SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

The unfolding drama surrounding LTFRB’s regulation of ride-hailing services (especially Uber) is of particular interest to teachers of economics: it’s a perfect illustration of the basic model of supply and demand.

Supply and demand is taught on Day One of any basic economics class for two good reasons. First, it explains why prices go up during times of relative scarcity and down during times of relative plenty.

Second – and perhaps more importantly – supply and demand arms students with a simple yet powerful framework by which to understand government intervention in markets, and how such policies can improve or worsen society’s welfare.

In this article we use supply and demand to explain the fascinating economics of Uber and Grab, and predict the likely impact of LTFRB’s regulations on both their riders and drivers.

Regulating the number of Uber and Grab vehicles

Each Uber or Grab ride is mutually beneficial to the rider who hails it and the driver who supplies it. Otherwise, they wouldn’t bother transacting with each other on the apps.

So when the government prohibits such rides – partially or totally – it eliminates such gains from trade. Riders and drivers can’t benefit from the rides they can’t take, and this reduces social welfare.

This is what happens when the LTFRB limits the number of Uber and Grab vehicles, whether by imposing quotas or prohibitions.

Consider Uber’s one-month suspension that started on August 15. Beyond the many angry comments, hashtags, and memes that it inspired on Facebook and Twitter, the welfare losses from such suspension could prove huge in monetary terms.

In the US, one study found that UberX generated about $6.8-billion worth of consumer welfare in 2015 alone.

No such study yet exists for the Philippines. But given the hundreds of thousands of rides that don’t happen anymore because of the suspension, the losses for riders and drivers could easily amount to several millions of pesos daily.

Regulating ‘surge pricing’

Market prices orchestrate the decisions of consumers and producers. In the case of Uber and Grab, riders want to hail vehicles when prices are low, while drivers want to ply the streets when prices are high (or “surge”).

Governments worldwide are particularly keen to regulate “surge pricing.” It is often taken as a form of price gouging, akin to what happens when prices of basic commodities rise during times of short supply (think Yolanda or Marawi).

In the previous Christmas season, the LTFRB warned Uber and Grab against these “unreasonable” price surges that “take advantage” of people.

But far from abusing people, this “dynamic pricing” mechanism – afforded by algorithms – lies at the heart of the dependability of Uber and Grab. By allowing prices to rise and fall with changes in supply and demand, riders can reliably hail vehicles whenever, wherever.

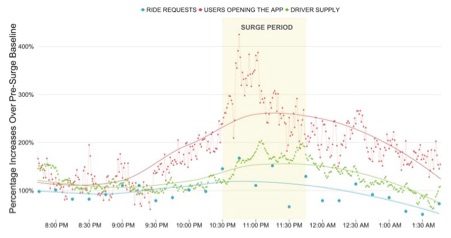

Figure 1 below shows surge pricing in action. Notice the rise of driver supply (green) in response to a rise in demand (red). Surge pricing makes sure that demand always meets supply, and a similar phenomenon occurs whenever it suddenly rains or it’s rush hour in Metro Manila.

Figure 1. UberX supply rises to meet higher demand. Source: Hall, Kendrick, and Nosko (2015).

Tinkering with dynamic pricing – by imposing a price ceiling beyond which prices can’t surge – will not just diminish the reliability of Uber and Grab, but also prolong wait times. Entrants that lack dynamic pricing altogether (such as taxis using the new Micab) are also therefore unlikely to match the availability of Uber and Grab vehicles.

To see the effect of price controls, one need only look at the first day of Uber’s recent suspension. Bookings for Grab rides jumped by 10% to 15%, and Grab managers responded by capping their surge rates at 1.4 (meaning their rates can’t go beyond 1.4 times the regular rates).

But the effects of such a binding “price ceiling” are well-known in Econ 101: It creates excess demand, where demand exceeds supply.

In Grab’s case, more riders were willing to hail rides than there were Grab vehicles on the road, resulting in a shortage of vehicles and longer wait times. Grab wanted to help riders with this surge cap, but ended up making them wait longer for their rides.

Regulating work hours

LTFRB also came up with a proposal to impose “minimum work hours” on Uber and Grab drivers. They reasoned that the franchises they issue will be put to waste if many drivers don’t ply the streets at least a certain number of hours per week.

But again, this proposal ignores the centrality of supply and demand in Uber and Grab’s operations: With dynamic pricing, both prices and the number of cars on the road have to adjust freely to reflect supply and demand.

During peak hours – when demand is high – prices rise to incentivize drivers to go out and drive. By contrast, during off-peak hours – when demand is low – prices go down, which turns off most drivers, many of whom choose not to drive.

The net effect is that ride-hailing vehicles typically have higher “capacity utilization rates” than taxis. Simply put, Uber and Grab drivers are far likelier than taxi drivers to ply the streets with passengers in their cars.

In a 2016 paper, two economists confirmed this when they looked at UberX in 5 American cities in 2015. Figure 2 shows that, in Los Angeles, UberX was 58% more efficient than taxis; in Seattle, 41%.

Figure 2: Capacity utilization rate for taxi and UberX drivers in Los Angeles and Seattle. Source: Cramer and Krueger (2016). Capacity utilization rate = percent of miles driven with a passenger.

Again, no similar study yet exists for the Philippines. But if the LTFRB requires Uber and Grab drivers to work minimum hours, supply and demand tells us their vehicles will likely become idler on the road.

Heed the law of supply and demand

One might argue that, in all this, the LTFRB – with all its “draconian” and “antiquated” policies – is just doing its job. On the first day of Uber’s recent suspension, motoring journalist James Deakin said on Facebook, “rules are rules.”

However, what is illegal is not necessarily bad economics, and what is legal is not necessarily good economics. The letter of the law is no excuse for LTFRB to spawn a flurry of discretionary policies that completely ignore (and even negate) the most basic lessons of economics.

To make sure that there are enough rides when people need them, don’t impose caps on surge rates. To make Uber and Grab operations more efficient, don’t impose minimum work hours. To improve the welfare of the riding public, don’t kill a new industry that many people have come to love and depend on.

The LTFRB can impose all the orders and decrees it wants, but it cannot repeal the law of supply and demand. Try as it might, it will be as successful as the proverbial king who commanded the waves to retreat. – Rappler.com

The author is a PhD candidate at the UP School of Economics. His views are independent of the views of his affiliations. Follow JC on Twitter: @jcpunongbayan.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.