SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

BRUSSELS, Belgium – Greece lurched deeper into crisis Wednesday, July 1, as European finance ministers prepared to consider a request for new loans in a last-ditch effort to keep the country in the eurozone after it defaulted on a key payment and a bailout keeping its economy afloat expired.

Cash-strapped Greece became the first developed country to default on the International Monetary Fund after missing a 1.5 billion euro ($1.7 billion) payment on Tuesday, as efforts to find a compromise with its EU lenders came to naught.

The missed payment underscored the failure of more than 5 months of wrangling between Greece’s left-wing government and its creditors to reshape the country’s bailout and prevent it dropping out of the eurozone.

But talks were set to resume on Wednesday after Athens asked for a new two-year aid plan – the third in five years – as ratings agencies cut their ratings on Greece’s debt, predicting it will return to recession this year.

Athens is asking for a further 29.1 billion euros from the European Stability Mechanism (ESM), to “fully cover its financing needs and the simultaneous restructuring of debt,” for the next two years, according to the prime minister’s office.

Greek officials indicated they would be willing to suspend a referendum planned for Sunday on the reforms demanded by its creditors if Wednesday’s eurozone talks in Brussels yield agreement on the new funding request.

“There was a willingness to take a look at the question in the referendum or update the referendum or suspend it,” an EU source told the Agence France-Presse (AFP) after talks between Greek Finance Minister Yanis Varoufakis and his eurozone counterparts.

“All that depended on the signal the Eurogroup would give to this new proposal.”

Greece has entered uncharted waters without international aid for the first time in five years, sparking fears of a chaotic eurozone exit which could have untold repercussions for global markets and the EU.

The ongoing uncertainty hit European stocks and the single currency on Tuesday. In Asian trade on Wednesday, the euro treaded water, buying $1.1140 compared to $1.1139 in New York late Tuesday.

On the streets of Athens, some 20,000 people turned out to show their support for a bailout deal after banks were closed this week amid the spiralling debt crisis, forcing people to queue for hours for cash.

Wealthiest IMF default

An IMF spokesman in Washington confirmed the payment due by 2200 GMT Tuesday had “not been received,” making Greece the first country to default to the Washington-based lender since Zimbabwe in 2001 and the wealthiest ever.

“We have informed our Executive Board that Greece is now in arrears and can only receive IMF financing once the arrears are cleared,” Gerry Rice said in a statement.

The IMF is now considering extending Greece’s payment deadline — something it has only done twice before in 1982 for Nicaragua and Guyana — giving it the power to ease pressure on Athens as it starts fresh talks with the EU.

Greek Prime Minister Alexis Tsipras plunged the protracted discussions into chaos over the weekend when he announced the referendum, urging Greeks to vote against the pension cuts and sales-tax increases demanded by its creditors

The request by Athens for a new loan from the ESM followed European Commission chief Jean-Claude Juncker’s attempt to clinch a “last-minute” solution before the referendum which would involve accepting the EU-IMF reform proposals.

Chancellor Angela Merkel of Germany stuck to Berlin’s hard line when she said she would not discuss any new Greek request until after Sunday’s referendum.

“Before the referendum, Germany can’t negotiate a new request” for assistance, Merkel was quoted as saying by a lawmaker of her conservative Christian Democrats.

ECB to meet

On Wednesday, the European Central Bank’s governing council will also meet to discuss the crisis in Greece.

It was the ECB’s decision on Sunday to not increase emergency funding for Greek banks that pushed Athens to close lenders and impose capital controls.

The ECB will probably stick with its current stance on Greek banks but could take measures to prevent contagion in other eurozone markets.

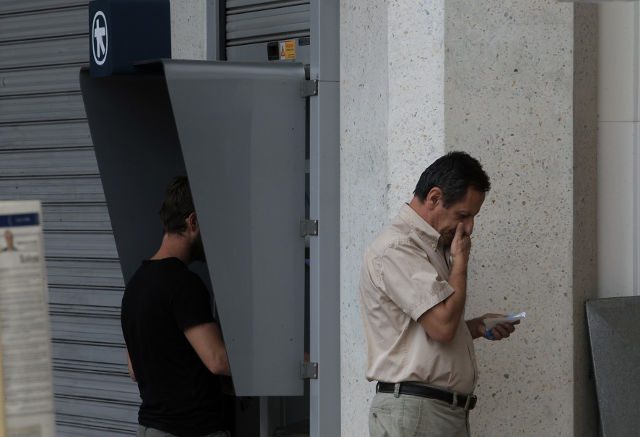

In Greece, many people have been caught up in lengthy queues at ATMs after banks were shut down for one week, to withdraw the maximum daily allowance of 60 euros.

Police said 20,000 people rallied in the historic Syntagma square in Athens to call for a “Yes” vote in the bailout referendum, a day after a large rally backing Tsipras’s “No” stance on Monday.

Protestors carried banners featuring slogans such as “Greece is Europe” while the cry “resign” went up from the crowd repeatedly.

Lawyer Vassiliki Salaka said those in charge of Greece now were “incompetent, they lack organisation, they don’t know what they want”.

But many other Greeks also back the government’s defiant stance since it was elected in January, blaming the nation’s creditors for forcing Greece into years of painful recession by demanding tough austerity cuts.

Pro-Greece demos were set to take place this week in Berlin, Paris, Brussels, Rome and Amsterdam. – Danny Kemp, AFP/Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.