SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

From financial documents relating to the Coronas thus far presented, the following can be established:

- First, that both the Chief Justice (CJ) and his wife Cristina did not have other sources of income as they did not file their ITRs. Their incomes were reported solely under the Alpha Listings of the Supreme Court and John Hay, respectively.

- Second, while CJ reported in his various Statements of Assets, Liabilities, and Net Worth (SALNs) since 2003 Cristina’s business interest in Basa-Guidote Enterprises, Cristina apparently was not receiving any compensation from this family business.

- Third, based on a breakdown of a sample Alpha listing of the Supreme Court, and given the specific case mentioned, the CJ’s total compensation appeared all inclusive since it included both taxable and non-taxable items such as bonuses and RATA etc.

The figures stand alone. Spouses CJ and Cristina had no other sources of income from employment.

Failure to report

In the January 26 hearing, it came out that Cristina’s fees as director in the total amount of P1.4-M over the same 5-year period (from 2006-2010) were just subjected to the 10% Expanded Withholding Taxes. As indicated by Internal Revenue Commissioner Kim Henares, Cristina should have filed separate yearly ITRs for the proper tax payments on these director’s fees. Assuming she was at the 32% bracket, Cristina should have paid another P311,000 for a total of P451,000 — and not just the 10% tax withheld equivalent to P140,000.

During the same January 26 hearing, it was also mentioned that there could be other sources of income that are not reported in the ITRs since these could have been subjected to final tax. For example, there could be income from sale of property or liquidation of investments in listed shares. Perhaps so. If there were, these properties or listed investments must be among those reported in the SALNs. The burden of proof is on them, as formally ruled — ironically by CJ Corona himself.

Cristina earned 63% more than her husband during the 5-year period: P4.63-M against CJ’s P2.84-M. It appears that Cristina’s position at John Hay was financially significant for the family, considering that based on reports she was receiving much more than her spouse. Their combined income for the 5 years amounted to P7.47-M or an average annual income of P1.49-M.

Alpha Lists & the SALNs

Comparing the newly revealed income and tax returns with the SALNs, the figures should speak for themselves under universally accepted accounting principles. As they do, the disparity between lower-income levels vis-à-vis bigger increments in net worth shows that there were misrepresentations in the SALNs, filed under oath by no less than one who is expected to be the “epitome of truth,” the Chief Justice of the land.

These findings can add up to other articles of impeachment to include the non-declaration of some real estate properties. All these can support the prosecution’s claim that there is a preponderance of evidence leading to “betrayal of public trust.”

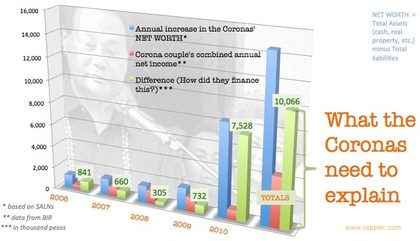

Analyzing their income for the 5-year period 2006 to 2010, incremental increases in yearly income are discernible: by P1.2-M in 2006, and subsequently by P1.5-M in 2007, then another P1.5-M in 2008; by P2-M in 2009, and finally by P8.38-M in 2010 (see infographic).

These increases require explanation from the Coronas especially because their combined net income also increased each year.

In sum, while net worth increased by P14.58-M during this period, combined net income amounted to only P 4.51-M, a huge difference of P10-M. Definitely, this difference needs explanation as well.

Normal living expenses

This difference will become bigger if we decrease the yearly combined income by the normal expenses of a regular Filipino family such as electricity, water, food, etc. How much can these be for the Coronas: P50,000 per month, (or P600,000 a year)? P100,000 per month, (or P1.2-M per year)? It all depends on their lifestyle. Again, these normal living expenses have not yet been accounted for.

Furthermore, there were identified cash flows that have to be “audit trailed.” What were the sources of the reported capital gains tax paid on the La Vista property in the amount of about P1.2-M? How was the P18-M sale price transacted?

From an accounting point of view, how was this sale treated, given that they bought the lot at a lower amount of P11-M, (apparently borrowed from Basa-Guidote). They then reported it in their SALN for only P3-M, sold the property at P18-M, and paid capital gains tax at a zonal value of P20.4-M. (This is based on the report that the capital gains tax paid was P1.22-M. If so, this is consistent wtih the actual zonal price of P17,000 per square meter, the prevailing price of lots in La Vista in 2010.)

Possible conclusions

- The earning capacity of spouses Corona cannot and will not support the substantial net worth they have accumulated, especially given the specifics of what they have so far disclosed in their SALNs and identified sources of income.

- With the substantial disparity at face value of their accounting figures — a much lower income level vis-à-vis bigger increments in net worth — CJ Corona appears to have misrepresented under oath the value of his assets, liabilities, and net worth.

CJ Panganiban has a good discussion on the position of public trust in his recent newspaper column in the Inquirer. The position is not a right but a privilege; an honor vested by the people. If there is loss of confidence, the people through both Congresses should impeach the person entrusted. The accounting numbers speak for themselves.

A lingering question that needs a reply: was there misrepresentation by the Chief Justice? – Rappler.com

The author is former chair of the Philippine National Railways. Other former positions he held include: president/CEO of Philippine Deposit Insurance Corp (PDIC); president/CEO of Philippine Banking Corp; director/treasurer of Philippine Stock Exchange; chair of Philippine National Bank. He has over 30 years experience as a commercial/investment banker mostly with Citibank. He also shared this analysis with the prosecution.

Click on the links below for more of Rappler’s special coverage of CJ Corona’s trial.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.