SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

AT A GLANCE

- The economy hibernates for the sake of public health, but the freeze triggers a chain reaction from job losses to business closures.

- Government intervention in private businesses is badly needed, but the bigger role may also result in more populism.

- Investing after the pandemic will be tricky and yields may not be as enticing as before.

MANILA, Philippines – The coronavirus pandemic has forced governments to freeze economic activity to save lives.

Lockdowns, along with mass testing, have been effective in taming the infection curve. But the trade off for better health is a painful global recession.

But economists pointed out that it should not be the concern of countries right now. In fact, a contraction may be necessary.

“The recession, so to speak, is a necessary public health measure,” said Richard Baldwin and Beatrice Weder di Mauro in a paper published by the Center for Economic Policy Research.

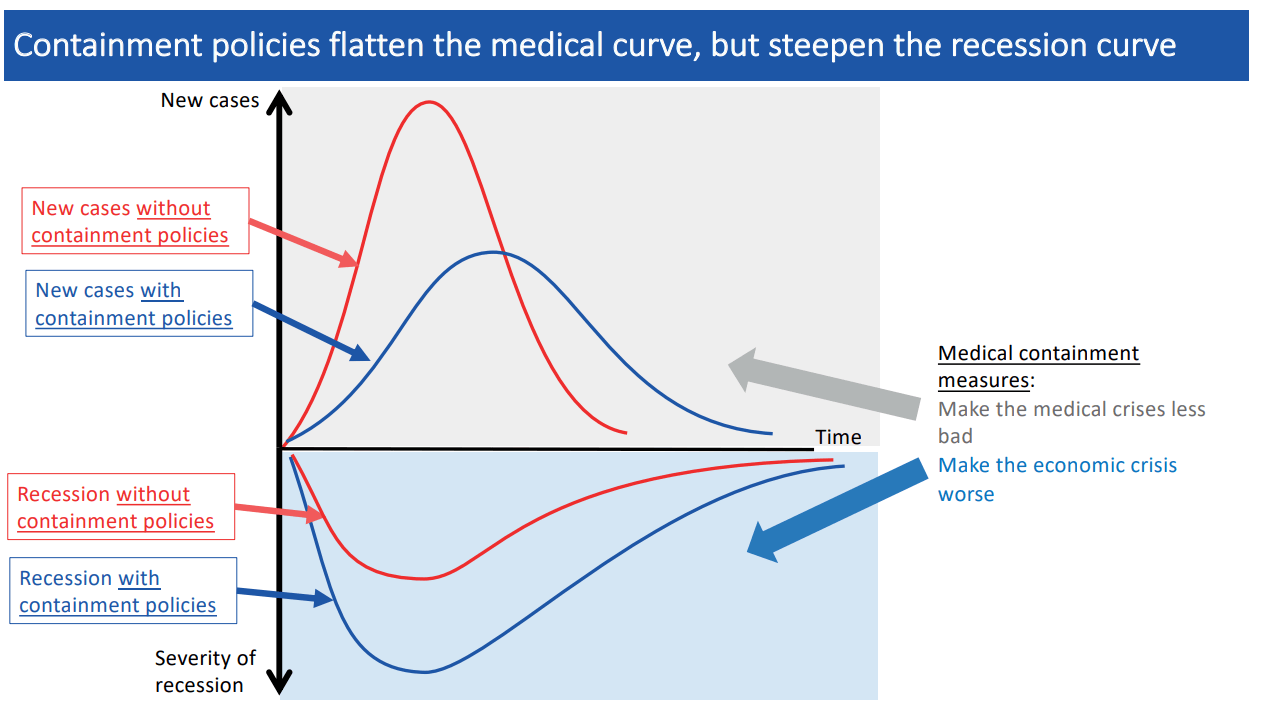

The chart below shows containment measures flatten the infection curve, but steepen the recession curve.

The recession or two consecutive quarters of negative economic growth may have “already started” in the Philippines, according to Alfredo Paloyo, senior lecturer at the University of Wollongong in Australia.

“We want it [economic slowdown] sharp and temporary, but it’s difficult to say at this point,” Paloyo said in a Rappler Talk interview.

The National Economic and Development Authority (NEDA) projected 2020 gross domestic product (GDP) growth to be as low as -0.6%, as tourism, trade, remittances, and consumption drastically drop during the lockdown.

The Philippines is now battered by a perfect economic storm. The aftermath and the rebuilding process will prove to be even more daunting.

Job losses, poverty

Some essential industries have been allowed to operate under the so-called enhanced community quarantine (ECQ).

Other than medical frontliners and those involved in the food supply chain, the government has allowed the business process outsourcing (BPO) industry to continue operations.

When President Rodrigo Duterte ordered the lockdown in Metro Manila, BPO companies had less than two days to organize a lean workforce, look for hotels to house employees, and still provide the same level of experience for customers abroad.

Darwin Rivers of Philippines HR Group told Rappler that BPOs are burning millions per day for hotel accommodations alone, along with other unanticipated expenses due to the pandemic. (WATCH: Rappler Talk: How BPOs, human resources are dealing with coronavirus)

“A lot of clients in North America are cutting jobs and when they do, we will also cut jobs on our end. I heard big companies are, if this will go beyond April 12, they are planning to reduce 30-40% of manpower in the Philippines by work suspension or they are totally laid off,” Rivers said.

Rivers added that rank and file call center agents and support jobs, as well as those in human resources and finance are likely to be let go.

The BPO industry employs over 1.3 million Filipinos and contributes almost 1 percentage point of the country’s GDP growth. A drastic cut in their workforce triggers a chain reaction in the economy.

The tourism and aviation sectors were the first to report lay offs. Experts anticipate unemployment and underemployment to soar this year, spoiling the Duterte administration’s targets. (READ: Cebu Pacific to lay off 150 new cabin crew as virus lockdowns mount)

The country’s unemployment and underemployment rates dipped to 14-year lows in 2019. Poverty also saw a significant drop from 23.3% in 2015 to 16.6% in 2018.

Struggling businesses

The coronavirus has already pushed Philippine Airlines, Cebu Pacific, and AirAsia to ask the government for a lifeline and access to credit.

“The Philippine carriers are facing existential threat to their survival which is faced by other airlines in the region and in other parts of the world,” the Air Carriers Association of the Philippines (ACAP) said in a letter sent to the government’s economic team last March 25.

The Luzon-wide lockdown has led to over 30,000 canceled flights and affected 5 million passengers. ACAP cited the Center for Asia Pacific Aviation’s forecast that most airlines will be bankrupt by May due to the pandemic.

Paloyo said that local airlines hold symbolic value. Philippine Airlines was the first commercial airline in Asia. For a national symbol to go under will negatively affect the country’s sentiment.

While big companies like airlines need some form of support, Paloyo said certain conditions like retention of workers must be specified.

“We dont want companies to perform poorly just for government to save them. So there is a very delicate balance involved,” Paloyo said.

For small companies, government needs to do more.

Micro enterprises, or businesses with less than 9 workers, make up 88.5% of businesses in the country. They are also next to large enterprises or corporations in terms of employment, employing as much as 28.9% of the total labor force in businesses nationwide.

Unlike conglomerates, small businesses do not have contingency funds.

Paloyo, along with economists of the University of the Philippines, urged the government to provide emergency loans to small and medium enterprises to incentivize them to retain their workforce. The loans can be channeled through existing financial institutions with the support of the Bangko Sentral ng Pilipinas. (READ: Economists to gov’t: Spend P300 billion or more vs coronavirus)

More government intervention and debt

As the economy crashes, experts anticipate more government intervention.

“COVID-19 has forced governments to intervene in the economy and daily life in a way unprecedented in peacetime. More changes will come after emergency lockdowns and support has ended,” said Mark Cliffe, global head of the new horizons hub of Dutch multinational bank ING.

Countries are expected to spend and borrow amid both supply and demand shocks. Cliffe added that the “radical transformation” of macroeconomic policies will pose an enormous challenge in the global economy.

ING Bank Manila chief economist Nicholas Mapa said Duterte must spend around 1% to 2% of the GDP or P300 billion to almost P600 billion for the coronavirus battle. (WATCH: Rappler Talk: Coronavirus and the economy)

The massive spending will result in the government breaching the budget cap, also leading to more loans.

“Don’t worry about the credit ratings anymore because we are likely to run a very substantial deficit. But in this extraordinary time, lives should matter more than fiscal lenders,” Mapa said.

Mapa added that the Philippines has proven that it can pay its debt, given the credit rating upgrades the country got from debt watchers.

The country’s debt-to-GDP ratio, or the metric that compares the country’s debt level to the size of the economy, is at its lowest since 1986. This means that the previous administrations, notably former President Benigno Aquino III, gave Duterte sufficient leg room to borrow.

Financial markets and pension funds

The government in the financial system will continue, according to Cliffe.

“Beyond a rethink of how to keep financial markets functioning in future crises, a surge in insolvencies will leave a painful legacy,” he said.

American financial analyst Gary Schilling said in a Bloomberg column that global stocks will likely rebound after lockdowns, but not as high as before. Individual investors will also be slow in returning to the markets.

The Philippine Stock Exchange index (PSEi) fell to as low as 4,039 amid the pandemic. As of Wednesday’s (April 8) close, the PSEi traded at 5,510. This means that if you bought stocks at the start of the year, you lost almost 30% of what you invested.

Piper Tan, analyst at Philstocks, said in recent media interviews that the PSEi will likely not go back to the 7,000-8,000 level this year.

Meanwhile, Schilling warned pension funds will be badly hit due to the pandemic.

“Pension funds will be troubled as their move into riskier investments in recent years in their search for higher yields proves disappointing. Their options to meet ambitious return goals – cutting retiree benefits, increasing employee contributions and increased funding from sponsors – are equally unattractive,” Schilling said.

Recall that Duterte approved the P1,000-Social Security System pension hike – a move widely deemed as one of his populism-driven policies.

Peak of populism

With more government presence comes the rise of populism.

Cliffe noted that during this time, populists will likely “push their nationalist agendas, pointing to the dangers of unbridled openness.”

At the same time, he said “governments and companies that fail to show competence and compassion amid lost lives and livelihoods will rapidly lose trust and support.”

Cliffe added that some countries may embrace a more “focused internationalism to tackle global problems.”

As of writing, survey companies have not released data on public sentiment regarding Duterte’s pandemic response.

While his team has given assurances that Duterte is on top of the situation, the President has given conflicting statements about the pandemic.

Duterte said he warned Filipinos about the threat of the novel coronavirus “at the start.” Rappler’s fact check team rated this claim as false.

“Kagaya ng (Like) SARS, I assure you even without the vaccines it will just die a natural death. Apparently, itong mga ganito, mga virus, ano ‘to HIV, wala – nawala na. Meron, kokonti na lang (viruses like this, like HIV, it’s gone, there are only a few cases now),” Duterte said during a media briefing on February 3.

Duterte also ordered police and soldiers to “shoot” residents causing “trouble” during the government’s lockdown.

As of Wednesday, April 8, the Philippines has recorded 3,870 coronavirus cases. 182 have died, while 96 recovered. – Rappler.com

Add a comment

How does this make you feel?

![[ANALYSIS] A new advocacy in race to financial literacy](https://www.rappler.com/tachyon/2024/04/advocacy-race-financial-literacy-April-19-2024.jpg?resize=257%2C257&crop_strategy=attention)

![[In This Economy] Can the PH become an upper-middle income country within this lifetime?](https://www.rappler.com/tachyon/2024/04/tl-ph-upper-income-country-04052024.jpg?resize=257%2C257&crop=295px%2C0px%2C720px%2C720px)

There are no comments yet. Add your comment to start the conversation.