SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[ANALYSIS] How rough was 2018 for the PH economy?](https://www.rappler.com/tachyon/r3-assets/71058F9982004B7F80AB2A0EE6EBD43A/img/FBF40F97053940FB8723B38BB4CB99E2/How-rough-was-2018-for-the-PH-economy-Dec-12-2019.jpg)

On many levels, 2018 was a rough year for the Philippine economy.

From the steady acceleration of prices, the depletion of subsidized rice, slower economic growth, the snail’s pace of Build, Build, Build, and our declining competitiveness – all this meant hardships for all Filipinos, young or old, rich or poor.

In this article let’s take stock of the major economic trends and events that occurred in 2018. What lessons can we draw from them, and what headwinds and tailwinds do we face in 2019?

1) Government allowed inflation to run away.

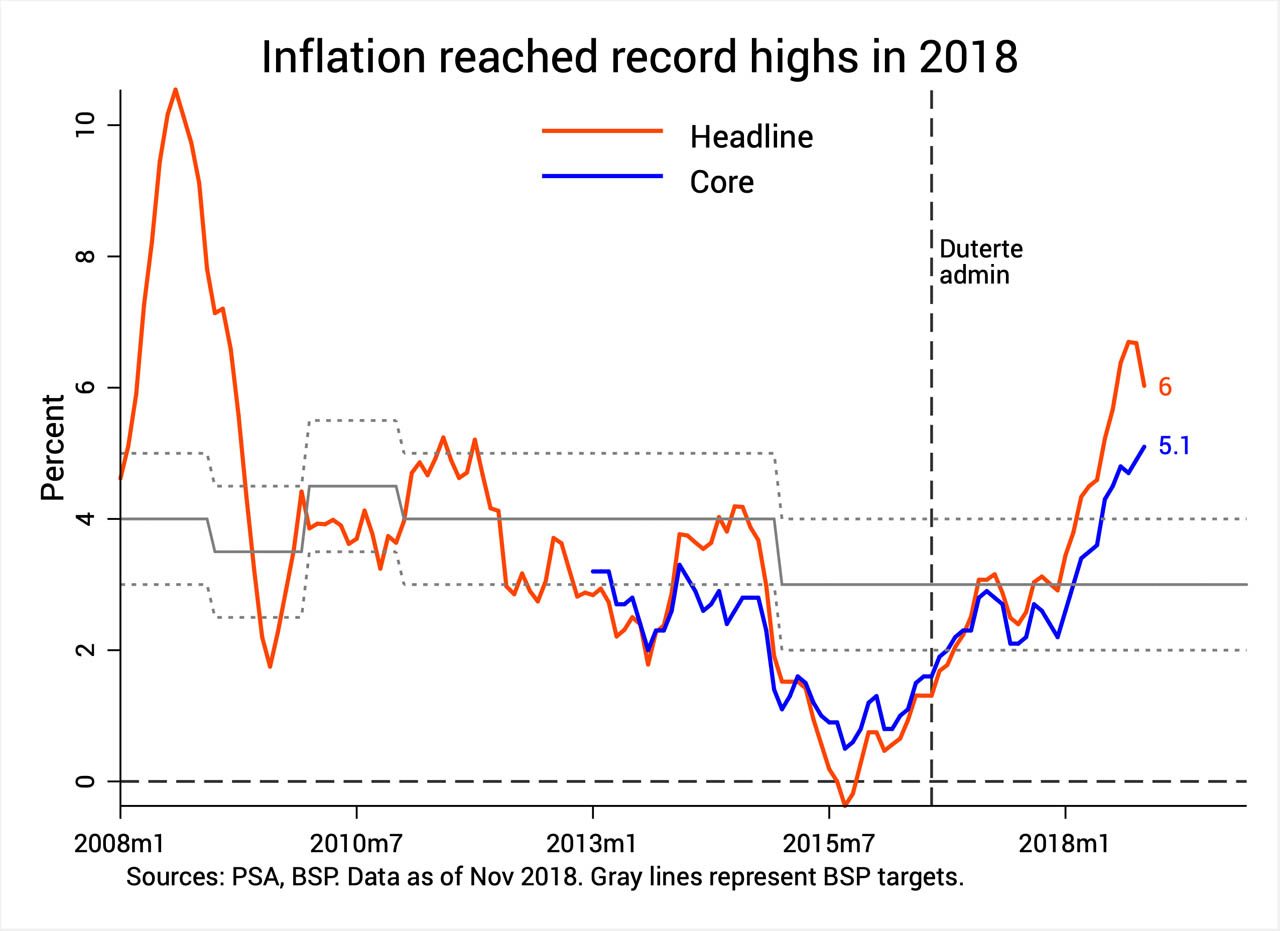

Figure 1.

What happened: Inflation was hands down the defining economic issue of 2018. From just 3.45% in January, inflation shot up to 6.7% in September, the highest in almost a decade (Figure 1).

This was driven in part by international factors (like higher world oil prices and the weaker peso) but also by local factors (like rice supply mismanagement and TRAIN’s new excise taxes). Meanwhile, the government’s cash transfers were delayed and largely inadequate to offset the pernicious impact of inflation especially on the budgets of the poor.

What’s going to happen: Though inflation eased to 6% in November, it’s still a full 2 percentage points higher than the government’s upper target for this year. With TRAIN’s second batch of petroleum taxes well underway – along with the 2019 elections – inflation is expected to remain above the target range in 2019. Some banks and think tanks also claim that the economy may already be “overheating.” But government has downplayed this, and in any case the Bangko Sentral already acted on it through its successive interest rate hikes, which will be felt the most next year.

2) Rice mismanagement caused needless suffering.

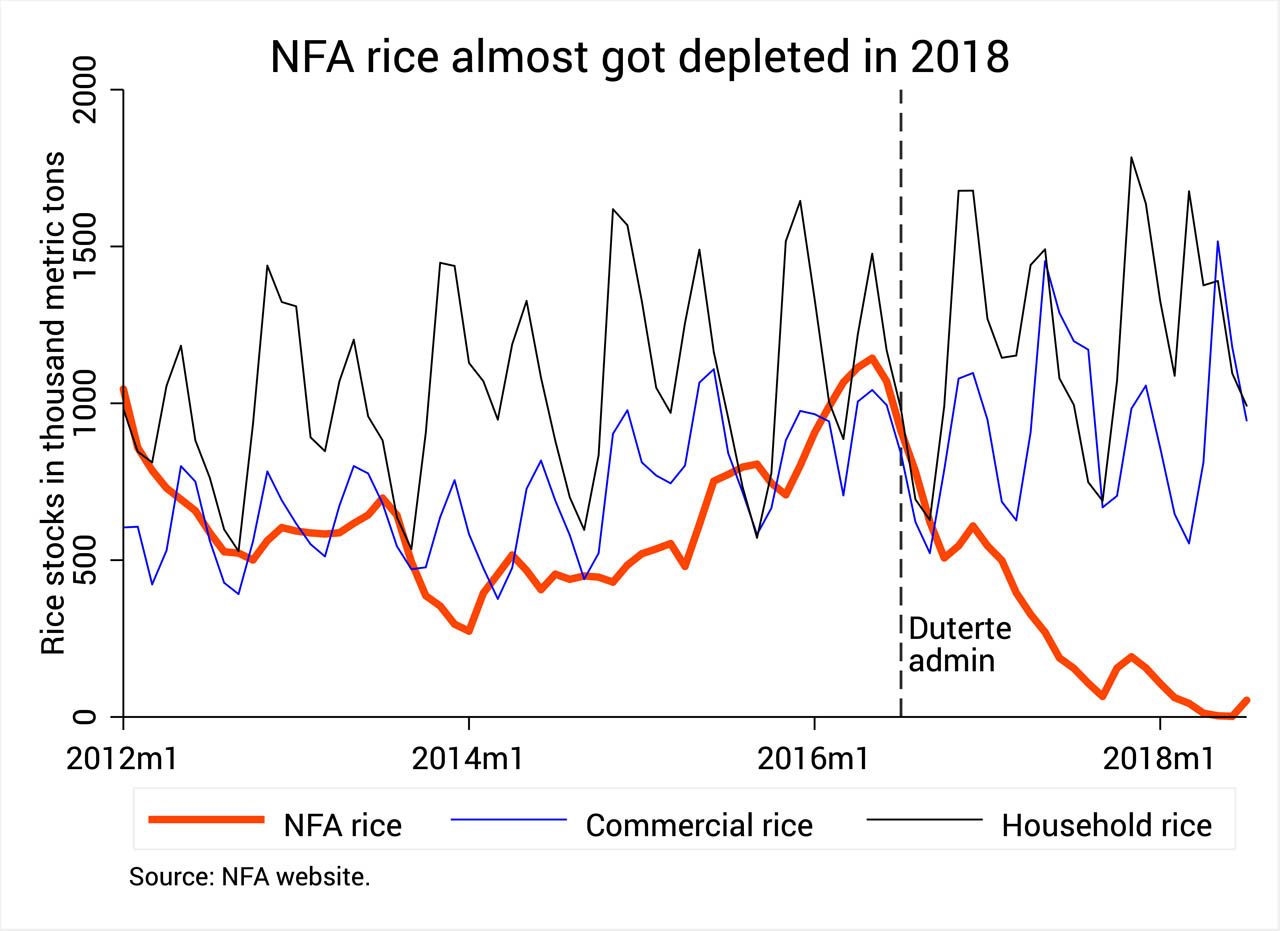

Figure 2.

What happened: Bungled rice policy played a key role in the continuous rise of inflation this year. Delayed rice imports late last year led to the near-depletion of NFA rice stocks this year – the first time since the agency’s establishment (Figure 2).

The resulting shortage forced poor consumers to buy commercial rice, which further drove up its already high prices, thus stoking inflation. The response of government was also marred by corruption, incompetence, and insensitivity (like when Agriculture Secretary Manny Piñol ate weevil-infested rice on national TV in a ridiculous attempt to show it’s edible).

What’s going to happen: Economists frequently blame the NFA’s rice importation monopoly as the root of all evils in the rice sector. The new Rice Tariffication Bill, almost up for Duterte’s signature, is expected to undo this. Freer importation of rice is expected to reduce retail prices by as much as P7 per kilo. However, the bill retains licenses in the guise of health permits, as well as a P10-billion fund which many fear might be prone to abuse (as similar agricultural funds in the past have shown).

More generally, however, government must address the stagnation of agriculture which, as of the third quarter of 2018, dragged down overall economic growth.

3) Where is Build, Build, Build?

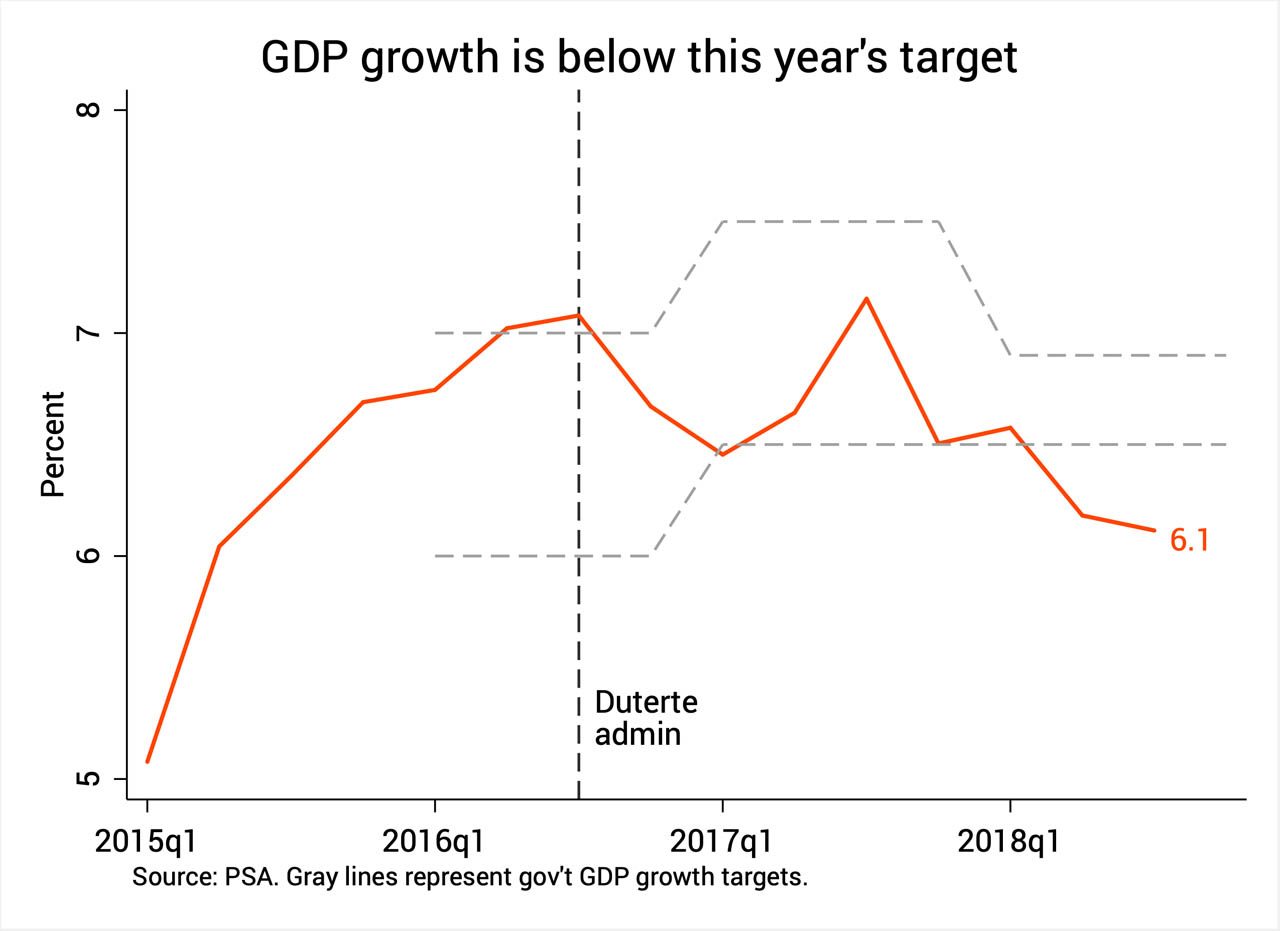

Figure 3.

What happened: At 6.1%, economic growth slowed down in the third quarter to its slowest pace since mid-2015 (Figure 3). Although investment spending now plays a larger role in growth, the economy’s expansion slowed down on account of humongous imports of goods, primarily capital equipment and inputs like steel and iron. Government claims this is okay, insofar as these inputs are being used in the government’s P8-trillion Build, Build, Build program. However, as of late November, only 10 of the 75 approved projects for Build, Build, Build have started construction.

What’s going to happen: Government is targeting 7% to 8% growth in 2019, but most analysts outside government anticipate growth of only between 6% to 7%. Although this is still respectable, 7% to 8% growth is not at all impossible to attain for an economy our size. To boost growth, government must improve the government’s capacity to implement all the slated Build, Build, Build projects. Moreover, having a reenacted budget for 2019 threatens not just the expansion of infrastructure spending but also overall economic growth and job creation.

4) China’s role in the economy is palpably increasing.

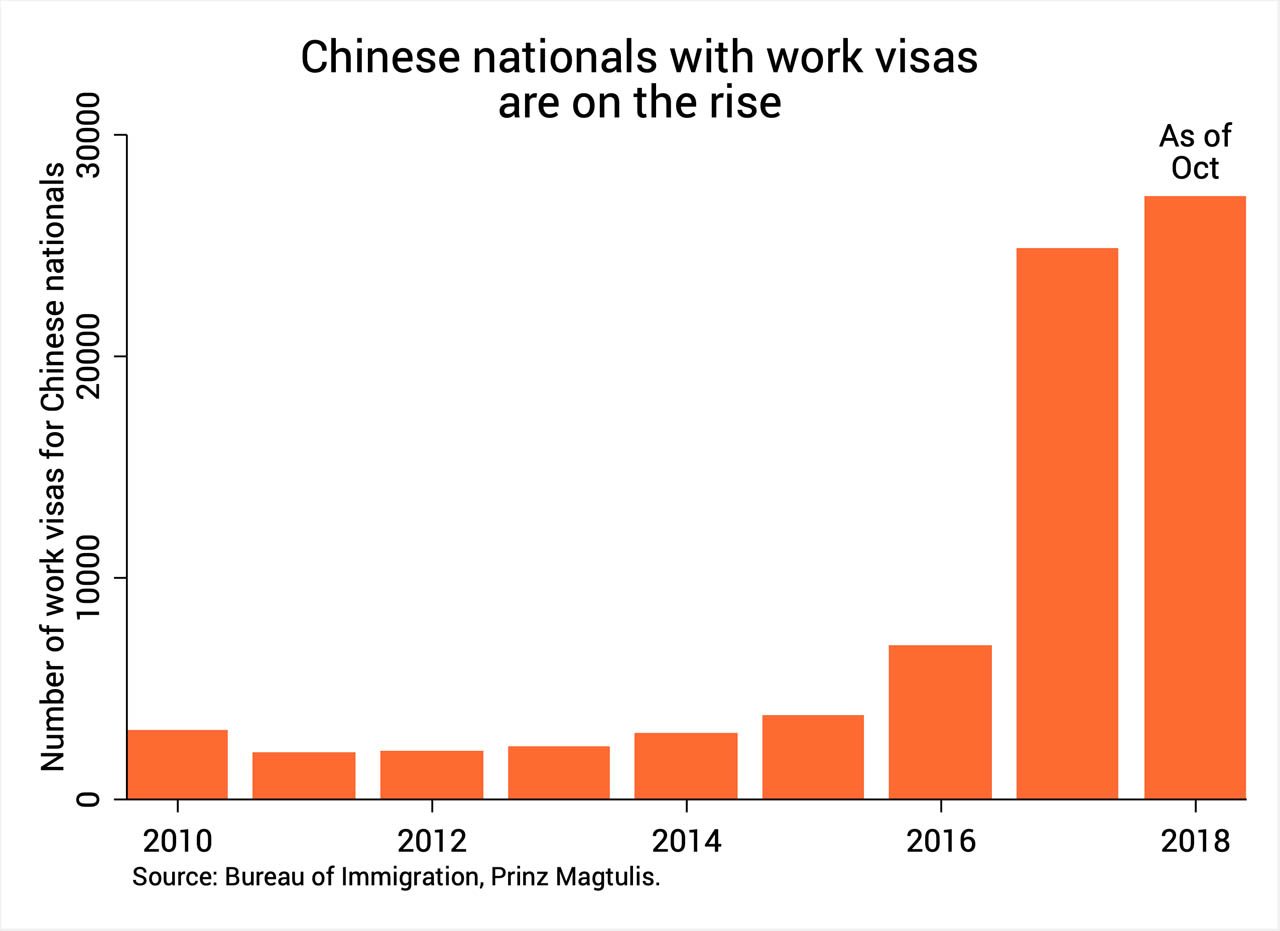

Figure 4.

What happened: The economic landscape of the Philippines also got a bit more Chinese this year. This is most apparent in Metro Manila, which saw the heavy influx of Chinese tourists and workers (Figure 4), mainly because of the burgeoning POGO (Philippine online gambling operations) industry. Chinese-funded infrastructure projects (like the new bridge in Binondo) have also commenced. All this stemmed from the pivot of Duterte to China in 2016. This was further reinforced during Chinese President Xi Jinping’s visit last month, which resulted in 29 new deals and agreements, mostly economic in nature.

What’s going to happen: Deeper ties with Beijing are bound to further deepen our economic interactions with China in terms of trade, investments, and loans. Sure, all of these are not bad per se. But we should nonetheless be wary of incurring too much Chinese debt. This is in view of China’s broader geopolitical goals, also called the Belt and Road Initiative, as manifested by its unabated militarization and exploitation of our resources in the West Philippine Sea. The more Duterte acquiesces to this encroachment, the harder it will be for future administrations to shake off the unwelcome exploitation of our natural resources by the Chinese.

5) Too much uncertainty hangs in the air.

Figure 5.

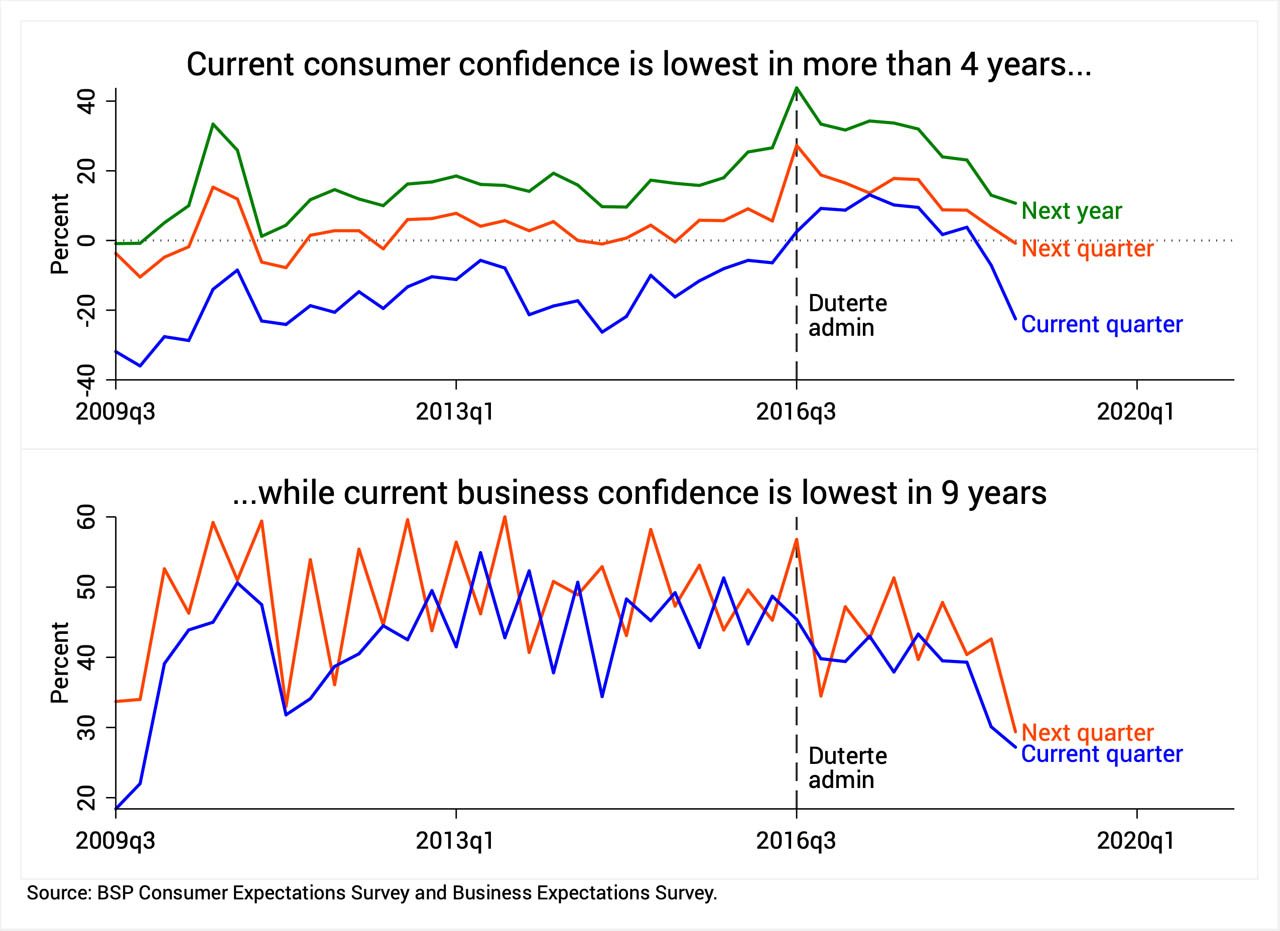

What happened: Most disquietingly, a pall of economic uncertainty continues to hang in the business environment more than two years since Duterte came into office. For instance, Boracay’s abrupt closure was pushed this year without the benefit of any sound economic plan or cost-benefit analysis, and it destroyed thousands of businesses and jobs in its wake. Beyond his gross ignorance of economic policymaking, Duterte’s weaponization of rules and laws against specific businesses (such as in media, telecoms, airlines) continues to put businesses on edge. Indeed, business and consumer confidence reached record lows this year (Figure 5).

What’s going to happen: Next year businesses are watching out for the TRABAHO Bill, which promises to lower corporate income tax rates but also impose stricter incentives for exporters – at a time of weak exports. As a result, many prospective investors are reportedly putting their investment decisions on hold and considering to locate instead to more business-friendly environments like Viet Nam.

Meanwhile, the outcome of the 2019 elections will prove pivotal for the passage of the proposed federalism bill via charter change. This promises to cause massive upheaval throughout the economy (to say the least).

Needless hardships

All in all, there’s a sense that the Duterte government brought about needless economic hardships to the Filipino people in 2018.

Remember that we are all coming from an era of relative prosperity, when inflation was low to moderate and our incomes were growing at a high level and a steady pace. Sadly, that era seems to be over now.

Worse, the Duterte government showed gross callousness and insensitivity to the worsening plight of our people. Amid increasing economic hardships, they told us to “tighten our belts,” stop being “crybabies,” and just be hardworking.

Unfortunately, such statements cannot hide the fact that the Philippine economy is in a worse shape now in the time of Duterte.

If business as usual remains, 2019 does not look so promising either. – Rappler.com

The author is a PhD candidate at the UP School of Economics. His views are independent of the views of his affiliations. Follow JC on Twitter (@jcpunongbayan) and Usapang Econ (usapangecon.com).

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.