacco by 2018 despite the absence of this provision in both the Senate and House versions.

Under the existing sin tax law passed in 2012, the tax rate for next year would be P31.20.

But if TRAIN is signed into law, this would increase to P32.50 for the first 6 months of 2018 (January 1 to June 30).

It would then increase to P35 from July 1, 2018 to December 31, 2019.

A tax of P37.50 would then be imposed from 2020 to 2021; P40 by P2022 to P2023; and a 4% annual increase after that.

Cars, mining, cosmetic surgery

The bicam also approved a 4-tier tax scheme for automobiles:

- 4% for up to P600,000

- 10% for over P600,000 to P1 million

- 20% for over P1 million up to P4 million

- 50% for over P4 million

All pick-up trucks and electric vehicles would be exempted from additional taxes.

Hybrid cars would be imposed half the taxes as non-hybrid vehicles.

Congress also decided to impose a 5% levy on cosmetic surgeries and to double taxes on mining.

The target revenue from the first package of the tax reform bill is P130 billion. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.